[Markets]

Stocks 'Squeeze' Higher, Crude Crushed, Bitcoin Bid Ahead Of Catalyst-Heavy Week

Stocks 'Squeeze' Higher, Crude Crushed, Bitcoin Bid Ahead Of Catalyst-Heavy Week

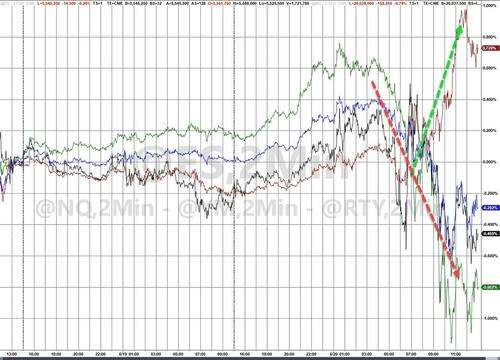

Today saw the quiet (short squeeze higher) before the storm of risk catalysts ahead this week (including 41% of SPX earnings and a handful of key macro data - JOLTS, GDP, PCE, NFP). But October Dallas Fed manufacturing activity was better than expected today, adding to momentum in the Citi US Macro Surprise Index...

Source: Bloomberg

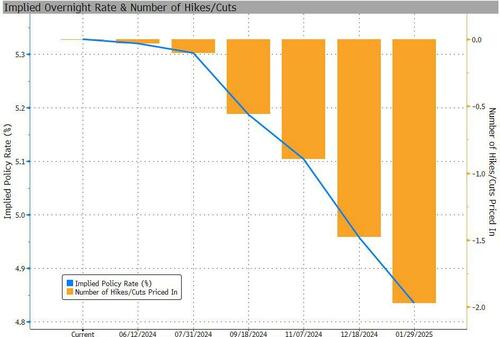

The 'good' data sent rate-cut expectations (hawkishly) lower with 2024 now a coin toss between 1 and 2 25bp cuts and 2025 down to pricing in just 3 cuts...

Source: Bloomberg

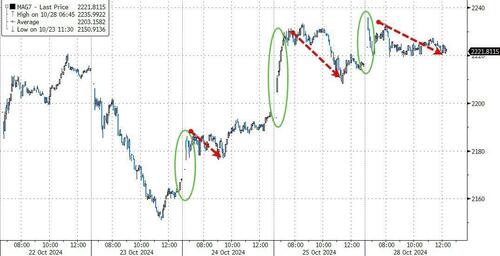

Goldman's trading desk noted that market volumes are down -5% and top of book depth is only $8.4mm with a "squeezy price action" evident in stocks: Bitcoin Equities (GSCBBTC1, +7.5%); China ADRs (GSXUCADR, +4.6%); Non-Profitable Tech (GSXUNPTC, +3%) & Most Short Rolling (GSCBMSAL, +2.8%) - third major squeeze day in a row...

Source: Bloomberg

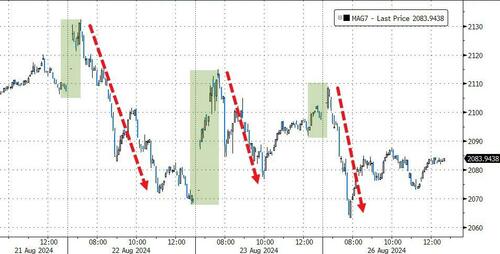

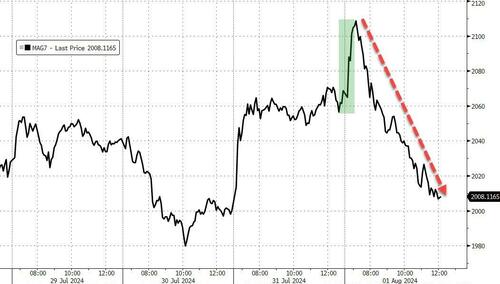

Mag7 stocks ended very marginally higher on the day after a short-squeeze open.

Source: Bloomberg

Bear in mind that today marks the first day of the estimated open window period for corporate buybacks with ~50% in open window today. We have already seen a number of companies start entering into new 10b5-1 plans over the past week.

Taking all that into consideration, Small Caps were the days best performer (squeeze) while Nasdaq was the laggard (barely holding on to unchanged). The S&P lagged The Dow...

VIX was lower today but the vol term structure for the S&P 500 is very much anticipating some malarkey over the next couple of weeks...

Source: Bloomberg

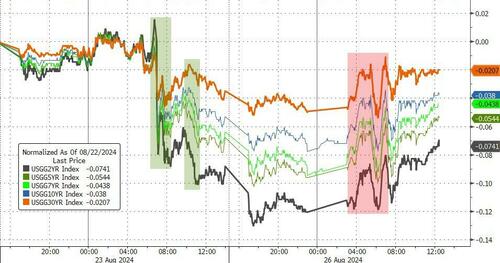

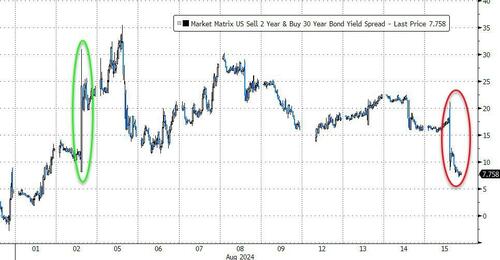

Bond yields pushed higher with the 'Trump Trade'...

Source: Bloomberg

With yields up 3-4bps across the curve - but it was a wild day in bond-land with TSYs bid across Europe and then offered during most of the US session...

Source: Bloomberg

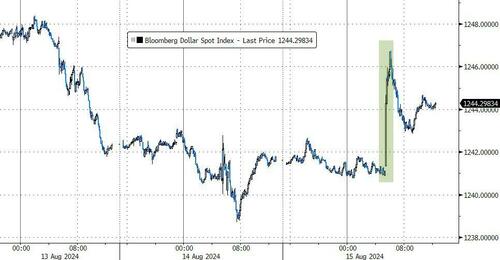

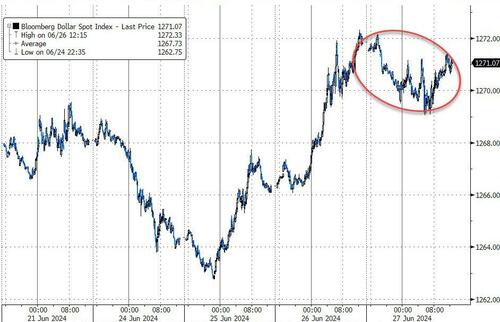

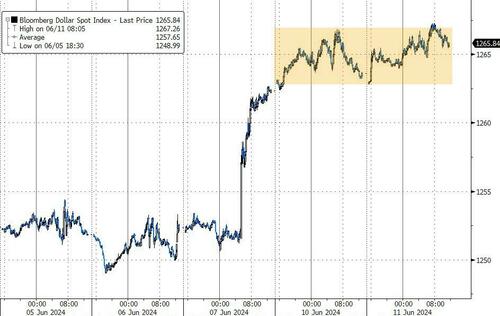

The dollar ended the day unchanged after extending Friday's gains, falling back then inching back up to unch...

Source: Bloomberg

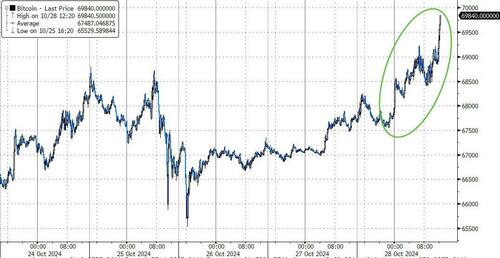

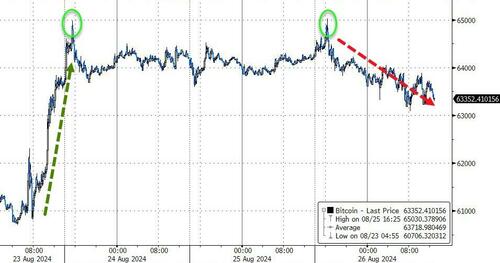

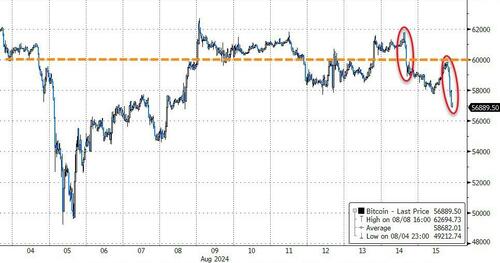

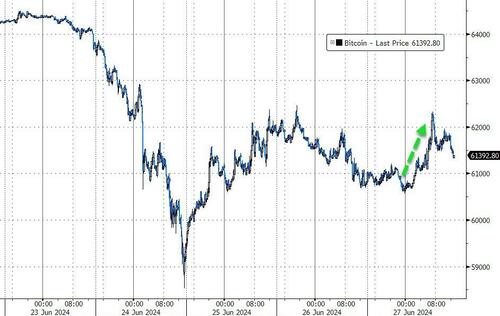

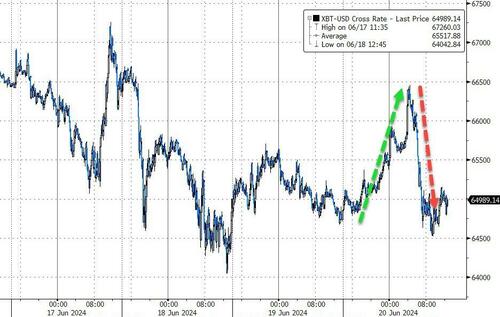

Bitcoin surged back up within a few ticks of $70,000...

Source: Bloomberg

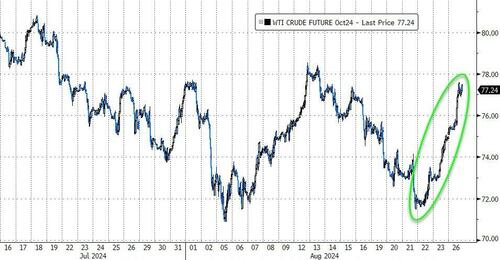

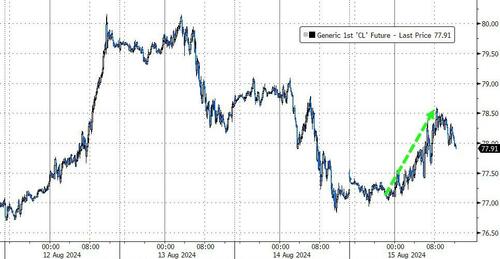

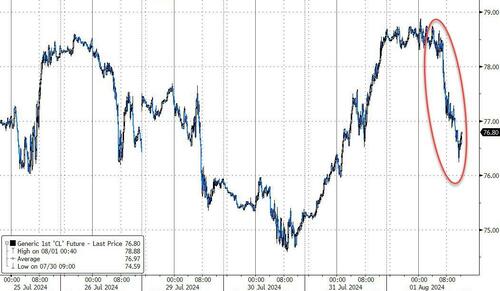

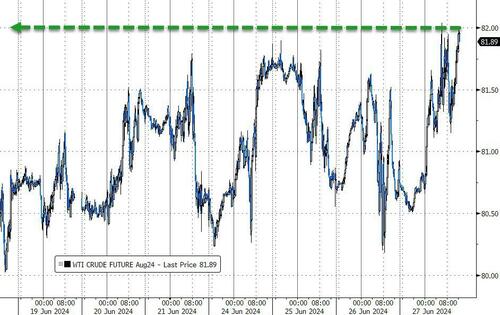

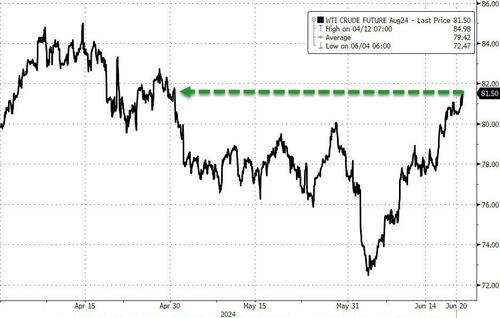

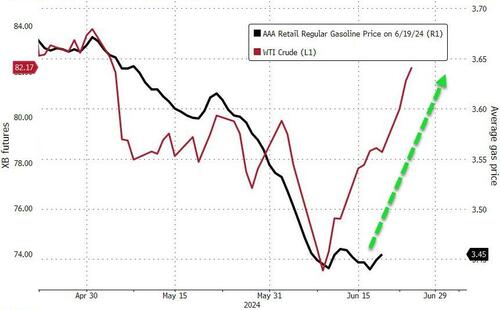

Crude prices were clubbed like a baby seal today as the Iran-Israel theatrics seemed to calm traders minds and erase geopolitical risk premium....

Source: Bloomberg

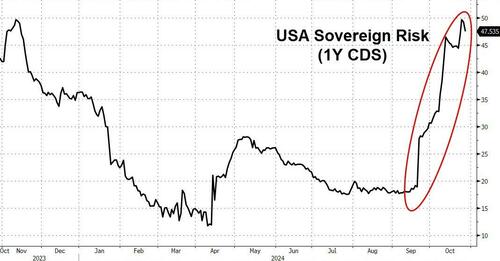

Finally, USA Sovereign risk continues to rise quietly behind the scenes...

Source: Bloomberg

...as the world bids on the ultimate 'insurance' bet into an election surprise (red or blue sweep)...

|

|

[Business]

A Lawsuit Against Perplexity Calls Out Fake News Hallucinations

In a new copyright lawsuit against AI startup Perplexity, Dow Jones and the New York Post argue that hallucinating fake news and attributing it to real papers is illegal.

Published:10/21/2024 5:27:48 PM

|

[Markets]

Key Events This Week: PMIs, Durables, Fed Speakers And Earnings Galore

Key Events This Week: PMIs, Durables, Fed Speakers And Earnings Galore

In his preview of the next few days, DB's Jim Reid has some good news for those who feel like it's already Friday: "It doesn't feel like its going to be the most exciting week ahead of us" although with earnings season now in full throttle and with a seemingly extremely tight US election just two weeks tomorrow there is undoubtedly plenty to think about and react to.

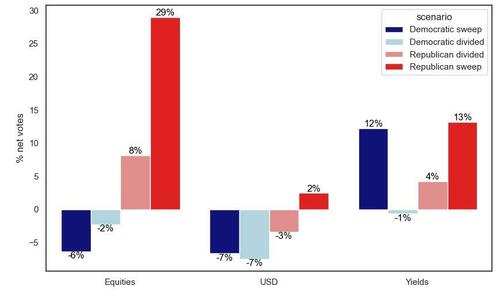

Having said the election is tight, Reid notes that over the last two weeks the probability markets have been shifting back towards Trump. At the start of October a Republicans sweep was a 28% probability on Polymarket.com but that's now shifted to a 42% chance. A Democrats sweep has fallen from 21% to 14%.

Outside of the tax and spending implications, Trump last week said that "the most beautiful word in the dictionary is tariff". So that should have reminded markets that he is serious on this matter if he gets elected. In terms of fiscal, Deutsche Bank economists believe that the deficit will be between around 7 to 9% from 2026-2028 whatever political configuration we have in the White House.

Staying on debt we do have the IMF and World Bank annual meetings in Washington from today and across the rest of the week. There is expected to be a focus on the unsustainability of global debt in these meetings but that is probably more of a medium-term concern rather than anything markets will latch on to this week. There are plenty of central bankers speaking at the various Washington events but in particular watch out for ECB President Lagarde and BoE's Governor Bailey (both tomorrow). Ahead of that, today sees quite a bit of Fedspeak. There is also the BRICS summit held in Kazan, Russia from tomorrow to Thursday hosted by Putin. China's President Xi and India's Prime Minister Modi are expected to attend.

In terms of data, the main highlight is probably the round of global flash PMIs (Thursday). Walking through the data day-by-day, the other highlights are German PPI, French retail sales and the US leading index today, the US Phili Fed tomorrow, US existing home sales, the Beige book, Eurozone consumer confidence and the Bank of Canada meeting on Wednesday, US initial jobless claims on Thursday, and US durable goods, Tokyo CPI, and the German Ifo on Friday. Recent strikes and storms will likely distort US claims and durable goods so it will be tough to get a clean data read at the moment. The Beige book may give us a bit more insight into current economic momentum.

In corporate earnings, the main highlights are SAP (today), Texas Instruments, GE, and GM (tomorrow), and Tesla, IBM, and Boeing (Wednesday). We list others in the day-by-day calendar at the end.

Source: @eWhispers Source: @eWhispers

Courtesy of DB, here is a Day-by-day calendar of events

Monday October 21

- Data: US September leading index, China 1-yr and 5-yr loan prime rates, Germany September PPI, France September retail sales

- Central banks: Fed's Logan, Kashkari and Schmid speak, ECB's Simkus speaks

- Earnings: SAP

Tuesday October 22

- Data: US October Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, business conditions, UK September public finances, EU27 September new car registrations, Canada September industrial product price index, raw materials price index

- Central banks: Fed's Harker speaks, ECB's Centeno, Knot, Holzmann, Villeroy and Rehn speak, BoE's Bailey, Greene and Breeden speak

- Earnings: General Electric, Danaher, Texas Instruments, Philip Morris, Verizon, RTX, Lockheed Martin, Fiserv, Moody's, Freeport-McMoRan, General Motors, Deutsche Boerse

Wednesday October 23

- Data: US September existing home sales, Eurozone October consumer confidence

- Central banks: Fed's Beige Book, Bowman and Barkin speak, BoC decision, ECB's Lagarde, Lane, Cipollone, Escriva, Knot and Centeno speak, BoE's Bailey and Breeden speak

- Earnings: Tesla, Coca-Cola, T-Mobile US, Thermo Fisher Scientific, IBM, ServiceNow, NextEra Energy, AT&T, Boston Scientific, Lam Research, Iberdrola, Boeing, Atlas Copco, Amphenol, CME, GE Vernova, Newmont, Hilton, Heineken

- Auctions: US 20-yr Bond (reopening, $13bn)

Thursday October 24

- Data: US, UK, Japan, Germany, France and Eurozone October flash PMIs, US September Chicago Fed national activity index, new home sales, October Kansas City Fed manufacturing activity, initial jobless claims, France October manufacturing confidence

- Central banks: Fed's Hammack speaks, ECB's Kazaks and Lane speak, BoE's Mann speaks

- Earnings: S&P Global, Union Pacific, Honeywell, KKR, UPS, SK Hynix, Equinor, Dassault Systemes, Keurig Dr Pepper, Nasdaq, Dow, Evolution AB, Neste Oyj, Norsk Hydro

- Auctions: US 5-yr TIPS ($24bn)

Friday October 25

- Data: US September durable goods orders, October Kansas City Fed services activity, UK October GfK consumer confidence, Japan October Tokyo CPI, September PPI services, Germany October Ifo survey, France October consumer confidence, Q3 total job seekers, Italy October consumer confidence index, manufacturing confidence, economic sentiment, Eurozone September M3, Canada August retail sales

- Central banks: ECB consumer expectations survey

- Earnings: Sanofi, HCA Healthcare, Colgate-Palmolive, Mercedes-Benz, Eni, Sika, Centene

* * *

Finally, turning to the US, Goldman writes that the key economic data release this week is the durable goods report on Friday. There are several speaking engagements from Fed officials this week.

Monday, October 21

- There are no major economic data releases scheduled.

- 08:55 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks at the 2024 Securities Industry and Financial Markets Association (SIFMA) Annual Meeting. Text and moderated Q&A are expected.

- 01:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a townhall hosted by the Chippewa Falls Chamber of Commerce in Wisconsin. Audience and moderated Q&A are expected. On October 14th, Kashkari noted that “further modest reductions” in the fed funds rate were likely appropriate in coming quarters. Kashkari also said that “a rapid labor weakening does not appear to be imminent” and stressed that “the path ahead for policy will be driven by the actual economic, inflation, and labor market data.”

- 05:05 PM Kansas City Fed President Schmid (FOMC non-voter) speaks: Kansas City Fed President Jeffrey Schmid will deliver remarks on the economic and monetary policy outlook to the Chartered Financial Analyst (CFA) Society in Kansas City. Text and audience Q&A are expected.

- 06:40 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will take part in a moderated discussion at a Wall Street Journal Live event in California. Moderated and audience Q&A are expected. On October 15th, Daly said that “one or two cuts [this year] was a reasonable” baseline if the economy performs as expected and noted that “it’s clear … the direction of change is down.”

Tuesday, October 22

- 10:00 AM Richmond Fed manufacturing index, October (consensus -17, last -21)

- 10:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will speak at the 8th Annual Fintech Conference, hosted by the Philly Fed. Text is expected.

Wednesday, October 23

- 09:00 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will deliver opening remarks at the Philly Fed’s Fintech Conference.

- 10:00 AM Existing home sales, September (GS +2.1%, consensus +1.0%, last -2.5%)

- 12:00 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will deliver a speech about community colleges at the 2024 Virginia Education and Workforce Conference. Text is expected. On October 10th, Barkin noted that, while he “wouldn’t declare victory” on inflation, he thought it was “definitely headed in the right direction.” Barkin said that the FOMC’s 50bp cut in September was “a recalibration toward a somewhat less restrictive stance” and noted that he “didn’t have a lot of heartburn about whether you got there in three steps or four steps or two and then one.” Barkin noted that the recent labor market data “confirms what I’m hearing … We’re in a low hiring, low firing environment.”

- 02:00 PM Beige Book, November meeting period

Thursday, October 24

- 08:30 AM Initial jobless claims, week ended October 19 (GS 245k, consensus 240k, last 241k); Continuing jobless claims, week ended October 12 (consensus 1,876k, last 1,867k): We estimate that initial claims increased to 245k in the week ended October 19th, reflecting a 5-10k incremental boost from hurricane-related filings on the back of Hurricane Milton but a slight headwind from residual seasonality.

- 08:45 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will deliver welcoming remarks at an event hosted by the Cleveland Fed’s Center for Inflation Research.

- 09:45 AM S&P Global US manufacturing PMI, October preliminary (consensus 47.5, last 47.2); S&P Global US services PMI, October preliminary (consensus 55.0, last 55.2)

- 10:00 AM New home sales, September (GS -0.5%, consensus +0.6%, last -4.7%)

- 11:00 AM Kansas City Fed manufacturing index, October (consensus -5, last -8)

Friday, October 25

- 08:30 AM Durable goods orders, September preliminary (GS -2.0%, consensus -1.0%, last flat); Durable goods orders ex-transportation, September preliminary (GS +0.1%, consensus -0.1%, last +0.5%); Core capital goods orders, September preliminary (GS +0.1%, consensus +0.1%, last +0.3%); Core capital goods shipments, September preliminary (GS +0.1%, consensus flat, last -0.1%): We estimate that durable goods orders declined 2.0% in the preliminary September report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast 0.1% increases in core capital goods orders and shipments, reflecting mixed global manufacturing data.

- 10:00 AM University of Michigan consumer sentiment, October final (GS 68.8, consensus 69.5, last 68.9): University of Michigan 5-10-year inflation expectations, October final (GS 3.1%, last 3.0%)

Source: DB, Goldman

|

|

[Markets]

This presidential candidate is still the stock market’s bet to win the election

The Dow’s indication of who will win the U.S. presidency deserves to be taken seriously.

Published:10/17/2024 6:29:41 AM

|

|

[Markets]

The Dow is running hot. History says that’s usually a good sign.

The Dow Jones Industrial Average is showing “impressive and persistent momentum on daily, weekly, monthly, and yearly time frames,” says SentimenTrader’s Jason Goepfert.

Published:10/10/2024 4:39:33 AM

|

|

[Markets]

Dow logs record high as stocks rise, Treasury yields jump after strong jobs data

U.S. stocks rallied Friday on fresh signs of a strong labor market, with the Dow Jones Industrial Average ending at a record peak while the bond market dialed back recession fears.

Published:10/4/2024 5:57:24 PM

|

[Markets]

Warren Buffett, Dave Ramsey, & John Maynard Keynes Are Wrong!

Warren Buffett, Dave Ramsey, & John Maynard Keynes Are Wrong!

Authored by Mark Thornton via The Mises Institute,

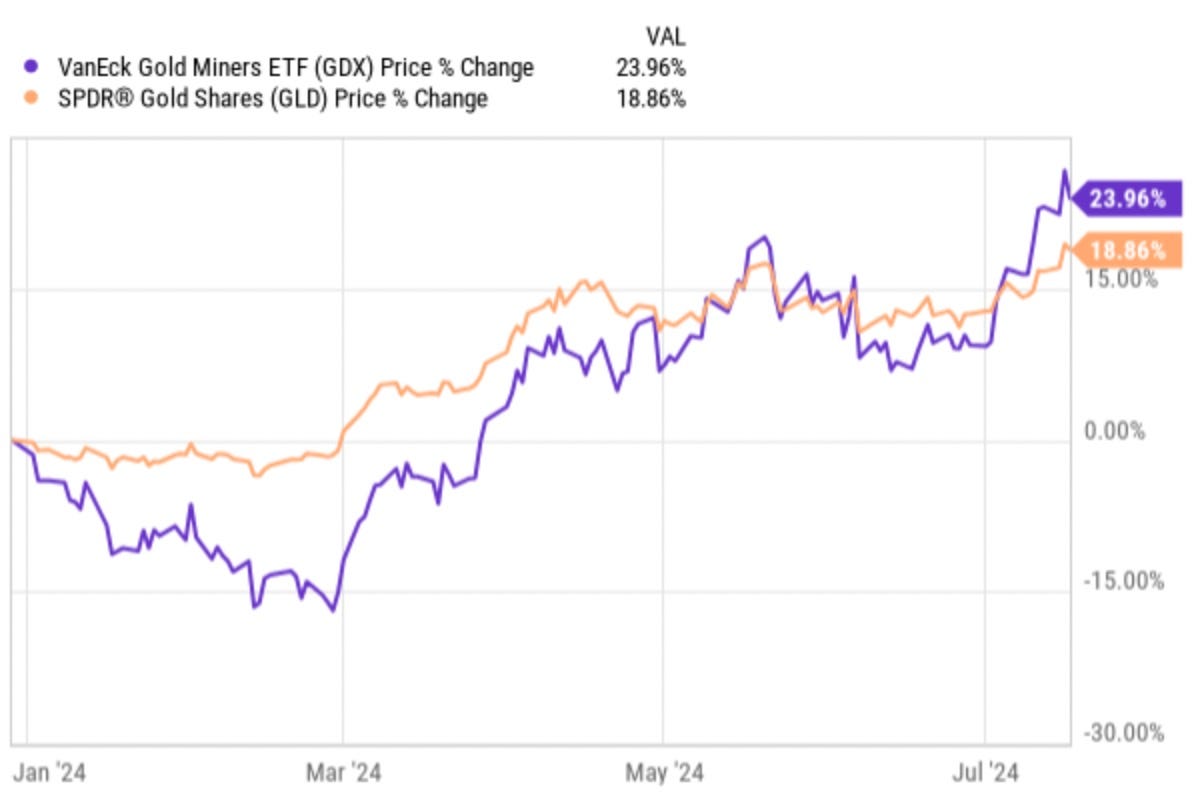

This week, we explain how Warren Buffett, Dave Ramsey, and John Maynard Keynes are wrong about gold.

John Maynard Keynes, the Godfather of Keynesian economics, famously called gold the “barbarous relic,” a term he used to denigrate the gold standard and to disparage the use of gold as money.

Specifically, he hated the constraint the gold standard placed on government spending. If the government prints too much currency that can’t be redeemed in gold, then it must cut back its spending, bringing on a recession or depression, or face runaway price inflation in the economy.

Following in Keynes footsteps, investment whiz kid Warren Buffett, son of the great investor and Congressman, Howard Buffett, has famously disparaged gold as an investment, saying it has “no yield.” He otherwise has voiced no coherent political philosophy, like his father.

Hotshot Radio voice, Dave Ramsey, has likewise sharply disparaged gold as an investment, saying it’s just a “shiny, shiny rock,” with no yield, and is a terrible investment.

Gold in Society

Of course, in this “age of inflation,” people like Buffet junior and Ramsey are heralded for their calls for prudence in what otherwise is a financial landscape warped by hedonistic government policies of spending, borrowing without limits, and printing fiat money by the trillions.

I will show here how wrong all three men are on all the investment points and even how contradictory their views on gold are, but I must emphasize that I am not offering any kind of investment advice here! This is just analysis and commentary on the current scene.

This hatred and disparagement of gold as money and the gold standard has become standard dogma of and a pillar of the modern state.

In complete contrast, regular people in society still instinctively see gold as an emblem of excellence more than a half century since the last vestige of the gold standard was taken away from us.

Gold medals represent the very best achievements; silver medals represent the next level down.

Teachers and parents still use the “star system” with gold or yellow stars representing the highest achievement. From babies to high school students, gold stars are still an inducement to effort and achievement.

Later on in life, gifts of jewelry are used to convey our affection and admiration. First, it might be things like friendship rings, but we all know that gifts of gold jewelry are an attempt to convey a high level of esteem by the gift giver. When the Wise Men visited the baby Jesus they brought gifts of gold, along with the precious perfume-medicinal compounds of frankincense and myrrh.

Even marketers of companies and company products—where there is a profit and loss prime directive—strive to be able to claim that their company, their product, or their service is “the gold standard” in their industry, or with their customers.

When humans started to see the world in terms of its elements, humanity took off! The Bronze Age: society, culture, religion, buildings, science, etc.—gold was the rarest and most precious, even cherished, of them all. Human history is replete with gold exclamations whether it is culture, religion, art, and now technology and even medicine! The greatest age of peace and prosperity is the gold standard era of the 19th century!

Investment Comparisons

First of all, gold is not primarily an investment. Gold and silver are monies, the most advanced forms of money for thousands of years before the “age of inflation.”

Technically, gold and silver are not money now, but only because they were forced out of that role by the state. Gold shackles the state; paper money unleashes it from its golden cage. Murray Rothbard explains this in his What Has Government Done to our Money? This is such an important work.

Obviously, if gold and silver are money, you don’t need to “invest” in gold and silver, as you are already keeping some large percentage of your net worth in cash balances, checkable deposits, savings deposits, and gold- or silver-denominated bonds and insurance policies.

I remember as a kid that after we were taken off the gold standard that investment advice typically recommended, say a 20% cash holding position, with say half of that in cash funds for personal use and emergencies and half in precious metals for reasons such as inflation protection. The rest of your net worth statement would be in investments such as stocks, bonds, and real estate. The cash type holdings were not considered investments, but were for emergencies, diversification, and to take advantage of investment opportunities as you built bigger cash holdings.

Of course, this cuts off Warren Buffett’s objections at the knees. He is after all the “king of cash,” often with mountains of cash on the balance sheet of his company. Yes, this cash does earn a yield, which might be important to his investors, but the cash yield is also subject to the inflation premium tax and all the government taxes too. The risk of loss has been very low.

Gold can underperform stock investments. However, when I took a look at the average closing prices for gold, the Dow, and the S&P 500, during 1971—when we were taken off the gold standard—and last year, 2023, dividing 2023 into 1971, gold went up 47 and a half times, the Dow went up only 38.6 times, and the S&P 500 only went up 44.6 times.

So, gold actually wins that simple comparison over the 52-year period. It’s a “simple” comparison because it doesn’t include reinvested dividends, where stocks would win, and it doesn’t include capital gains taxes on stocks or fees, which would hurt stocks, and it doesn’t include the annual safety deposit box fee where for less than $100 per year you can rent a box in a bank that would hold a large amount of gold and your important papers.

Again, my points are not a matter of financial advice, or that gold is a superior investment, it’s just to point out that Mr. Buffet and Mr. Ramsey don’t know what they are talking about and have failed to look at the facts of history—any kind of history—in voicing their “opinions.”

In fact, I’m not even suggesting that putting all your money into gold or silver is a great idea! In the past, investment advisors simply recommended that part of our cash investments be in precious metals to protect long run purchasing power, a diversification asset, and something to balance your net worth statement. It also helps build your “buy and hold” mentality towards savings because gold and silver come with transaction fees and difficulties—less than real estate, but more than typical stocks today, or just using your debit card.

In the end result, John Maynard Keynes was a socialist who preferred more of an absolutist state that could do much as it pleases, including unrestricted borrowing and spending. The anti-gold dogma generated by the Federal Reserve’s propaganda machine is intensely strong among us. Mr. Buffet and Mr. Ramsey swallowed that statist creed hook, line, and sinker.

* * *

We have kicked off the Fall Campaign at the Mises Institute. I humbly request that you make a small donation in the name of this podcast using the link in the show notes. It would mean a great deal to me. For every $100 or more donation, or recurring donation of $5 or more, using this link, I will send you a signed copy of my Skyscraper Curse book: mises.org/mi5

|

[Markets]

What's Changed? What's Different This Time?

What's Changed? What's Different This Time?

Authored by Charles Hugh Smith via OfTwoMinds blog,

This raises another question: how will the deflation of the Everything Bubble play out?

Causes generate effects. As noted in my previous post, if causal conditions have changed, the "guarantee" offered by statistics is empty. This leads to a simple question: what's changed? Have the causal conditions changed enough to generate different results?

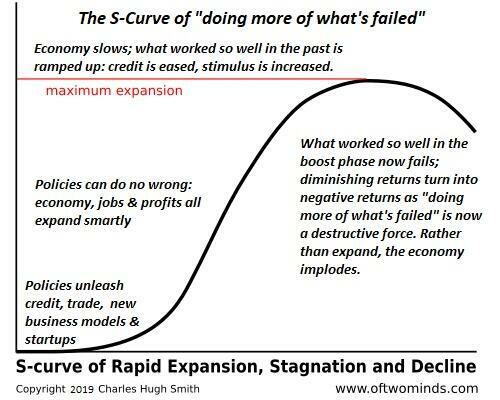

The status quo assumes the economy never really changes, and so the stimulus that worked last time will work again. This ignores the fundamental reality that change is constant and once causal conditions change, the effects will necessarily change as well.

So what's changed in the 42 years since 1982? Why 1982? 1982 marked the end of the stagflationary 1970s and the start of the 40+-year bull market in stocks, real estate, and until recently, bonds.

1. China was just emerging from the Cultural Revolution. After 40 years of astounding growth, it's struggling.

2. Debt levels across all sectors--public, corporate and household--were low compared to the present.

3. The global Baby Boom was entering peak earning, household formation, home buying, and starting enterprises. Now they're retiring and entering the phase of selling assets to downsize and fund retirement.

4. Computer technology entered the mainstream economy and boosted productivity. Now we have AI but its long-term effect on global productivity is unproven.

5. Diminishing returns are manifesting across the global economy, as what worked so well in the boost phase no longer generates the same results.

China has changed in many ways. Scale matters. When a company is small and it boosts revenues by $1 billion, the stock rockets to the moon. Once it's a trillion-dollar company, adding $1 billion no longer has the same effect. In fact, it's a red flag that growth has slowed. Once profit margins slip, the stock crashes, as the growth story has ended.

The same causal conditions are present in China, which has reached a vast scale at the top of the S-Curve. China boosted its economy for decades by inflating an unprecedented real estate bubble, which created an enormous wealth effect in its burgeoning middle class. But all bubbles pop, and the concentration of household wealth in real estate means the decline is obliterating the heady sense of confidence generated by soaring assets.

China has also reached limits in exports and domestic consumption, for a variety of reasons.

The "never fails" China credit impulse has failed. Every economy that depends on expanding credit for its growth eventually enters a liquidity trap, where lowering interest rates and lending standards no longer boost assets or consumption because 1) households are wary of adding more debt or 2) households cannot afford to add more debt, even at low rates of interest.

China is also mired in the middle income trap, where the elite holds the majority of wealth and the rural populace is still earning very low incomes.

China pulled the global economy out of the 2008-09 Global Financial Meltdown, that's not going to happen again. Once causal conditions change, so do the results.

The astounding expansion of credit/debt globally is an example of how a "solution" generates "problems" that only get worse the more "solution" is applied. Flooding the economy with low-cost credit works wonders when debt levels are low and there is pent-up demand for credit.

But once an economy is saturated with credit and staggering under the weight of servicing existing credit, adding more debt creates a problem more credit cannot solve: the greater the burdens of debt, the higher the risks of default.

Global debt has been rising on the shaky foundation of the Everything Bubble: as assets have bubbled higher, they expand the collateral available to borrow against. Once the bubble pops, then the collateral evaporates and the lender is under water: the assets is worth less than the loan amount. There is no escape for either borrower or lender.

Demographics have changed. The massive global Baby Boom is exiting the workforce and starting to liquidate assets to fund retirement. This transition from buying assets to selling assets raises the question: who will buy all these assets at today's nosebleed overvaluations? Younger generations lacks the capital and income to buy assets at these levels of overvaluation, and there is nothing on the horizon that could change that asymmetry.

Selling pushes down asset prices, which then reduces the collateral supporting global debt, which then lights the fuse of a credit crisis that can't be resolved by lowering credit and lending standards. Diminishing returns are not reversed by doing more of what's failed--they're accelerated into unstable crises by doing more of what's failed.

As for the hype that AI is going to save us: what we see as causal conditions are stupendous expenses, not gains in productivity. Economists puzzled over the "productivity gap" in the 1980s as new technologies entered the mainstream economy: companies and households were buying the new technologies but productivity wasn't responding as expected.

Rosy projections are not causal; real productivity gains take time, and don't always play out as projected. If AI eventually boosts productivity across the entire economy, is may take a decade to play out. The current credit-asset bubble that's popping will not be "saved by AI."

This raises another question: how will the deflation of the Everything Bubble play out? Richard Bonugli and I discuss this in our new podcast How Asset Deflation Could Play Out (35:37 min).

There are two basic scenarios, and which one plays out depends on the causal conditions emerging in the present.

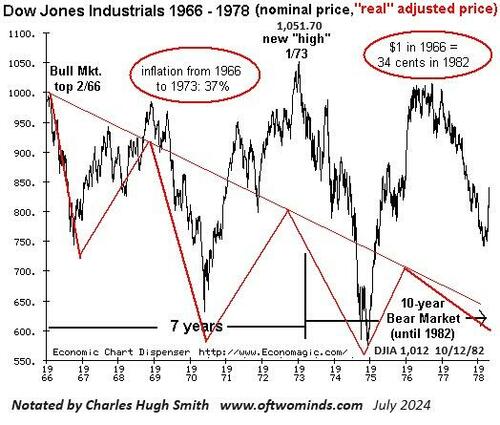

One is a massive deflation in the real-world value of assets hidden behind a stagflationary rise in nominal asset values, per the 1970s. When the Dow Jones Industrial Average finally exceeded its old high around 1,000 in 1982, everyone who had held on through the 1970s cheered: "we're whole again! We got our money back!" Alas, the purchasing power of the Dow 1,000 stocks had crashed by 57% since the 1973 stock market top of Dow 1,051 and by a staggering 66% since the Dow top in 1966.

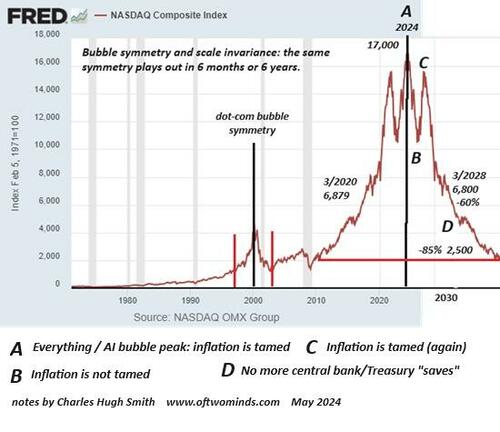

The other scenario is a no-frills crash. I prepared this chart of the Nasdaq stock index based on bubble symmetry. Crashes come in a variety of flavors, but the end result is the same.

What's changed? Many things. What will be different about the results? That is unknown, but we do know that statistics drawn from previous sets of causal conditions have no bearing on what happens in the current causal conditions. This time is different isn't always what we expect; it can also play out with extreme prejudice.

* * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

|

|

[Markets]

Amentum to replace Bath & Body Works on S&P 500

The engineering and tech-services firm Amentum will replace home-goods and fragrance chain Bath & Body Works on the S&P 500 at the end of the month, S&P Dow Jones Indices said Tuesday.

Published:9/24/2024 5:55:14 PM

|

[Markets]

Futures Fall As Fed Frenzy Fades And Traders Brace For $4.5 Trillion Quad Witch OpEx

Futures Fall As Fed Frenzy Fades And Traders Brace For $4.5 Trillion Quad Witch OpEx

After yesterday's delayed (and technically-driven) post-rate cut meltup, futures are set to close the week on a downbeat note as they slide across the board, following European stocks lower, but still just shy of the all time high they hit yesterday. As of 8:00am S&P futures are down 0.3% as disappointing earnings (FDX cratered -13% after missing and cutting guidance, dragging UPS -2.4% and logistics names lower) tempered the euphoria around the trajectory for interest rates; Nasdaq futures were down 0.4% with most MegaCap Tech names lower: TSLA (-3.6%) is the top mover, followed by META (-1.8%) and AAPL (-1.7%). The yen plunged more than 1% after the BOJ announced no hike to its policy rate, in line with expectation, and further signaled the gradualist approach to its rate hikes. USDJPY +0.8% to 143.8; NKY +1.5%. PBOC left loan prime rates unchanged. Throwing a potential wrench in what may have been a quiet end to the week is that today brings the ninth option expiry of 2024, and the last “quad witch” before the US election, where a record for September $4.5 trillion in notional will expire between now and 4pm ($2.6 trillion of this is SPX Sep regular / the remaining is split across etf and single stock at end of day) potentially triggering volatility, although market implied vol is low enough to rent delta in either direction. Yields are mostly higher, and USD is largely unchanged; 5-, 10-yr yields are 5bp, 10bp higher. Commodities are mixed with oil and metals higher, while ags are mostly lower. There is nothing on the macro calendar.

In premarket trading, FedEx plunged 14% after the parcel carrier lowed its annual outlook for adjusted earnings per share and revenue growth, while posting a worse-than-expected quarterly profit. Morgan Stanley downgraded the stock and warned Fedex could be facing structural risks. Nike shares rise 6.8% Friday after the company announced Elliott Hill will return to the company as CEO and president effective Oct. 14, replacing John Donahoe, who will retire. Analysts were positive about the announcement as Hill is an industry and company veteran. Here are some other notable premarket movers:

- Apellis Pharmaceuticals shares drop 7.5% after the drugmaker said a committee of the European Medicines Agency has upheld its negative opinion on the marketing authorization for the company’s eye drug, Syfovre.

- Assembly Biosciences shares rise 5.4% after Jefferies upgraded the stock to buy from hold ahead of data for the firm’s Herpes simplex virus (HSV) anti-viral drug.

- Snap shares edge lower, falling 1.2% as B Riley Securities initiated coverage on the social media company with a neutral recommendation. Analyst Naved Khan says the stock is trading at a premium to its peers with a “full” valuation.

The Fed's bld half-point rate cut this week boosted confidence that it will be able to engineer a soft landing, but warnings such as the one from FedEx underscore lingering risks to the economy. Fed policymakers have projected a further half point of reductions this year.

“For all the optimism in markets right now, it’s clear that a few concerns still lie under the surface,” said Jim Reid, a strategist at Deutsche Bank AG. “In particular, futures are continuing to price in a more aggressive pace of cuts than was implied by the Fed’s dot plot on Wednesday, so investors think they might need to accelerate those rate cuts if downside risks materialize.”

For BofA’s resident bear, Michael Hartnett, the optimism in equity markets following the Fed’s move is stoking the risk of a bubble, making bonds and gold an attractive hedge against any recession or renewed inflation. In his latest Flow Show, he said stocks are now pricing in more Fed easing and about 18% earnings growth for the S&P 500 by end-2025. It doesn’t “get much better than that for risk, so investors are forced to chase” the rally, Hartnett wrote in a note. He also said stocks outside the US and commodities, especially gold, were a good way to play a possible soft economic landing, with the latter being an inflation hedge. And sure enough, gold just hit a fresh record above $2,600 an ounce as the Fed’s aggressive start to policy easing continued to ripple through markets.

Traders are also braced for the quarterly “quad witching,” when about $4.5 trillion in options and derivatives and futures are set to mature according to Goldman, making it the largest September expiry of all time. The options expiry coincides with the rebalancing of benchmark indexes. The event has a reputation for causing sudden price moves as contracts disappear and traders roll over their existing positions or start new ones (full preview here).

Elsewhere, the Bank of Japan was in focus as it kept policy unchanged, with the yen sliding 1.2% as Governor Kazuo Ueda proved less hawkish than some traders expected. Ueda signaled little urgency to hike rates, and said that upside risks to inflation are easing.

European stocks slumped, with the Estoxx 50 falling almost 1% as Mercedes-Benz Group tumbled as much as 8.4% after cutting its financial forecast because of sluggish China sales; besides autos, info tech and consumer discretionary sectors underperformed while utilities and telecommunications stocks are the biggest outperformers. Here are the biggest European movers:

- Mercedes shares fall as much as 8.4% to nearly a two-year low after the German carmaker cut its 2024 financial forecast in a profit warning that RBC called both surprising and ambiguous

- Atoss Software gains as much as 2.3% after Deutsche Bank initiated coverage of the German software firm with a buy recommendation, calling it a “leader” in the German-speaking workforce management market

- Card Factory advances as much as 8.3% and Moonpig +6.8% as UBS recommends buying shares of the UK-listed greetings-card retailers

- Volution Group shares rise as much as 12% to hit a record high after the maker of indoor air quality products agreed to buy the Fantech Group of companies for up to a total of AUD280 million

- ASML shares fall as much as 2.7% after Morgan Stanley downgraded the chip-equipment maker to equal-weight from overweight, seeing earnings growth at risk of uncertain demand from memory chipmakers, Intel and China

- Hexpol falls as much as 7.8%, the most sinceJanuary 2023, after Kepler Cheuvreux reiterated its hold rating ahead of the Swedish polymer and rubber firm’s 3Q report on Oct. 25

- JDE Peet’s shares fall as much as 8.3% after a shareholder sold about 3.5 million shares in the Dutch coffee maker at a discounted price of €19 per share, according to terms seen by Bloomberg

- Burberry falls as much as 5.1%, extending yearly losses to 58% and among the worst performers on the Stoxx 600, after Jefferies cut its recommendation on the firm to underperform in a bearish review on the sector, advising investor caution

- Dr. Martens shares slide as much as 18%, hitting a fresh record low, after an unnamed investor sells around 70 million shares via Goldman Sachs at a 9.8% discount versus Thursday’s close

Earlier in the session, Asian stocks set its best week in a month as the Federal Reserve’s larger-than-expected rate reduction and hopes of China’s stimulus rekindled appetite for riskier assets. The MSCI Asia Pacific Index rose 0.7% to a two-month high on Friday, taking this week’s advance to 2%. Most benchmarks gained with the Hang Seng China Enterprises Index up for a sixth session. Japanese shares held onto gains as the Bank of Japan kept its monetary policy steady, signaling it’s in no rush to raise interest rates. Financial markets across the region have been upbeat, with a gauge of the region’s currencies reaching a 16-month high this week. The Malaysian ringgit and the Indonesian rupiah have strengthened against the dollar this week.

In FX, the Bloomberg Dollar Spot Index traded in a narrow range against most of its other Group-of-10 peers and swung from losses to gains as the yen first gained then tumbled. And speaking of the yen, it plunged more than 1% after Governor Kazuo Ueda indicated the Bank of Japan isn’t in a hurry to increase interest rates again. The pound outperformed its peers after UK retail sales grew at a faster pace than expected

In rates, treasuries were cheaper across the curve and yields rose in a mild bear-flattening move that partially unwinds the steepening trend advanced by Wednesday’s half-point Fed rate cut. Front-end yields are cheaper by more than 2bp, narrowing 2s10s and 5s30s curve spreads; 10-year around 3.73% is less than 2bp cheaper on the day with bunds and gilts outperforming by 1bp and 2bp. Treasury coupon auctions ahead next week include 2-, 5- and 7-year note sales Tuesday, Wednesday and Thursday

In commodities, oil was on track for the biggest weekly advance since February. Gold hit a fresh record above $2,600 an ounce as the Fed’s aggressive start to policy easing continued to ripple through markets.

US economic data calendar is blank; Fed speaker slate includes Philadelphia Fed President Harker at 2pm as well as ECB President Lagarde.

Market Snapshot

- S&P 500 futures down 0.2% to 5,703.75

- STOXX Europe 600 down 0.7% to 518.09

- MXAP up 0.7% to 186.70

- MXAPJ up 0.7% to 583.56

- Nikkei up 1.5% to 37,723.91

- Topix up 1.0% to 2,642.35

- Hang Seng Index up 1.4% to 18,258.57

- Shanghai Composite little changed at 2,736.81

- Sensex up 0.9% to 83,965.54

- Australia S&P/ASX 200 up 0.2% to 8,209.47

- Kospi up 0.5% to 2,593.37

- German 10Y yield little changed at 2.18%

- Euro little changed at $1.1165

- Brent Futures down 0.5% to $74.49/bbl

- Gold spot up 0.9% to $2,610.23

- US Dollar Index little changed at 100.70

Top Overnight news

- Japan’s BOJ left rates unchanged, as was widely expected, but said the economy was progressing in a manner consistent with its expectations (the view on consumption was tweaked higher), reinforcing expectations that another hike could occur this year. Nikkei

- China disappoints markets by leaving its Loan Prime Rates unchanged (some felt the country’s weakening growth outlook, coupled with the Fed’s outsized move, would spur a reduction in the LPR). WSJ

- China is working on a proposal to remove home purchase restrictions as the gov’t scrambles to support an economy that continues to cool. BBG

- The European Central Bank's rate cutting cycle could accelerate over coming months, governing council member Fabio Panetta said on Thursday. RTRS

- After months of saying a cease-fire and a hostage-release deal was close at hand, senior U.S. officials are now privately acknowledging they don’t expect Israel and Hamas to reach an agreement before the end of President Biden’s term. WSJ

- Port of New York/New Jersey executives have begun preparations for a potential complete work stoppage by the International Longshoreman’s Association which is the largest union in North America: CNBC

- Warren Buffett’s disposals of BofA shares have covered his investment cost of $14.6 billion, leaving him with a stake worth more than $34 billion that’s pure profit. Berkshire Hathaway sold about $900 million of the stock in the latest tranche. BBG

- OpenAI’s latest fundraising is nearing completion, with prospective investors set to find out Friday whether they’ll be part of the deal, according to people familiar with the matter. The $6.5 billion funding round for the artificial intelligence startup is oversubscribed, meaning investors were hoping to put in more money than the company was ready to take on. BBG

- Nike (+7% pre mkt) announced that Elliott Hill will become President and CEO, effective October 14, 2024. WSJ

- FedEx (-14% pre mkt) reported a miss on EPS, margins, and sales due to weak volumes and a mix shift to lower-priced products, and the full-year guidance was trimmed. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly gained following the rally stateside where the S&P 500 and the Dow surged to fresh record highs as the dust settled after the Fed over-delivered in its first rate cut in four years and US data topped forecasts. ASX 200 followed suit to its US counterparts as tech led the advances and the index printed a new all-time high. Nikkei 225 outperformed again and approached closer to the 38,000 level, while the BoJ policy announcement provided no major fireworks in which the central bank kept its short-term rates unchanged at 0.25%, as unanimously forecast. Hang Seng and Shanghai Comp were mixed with the former joining in on the optimism in the region owing to the recent central bank activity and with EV makers finding some encouragement from recent China-EU EV tariff talks. Conversely, the mainland lagged despite the recent pledge by the NDRC to roll out a batch of incremental measures and reports that China is mulling removing major homebuying curbs, while the PBoC also announced China's latest Loan Prime Rates which were unsurprisingly maintained at their current levels.

Top Asian news

- China weighs removing major homebuying curbs to boost demand and may end distinctions between first and second home purchases, while it may also ease restrictions on non-local homebuyers in Beijing and Shanghai, according to Bloomberg. People familiar with the matter also said authorities are mulling measures to shore up the sluggish stock market but didn't provide specifics.

- China and EU both aim to resolve differences via consultations over the EU investigation into Chinese EVs, while China's Commerce Minister and EU's Trade Commissioner are to continue pushing forward negotiations on price commitments and the sides are to spare no effort to reach a mutually acceptable solution through dialogue, according to Xinhua. This followed a previous report that no deal was reached in EU-China talks on EV tariffs and EU's Dombrovskis said both sides agreed to intensify efforts to find an effective, enforceable and WTO-compatible solution.

- USTR office said it will accept public comments from Monday on plans for steep tariff increases on Chinese polysilicon, silicon wafers and tungsten products, according to Reuters.

- Republican Senator Rubio is introducing a bill to prevent Chinese companies from benefiting from favourable US trade rules by operating in other countries.

- China's NDRC will cut retail gasoline and diesel prices by CNH 365/ton and CNH 350/ton respectively, starting September 21, via Bloomberg

European bourses, Stoxx 600 (-0.6%) are entirely in the red, but to varying degrees; price action today has been fairly lacklustre, with indices generally slowly drifting lower as the morning progressed. European sectors hold a strong negative bias; Utilities takes the top spot alongside Telecoms. Autos is by far the clear underperformer, dragged down by Mercedes-Benz (-7.1%) after it cut guidance citing China weakness. Consumer Products and Tech also lag, with the latter hampered by ASML (-2%) after it was downgraded at Morgan Stanley.

Top European news

- ECB's Rehn says they have progressed well towards the inflation target, easing pace is data-dependent.

- ECB's de Guindos says they have left the door totally open and in December they will have more information than in October.

- BoE's Mann says she agrees with investors who think inflation could stay above target for an extended period of time. It is better, under inflation uncertainty, to remain restrictive for longer, until right tail risks to the inflation process dissipate, and then to cut more aggressively. Has a guarded view on initiating a cutting cycle despite agreeing with the majority for a hold at the meeting just concluded. Policy needs to remain restrictive to purge inflationary behaviours. Risk of inflation expectations de-anchoring have subsdided. Did consider voting to cut rates in August but wanted to avoid a "boogie-dance" with policy rates.

BOJ Decision

- BoJ kept its short-term policy rate unchanged at 0.25%, as expected with the decision made by unanimous vote, while it said Japan's economy is recovering moderately albeit with some weaknesses and inflation expectations are heightening moderately. BoJ also stated that inflation is likely to be at a level generally consistent with the BoJ's price target in the second half of its 3-year projection period through fiscal 2026 and it sees medium and long-term inflation expectations increasing. Furthermore, it sees exchange rate trends as having a greater influence on prices and said Japan's economy is likely to achieve growth above potential but also stated that they must be vigilant to the impact of financial and FX market moves on Japan's economy and prices.

Ueda press conference

- Outlook for overseas economies, incl. the US and markets, remains unstable. When asked about remarks from Uchida, says markets remain unstable. Remarks which sparked USD/JPY upside.

- Upside price risks have decreased given recent FX moves; risks of an inflation overshoot have somewhat diminished.

- No change to the thinking that they will continue to lift rates if the economy develops as expected; will take the next policy step when there is enough evidence.

- Aware that more efforts are needed to change market expectations as policy rates have shifted in earnest to positive territory from zero or negative over long period.

- Need to watch to see if the US economy attains a soft landing, making a judgement on the US is difficult.

FX

- DXY is steady vs. peers (ex-JPY) in what has been an eventful week for the USD after the Fed delivered an outsized 50bps rate cut and sent DXY to a fresh YTD trough at 100.21.

- EUR is flat vs. the USD but in close proximity to recent highs. EUR/USD is sitting just below the WTD peak set on Wednesday at 1.1189 with focus on a test of 1.12.

- GBP is the marginal outperformer across the majors on account of better-than-expected UK retail sales and yesterday's "hawkish hold" by the BoE which led markets to no longer fully price a 25bps reduction at the November meeting. Cable is off best levels, however, printed another multi-year high earlier in the session at 1.3340.

- JPY is the laggard across the majors, initially unreactive to the BoJ policy announcement, which kept rates unchanged. However, follow-up remarks from BoJ Governor Ueda gave the impression that the Bank was not in a rush to hike rates further as policymakers assess the impact of prior tightening. Accordingly, USD/JPY rose from a 141.75 base to a 143.75 peak but is yet to eclipse yesterday's 143.94 peak.

- AUD/USD's recent run of gains since Monday has paused for breath with the USD a touch firmer vs. AUD. NZD/USD is seeing uneventful trade with the pair contained within yesterday's 0.6181-0.6268 band.

- PBoC set USD/CNY mid-point at 7.0644 vs exp. 7.0637 (prev. 7.0983).

- Chinese major state-owned banks are seen buying dollars in the onshore currency market to prevent the yuan from strengthening too fast, according to sources cited by Reuters.

Fixed Income

- USTs are slightly firmer with specifics light thus far for the US but with action coming from the BoJ; while the decision itself was largely uneventful the presser saw a particularly dovish Ueda. Thus far, USTs have probed but failed to breach 115-00 or, by extension, test yesterday’s 115-02+ top. Fed's Bowman (who dissented at the most recent meeting) is set speak about her decision later.

- JGBs climbed by almost 30 ticks during Ueda's speech and potentially driving the broader modest move higher in USTs/EGBs/Gilts across the morning.

- Gilts gapped lower by nine ticks as the benchmark reaction to UK data points from earlier in the morning with strong Retail Sales (buoyed by good weather) sparking a hawkish reaction in GBP at the time a modest but fleeting move in market pricing. The move ultimately proved fleeting, broadly a factor of the JGB upside.

- Bunds are towards the top end of a sub-30 tick range with European specifics relatively light aside from a handful of ECB speakers, though commentary was in-fitting with the data-dependent tone and as such did not merit any reaction. At a 134.53 peak, someway shy of Wednesday’s 134.86 best.

Commodities

- Crude complex is slightly softer largely a factor of today's subdued market sentiment. Brent'Nov sits near the lower end of a USD 74.40-74.87/bbl parameter.

- Precious metals are firmer but to varying degrees with spot silver the outperformer, spot gold printing fresh record highs, and spot palladium relatively flat. XAU rose from a USD 2,584.87/oz APAC low to a high of USD 2,612.60/oz in early European hours.

- Overall a mixed session for base metals amid the cautious tone elsewhere, but industrials are seemingly still supported by the Fed's 50bps rate cut alongside reports that China weighs removing major homebuying curbs to boost demand, according to Bloomberg.

- Operator of Kazakhstan's Karachaganak field says it cut oil output on Sept 9-5 due to maintenance; says it will run another round of maintenance on Sept 23-28.

Geopolitics: Middle East

- Israel conducted dozens of strikes in south Lebanon in a major intensification of bombing, according to Reuters citing security sources, while Israeli military later said that their fighter jets struck hundreds of rocket launcher barrels in southern Lebanon that were ready to be used immediately to fire toward Israeli territory, according to Reuters.

- "Senior adviser to (Israeli PM) Netanyahu presented the Biden administration with a new proposal for a ceasefire and the liberation of hostages", via Al Jazeera citing CNN

- Hamas source told Al-Arabiya that they are keen to reach an agreement in Gaza.

- The US doesn't expect an Israel-Hamas deal before the end of US President Biden's term, according to WSJ

- "Russia warns of 'dire consequences' if Israel launches large-scale military operation in Lebanon", according to Al Arabiya.

Geopolitics: Other

- Russia says it is concerned by increasingly "provocative" NATO activity on the border with Belarus. Russia notes that it has tactical nuclear weapons in Belarus, says Kyiv and the West risk "disastrous consequences" if they pursue provocative scenarios.

- Russian Foreign Minister Lavrov said they see how NATO is increasing its manoeuvres near the North Pole and that Russia is ready to defend its interests militarily, according to Asharq News.

- China Defence Ministry spokesperson said US arms sales to Taiwan seriously violated the One-China principle and provisions of China-US joint communiques.

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets put in a buoyant performance over the last 24 hours, as growing optimism about a soft landing and the Fed’s 50bp rate cut pushed risk assets up to new highs. In particular, the S&P 500 (+1.70%) surged to a fresh record, marking its 39th all-time high of 2024 so far, and taking it above its previous peak from mid-July. That was echoed across the board, with credit spreads tightening and oil prices rising, alongside a mounting belief that this economic cycle could still have some way to run.

This belief in the US soft landing got fresh support yesterday from the weekly initial jobless claims. Bear in mind that these are one of the timeliest indicators we have on the US labour market, and they showed claims were down to 219k (vs. 230k expected) in the week ending September 14. That’s the lowest number since May, and there are growing signs that isn’t just a blip, because the 4-week moving average was also down to 227.5k, which is the lowest since early June. The decline may have been boosted by residual seasonality, with strong September declines visible the previous two years. But the release comes on top of other strong data earlier in the week, including the retail sales and industrial production releases for August. Indeed, the Atlanta Fed’s GDPNow forecast is currently at an annualised +2.9% for Q3, almost in line with the +3.0% number in Q2, which doesn’t look like a recession at all.

Obviously it’s early days in this cycle of rate cuts, but so far at least, we appear to be in the benign scenario where the Fed are cutting rates outside of a recession. Historically, that has been a very good combination for equities, as Jim pointed out in his chart of the day earlier this week (link here). Moreover, with the Fed’s decision to cut on Wednesday, that’s adding to the global synchronicity of this monetary policy easing, as many of the developed world central banks are now cutting rates again.

That said, for all the optimism in markets right now, it’s clear that a few concerns still lie under the surface. In particular, futures are continuing to price in a more aggressive pace of cuts than was implied by the Fed’s dot plot on Wednesday, so investors think they might need to accelerate those rate cuts if downside risks materialise. For instance, the median dot signalled a further 50bps of cuts by year-end, with just one member opting for more than that at 75bps. But futures are pricing in 73bps of cuts by the December meeting, so by implication they think it’s more-likely-than-not that the Fed will cut faster than the dot plot.

The other interesting feature of recent sessions has been the recovery in near-term inflation swaps. As recently as September 6, the 2yr inflation swap fell to just 1.98%, which was the lowest it had been since 2020, before the inflation spike began. But over recent sessions, that has recovered back to 2.23%, which is the highest since July 19, before the market turmoil really kicked off in earnest at the start of August. Now clearly that’s pretty low by the standards of recent years. But with fears of a downturn falling back, it’s a sign that markets have become a little bit more cognisant of inflation risk over recent sessions, and gold prices (a classic inflation hedge) closed at another all-time nominal high yesterday of $2,587/oz.

Whilst many central banks have begun to ease policy again, one exception to this pattern of course is the Bank of Japan (BOJ), and their rate hike in July was a contributing factor to the market turmoil in early August. However, in their latest decision overnight, they’ve left their policy rate unchanged, in line with expectations. Their statement warned of “high uncertainties surrounding Japan’s economic activity and prices” and said that “it is necessary to pay due attention to developments in financial and foreign exchange markets”. Separately, data also showed that Japanese inflation picked up as expected, with headline inflation up to a 10-month high of +3.0% in August, having been at +2.8% in July. Against this backdrop, the Japanese Yen has strengthened +0.32% this morning, and is currently trading at 142.18 per US Dollar.

Otherwise in Asia, the region’s equity markets have built on the global rally overnight, with sizeable advances for the Nikkei (+1.90%), the Hang Seng (+1.45%) and the KOSPI (+0.94%). The exception to this have been equities in mainland China, where the CSI 300 (-0.27%) and the Shanghai Comp (-0.23%) are both lower this morning. That comes as the People’s Bank of China left their key lending rates unchanged, with the 1yr loan prime rate staying at 3.35%, and the 5yr loan prime rate at 3.85%.

Those moves in Asia follow a very strong performance in the US and Europe yesterday, with equities surging on both sides of the Atlantic. In the US, this saw the S&P 500 (+1.70%) hit a new record after its best session since early August, with tech stocks leading the way. That meant the NASDAQ was up +2.51%, and the Magnificent 7 saw an even larger gain of +3.44%. Small-cap stocks were another beneficiary, and the Russell 2000 (+2.10%) posted a 7th consecutive advance for the first time since March 2021. Meanwhile in Europe, it was a similar story of tech stocks leading the way, supporting gains for the STOXX 600 (+1.38%), whilst the DAX (+1.55%) hit a new record as well. However, futures are pointing to a pullback again this morning, with those on the S&P 500 (-0.12%) and the DAX (-0.33%) both lower.

Otherwise yesterday, the Bank of England announced their latest policy decision, where they kept their policy rate unchanged at 5%, in line with expectations. That follows their first rate cut of this cycle at the previous meeting, but Governor Bailey warned in a statement that “we need to be careful not to cut too fast or by too much”, even as he said they “should be able to reduce rates gradually over time”. At the meeting, they also voted to reduce their stock of gilts by £100bn over the next 12 months, maintaining the same pace as the previous year.

Against this backdrop, sterling strengthened to its highest level against the US Dollar since March 2022, at $1.3284 by the close yesterday. Similarly against the Euro, it was up to €1.1901. Gilts also underperformed their counterparts elsewhere, with the 10yr yield up +4.5bps, in contrast to yields on 10yr bunds (+0.7bps) and OATs (+1.5bps), which saw smaller rises.

When it came to US Treasuries, there was a fresh bout of curve steepening yesterday, which left the 2s10s at 13bps, the steepest it’s been since June 2022. That steepening has been seen across the yield curve, with the 5s30s up +3.2bps yesterday to 57bps, the steepest since January 2022. That came as the 10yr yield was up +0.9bps to 3.71%, whilst the 2yr yield fell back -3.6bps to 3.58%.

Looking at yesterday’s other data, US existing home sales fell to an annualised rate of 3.86m in August (vs. 3.90m expected), their lowest in 10 months. Separately, the Conference Board’s leading index fell -0.2% (vs. -0.3% expected).

To the day ahead now, and data releases include UK retail sales and German PPI for August. Otherwise, central bank speakers include ECB President Lagarde and the Fed’s Harker.

|

[Markets]

Delayed Gratification: Post-Powell Plunge Prompts Face-Ripping Rick-On Rally

Delayed Gratification: Post-Powell Plunge Prompts Face-Ripping Rick-On Rally

Yesterday's pump-and-dumps across most major asset-classes was met with a wall of BTFDing in Asia, Europe, and then the US which lifted stocks, gold, oil, and crypto prices (and bonds yields) in a delayed gratification day.

In fact, this is first time that yields rise after a 50bps cut since Lehman (Oct 2008).

It was 'Risk On' in equity-land, post the 50bps cut and the start of the easing cycle with Tech leading to the upside. Broad-based rally with >375 names up on the day in the S&P.

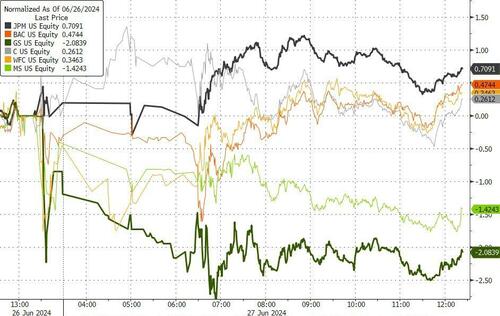

Nasdaq and Small Caps led the surge in stocks (the chart below is from 1400ET yesterday - to include the pump and dump around The Fed and Powell). The Dow is the laggard for now (up only 1%)...

Goldman's trading desk pointed out that volumes +20% today vs the 20dma and ETFs capturing close to 33% of the tape (but they highlight that top of book liquidity stands out as extremely poor, tracking -60% vs the 20dma).

-

We are active across rate-sensitive pockets of the mkt, specifically Fins (REITS + large cap) and Utes.

-

LOs are much better buys (1b net demand) led by Tech, Fins, Macro products, and Hcare.

-

HFs are net for sale, with supply concentrated in pockets of Discretionary, Fins, and Comms Svcs.

The basket of Mag7 Stocks surged back up to record highs today...

Source: Bloomberg

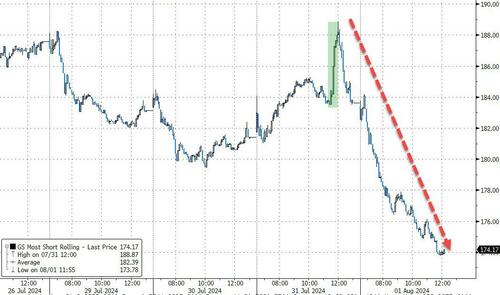

'Most Shorted' Stocks squeezed higher at the open but rolled over for the rest of the day to end only marginally higher...

Source: Bloomberg

Interestingly, rate-cut expectations to year-end 2024 (and 2025) are lower post-Fed crisis-cut. The market still expects 3 more cuts in 2024 though (and four more on top of that in 2025)

Source: Bloomberg

Treasury yields were mixed today with the short-end outperforming...

Source: Bloomberg

...extending the bear-steepening in the yield curve from yesterday's Powell comments. 2s10s is now at its steepest since June 2022 (notably disinverted)...

Source: Bloomberg

Bloomberg's Alyce Andres notes that comments from The Fed supported bear steepening of the US Treasury curve. Here are 10 reasons why bond investors believe the Fed’s actions telegraphed a hawkish cut:

-

In its statement, the Fed said the assessment of current conditions showed job growth slowed versus moderated previously. That means the Fed views labor market growth as now having a reduced speed. It also compares to a reduction in size, strength and force it described in June.

-

The Fed’s language around inflation was firmer. It eliminated the characterization about inflation easing in recent months and over the past year. Instead, the Fed emphasized it remains elevated.

-

The Fed continued to delay the end of QT. This coupled with the 50-bps cut signaled that the central bank clearly sees moves in the policy rate and balance sheet as independent.

-

Dissention from Governor Michelle Bowman, a Fed hawk, in favor of a smaller cut.

-

The dot plot showed a narrow majority favored lowering rates by an additional half-point this year over a 25-bps cut.

-

The longer run median dot rose to 2.9% from 2.8%. That’s the dot the Fed will use as its anchor.

-

Forecasts were optimistic with the median dot for growth at 2% over all time frames and longer-run unemployment and inflation steady at 4.2% and 2%, respectively.

-

Fed Chair Jerome Powell said the economy is basically fine, telegraphing a broadly optimistic view with a hawkish emphasis on the fact that the Fed isn’t in a rush to lower rates.

-

Bond investors voted with their feet -- opting to take profits on wagers for lower rates. Traders also threw in the towel on bull steepeners in favor of bearish ones viewing the 50-bps rate cut as a recalibration of monetary policy rather than a sign of concern about the health of the labor market.

-

That move continued Thursday with global investors adding to bear steepener positions under the notion that the Fed is likely to stick the soft landing.

The dollar chopped around today, hitting highs in the early Asia session and lows in the early European session before bouncing back to practically unch...

Source: Bloomberg

Bitcoin ripped higher today, testing up towards one-month highs at $64,000, right at the 200DMA (after breaking above the 50- and 100-DMA)...

Source: Bloomberg

Ethereum outperformed Bitcoin for the first time in nine days...

Source: Bloomberg

Gold was bid back up to record highs...

Source: Bloomberg

We encourage readers to use our exclusive partners JM Bullion for all your precious metals purchasing needs.

Crude prices continued their sawtooth rally back from three year lows with WTI breaking above $72...

Source: Bloomberg

Finally, bonds and stocks remain in worlds of their own since the last FOMC meeting in July...

Source: Bloomberg

Which happens first? S&P back down to 5200, or 10Y yield up to 4.2%?

|

|

[World]

The Dow Transports is telling stock investors to keep riding with the market

The broad market typically does better when Dow Industrials outperforms the Dow Transports.

Published:9/17/2024 9:55:41 AM

|

|

[World]

How Microsoft’s dividend hike and new $60 billion buyback program stack up

Only three U.S. companies have ever announced buyback programs bigger than Microsoft’s latest — though the new dividend yield is still low relative to those of fellow Dow components.

Published:9/16/2024 5:45:41 PM

|

[Markets]

"Congratulations On Becoming The Richest Man In The World," Said JP Morgan To Andrew Carnegie In 1901

"Congratulations On Becoming The Richest Man In The World," Said JP Morgan To Andrew Carnegie In 1901

By Eric Peters, CIO of One River Asset Management

Move On:

“Congratulations on becoming the richest man in the world,” said JP Morgan to Andrew Carnegie in 1901, merging various industrial firms into US Steel. The new firm was capitalized at $1.4bln and became the world’s most valuable company (the US federal budget in 1901 was $517mm for comparison). Carnegie was born in Scotland in 1835. His mom was an impoverished weaver, disrupted by mechanized weaving. She moved Andrew to Pennsylvania. At 13 he went to work in a cotton mill, earning $1.20 for a 12hr day. Morgan paid him $492mm.

Carnegie spent the last 20yrs of his life giving away 90% of his fortune. Beginning in 1880, he built 2,500 libraries in the US, Canada, Britain - feeding hungry young minds. The 1st was in his hometown of Dunfermline, Scotland. By his death in 1919, half the US public libraries had been built by Carnegie. Colonel James Anderson let apprentices and working boys borrow books from his personal library when Carnegie was a kid. “To him I owe a taste for literature which I would not exchange for all the millions that were ever amassed by man.”

US Steel was so dominant that it inspired anti-trust laws. In 1943 it employed 340k workers, supporting the war effort. In 1953 it produced 35.8 million tons of steel, while Europe and Japan struggled to rebuild their productive capacity. But it was slow to innovate and relied on old technology. It now produces 14.5 million tons and is the world’s 27th largest producer. In 1991 it was kicked out of the Dow Jones Industrial Average. Japan’s Nippon Steel is trying to buy US Steel for $14.9bln. Our politicians seem to care. But America moves on.

Whatever it Takes:

Draghi in his argument for a new EU industrial strategy calls for 800bln euros of new annual investment spending. At 4.7% of GDP, it’s double the scale of the Marshall Plan relative to the size of the economy. Imagine that bureaucratic trough. And setting aside the fact that the Germans, who would have to shoulder yet more Italian debt, will never agree to anything remotely close to this, it is worth asking why Europe would turn to a former central banker to draft plans for an economic renaissance? Perhaps they misunderstand their problems.

In the 12yrs since Draghi’s “whatever it takes” speech [here], Europe’s benchmark Euro Stoxx 50 index has rallied +108% ex dividends (+67% in real terms). The S&P 500 is +196% higher (+126% on a real basis). When it comes to producing real prosperity, manipulating money is never the answer. In 2012, EU GDP was $14.6trln and has grown to $18.4trln (2023). US GDP over that period has grown from $16.3trln to $27.4trln. The divergence is utterly staggering. And now, of the globe’s top 25 largest companies, just one is European [here].

|

|

[World]

Dow cuts revenue outlook, citing ‘unplanned event’ at Texas plant

Dow Inc.’s stock fell to fresh lows for the year on Thursday, after the materials-science company issued a revenue warning, citing higher costs and a “significant” issue at an ethylene plant.

Published:9/12/2024 10:04:06 AM

|

[Markets]

Dow Hits Record High But Nasdaq Dumps As Oil & Gold Jumps

Dow Hits Record High But Nasdaq Dumps As Oil & Gold Jumps

Amid the doldrums of summer liquidity, today saw some give back from Friday's euphoric response to Jay Powell's latest flip-flop.

Rate-cut expectations declined (most notably focused on a shift from 2024 to 2025)...

Source: Bloomberg

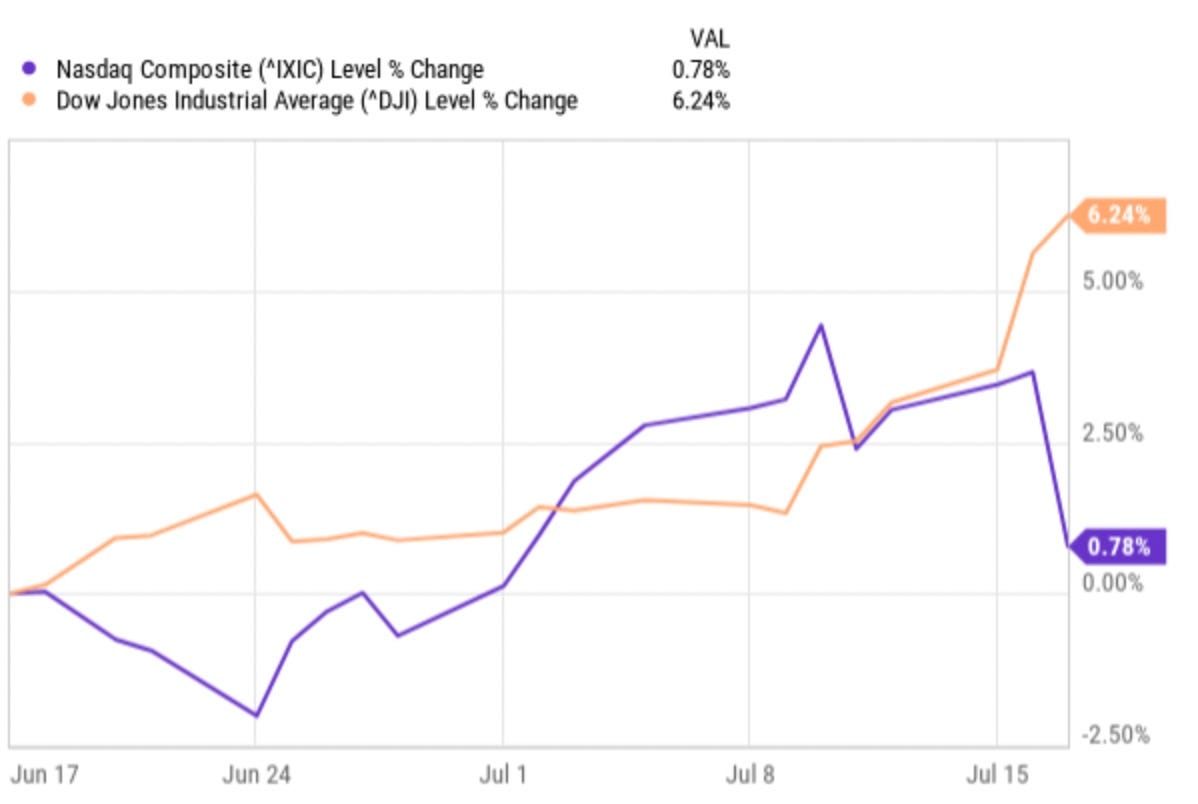

Stocks - broadly-speaking - did not love it and gave some back with the Nasdaq the biggest loser (and S&P dragged down by Tech). The Dow managed to reach a new all-time high before purging most of it back.

It's been an interesting couple of days for Mag7 stocks...

Source: Bloomberg

...as the world readies for NVDA's earnings...

Source: Bloomberg

The dollar rallied modestly, erasing some of the dovish decline...

Source: Bloomberg

Despite the dollar gains, gold rallied...

Source: Bloomberg

Treasury yields rose modestly (just 1-2bps), but remain down from pre-Friday panic. The short-end continues to outperform...

Source: Bloomberg

Oil prices also continued to rebound, with WTI back above $77...

Source: Bloomberg

After surging above $65,000 twice over the weekend, Bitcoin was sold (ubiquitously) during the US day session

Source: Bloomberg

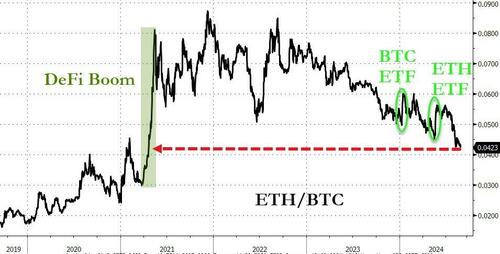

...and ETH is now at its weakest relative to BTC since the start of the DeFi boom...

Source: Bloomberg

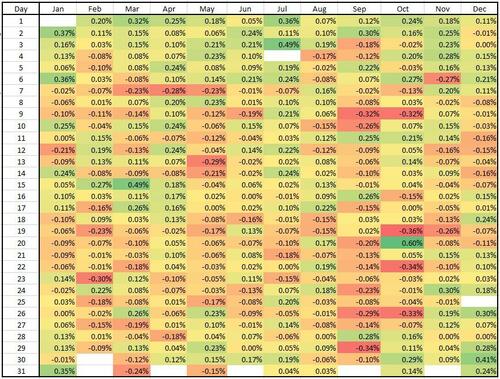

Finally, while the seasonals are holding up for now, the worst period of the year looms (September H2)...

BTFD to all-time high, then STFR and rest for post-election surge?

|

[Markets]

Stocks Extend Win-Streak Ahead Of J-Hole; Kam-unist Manifesto Accelerates Dollar-Collapse

Stocks Extend Win-Streak Ahead Of J-Hole; Kam-unist Manifesto Accelerates Dollar-Collapse

US equities rallied for the 8th straight day today (despite Leading Indicators slumping for the 29th straight month), with Nasdaq up 13% off its post-yen-carry-chaos lows - the longest win streak since Nov 2023.

Small Caps and Nasdaq led the rip today, The Dow lagged, but all the majors were higher. The last few minutes of the day saw yet more panic-buying pressure...

VIX spiked at the open today (back above 16) but faded all day to end modestly lower with a 14 handle...

Another major short squeeze lifted Small Caps...

Source: Bloomberg

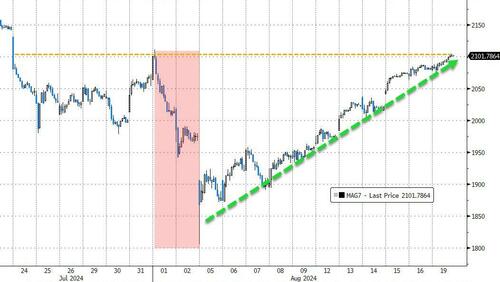

Mag7 stocks continued their dramatic rebound, rallying up to a key technical resistance level...

Source: Bloomberg

The dollar continued its collapse, as the DNC unveiled its Kam-unist manifesto...

Source: Bloomberg

Gold held on to its gains amid the dollar weakness, holding near record highs above $2500...

Source: Bloomberg

Treasuries were relatively quiet today (though choppy) with the short-end underperforming (2Y +1bps, 30Y +2bps)...

Source: Bloomberg

The 2y remains above 4.00% (and well above last week's CPI spike lows), but the 30Y has retraced all of the spike and then some...

Source: Bloomberg

Crypto was hit overnight, but bitcoin rallied back above $59,000 as stocks surged during the US day session, back up near pre-CPI levels...

Source: Bloomberg

Crude was clubbed like a baby seal today, with WTI testing back down to a $74 handle (at post-payrolls drop lows)...

Source: Bloomberg

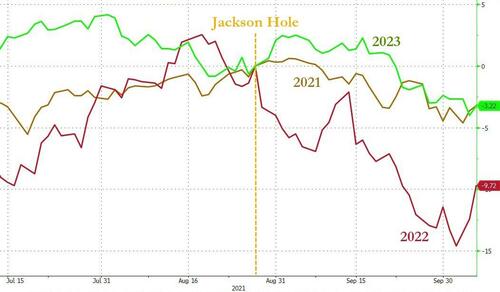

Finally, be careful what you're betting on from Powell at Jackson Hole this week...

Source: Bloomberg

The last few years it's been a sell-the-news event.

|

|

[World]

Trump Media’s stock on pace for lowest close in eight months

Shares of Trump Media & Technology Group Corp. are down 2.7% Monday and trading around $22.43, putting the stock on pace for its lowest close since Jan. 16, when it closed at $22.35, Dow Jones Market data show.

Published:8/19/2024 11:21:24 AM

|

[Markets]

Stocks Soar, Bonds & Bitcoin Battered On 'Fake' Data As VIX Plunges At Record Pace

Stocks Soar, Bonds & Bitcoin Battered On 'Fake' Data As VIX Plunges At Record Pace

...no, Goldilocks is not back!

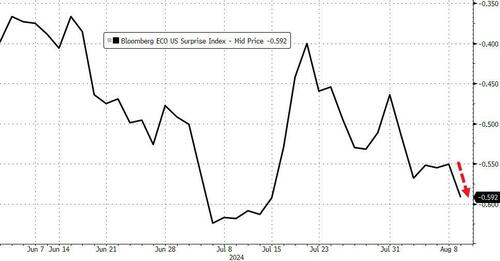

Retail Sales soared in August... thanks to massive historical revisions and a surge in Auto sales... but Auto production crashed by the most since COVID lockdowns (lowering GDP expectations)... and homebuilder sentiment slumped... and the Philly Fed business outlook plunged... and the Empire Fed Manufacturing survey remains in contraction for the 9th straight month... and import and export price inflation was hotter than expected... all of which sent the macro surprise index down to 2024 lows...

Source: Bloomberg

Here's Goldman's Chris Hussey on the 'mixed data':

The weak-to-mixed reading of these prints continue to show the unreliability of surveys in the post pandemic era. And investors continue to look through them as they have been consistently weaker than the hard data - and consistently misleading - since 2020.

...but all the algos cared about was the "beat" in retail sales confirming that the 'soft landing' narrative is back (except it's not), and WMT beating and raising (except consensus was already above their revision) reassuring that the consumer is not in shitsville (except they are because they are trading down to WMT!).

Nevertheless, stocks soared higher with Small Caps leading the charge along with Nasdaq as The Dow lagged (but was still up bigly). Some late day profit-taking spoiled the party but overall, it was a big day...

The Dow is on pace for its best week since Dec 2023... and Nasdaq's best week since November's Powell Pivot

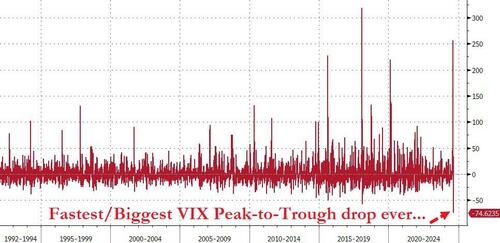

...withd VIX plunging lower...

...at its fastest/largest pace of decline ever...

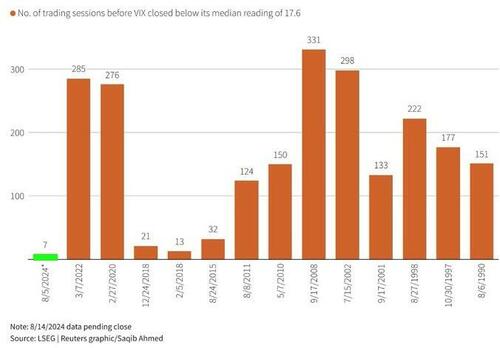

Bear in mind that historically, when the VIX has risen to close above 35, as it did on Aug. 5, the index has taken 170 sessions on average before returning to 17.6, its long-term median... not 7 days!

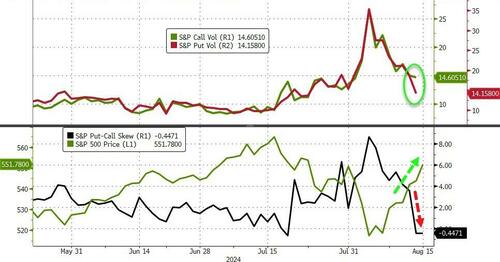

We do note that as the day wore on, VIX shifted back higher as calls were aggressively bid (and puts dumped), crushing the skew...

Source: Bloomberg

While VIX has tumbled, we note that VVIX remains above the scary 100 level still as the market is not fully buying that the panic is over...

Source: Bloomberg

And we also note that implied correlation has collapsed too - which shows that this vol compression is all systemic (index) and not idiosyncratic (single-name) driven...

Source: Bloomberg

Small Caps were lifted by another big short-squeeze...

Goldman - Summer volumes remain challenging (-10% vs 20day avg)... Seeing squeezy px action across the board on this melt higher

Source: Bloomberg

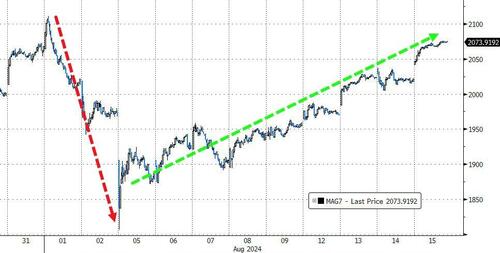

...and Nasdaq surged on the back of an aggressive bid for Mag7 stocks (the basket of Mag7 stocks is up 6 straight days)...

Source: Bloomberg

Here's how Goldman's trading desk describes the day's narrative:

Stocks higher on the back of bullish earnings from WMT, DE, and CSCO and favorable macro data on the growth front (retail sales & weekly claims). EVERYTHING rally with all baskets on our screens green on the day.

Volumes were lower (-10% vs the trailing 20 days but tracking higher compared to the start of the week). Also seeing S&P top of book liquidity start to creep back to better levels after recent weakness (sitting around $10mm today).

- Our floor is skewed 3% better to buy today which feels like a combo of squeezy price action + decent buy tickets across large cap tech. HFs buying consumer vs selling Tech, Industrials, and Fins.

Notably, 0-DTE traders turned decidedly less positive as the day wore on...

Source: SpotGamma

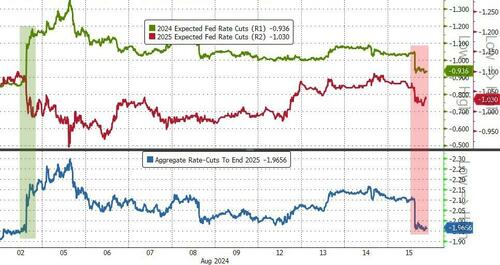

The 'good' data (retail sales) prompted a significant drop in rate-cut expectations - erasing all the dovish shoft post-payrolls...

Source: Bloomberg

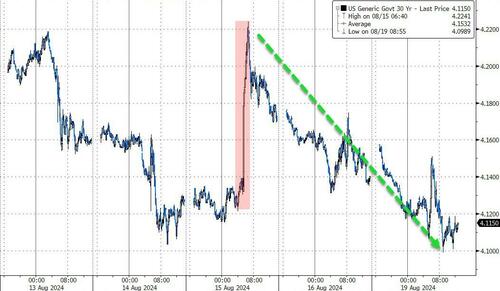

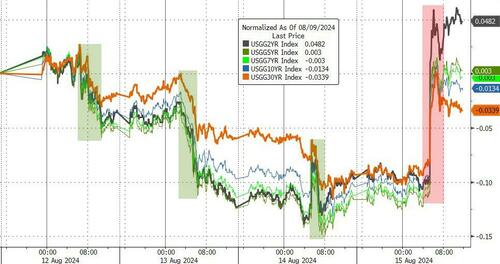

Bonds were battered on the day (2Y +15bps, 30Y +6bps), surging up to unchanged on the week...

Source: Bloomberg

The yield curve flattened significantly today - erasing all the post-payrolls steepening...

Source: Bloomberg

The dollar spiked on the hawkish retail sales data...

Source: Bloomberg

Gold puked on the Retail Sales print but recovered to end higher on the day (despite a strong dollar)

Source: Bloomberg

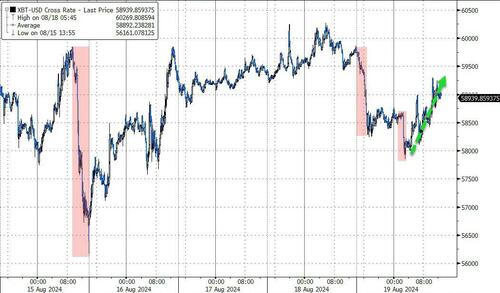

Bitcoin was clubbed like a baby seal again, back below $57,000 (as it seems someone is dumping crypto at $60,000 to chase what little momentum is left in stonks)...

Source: Bloomberg

Crude oil prices recovered yesterday's losses with WTI back up to $78...

Source: Bloomberg

Finally, while stocks are soaring back higher (because 'no recession' and 'slow-flation' - goldilocks), bonds and rate-cut expectations are not playing along (flashing recessionary signals)...

Source: Bloomberg

Who will be right in the end (hint look at the first chart above on US macro data).

|

[Markets]

"Japan Mixed The Batter, The Fed Will Bake The Cake..."

"Japan Mixed The Batter, The Fed Will Bake The Cake..."

Via SchiffGold.com,

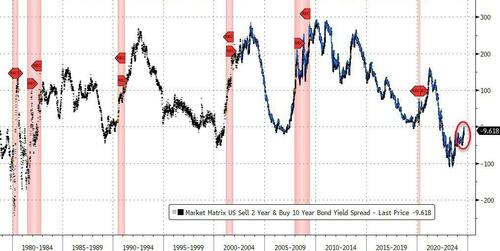

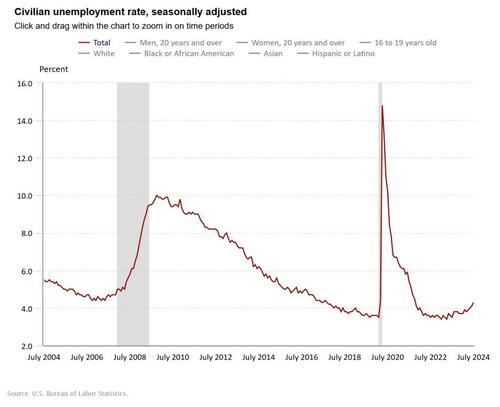

Americans are already struggling to feed their families and pay their bills, but having predicted every US recession since 1960, the steepening bond yield curve is speaking loud and clear that an “official” downturn is nearly inevitable. With bond prices on the rise as the Fed looks increasingly likely to cut rates in September, the yields are going down and the inverted curve is finally leveling out after an epic two-year inversion.

And with stocks now crashing around the world, global uncertainty is rocketing upward in a “Black Monday” event, especially as dizzyingly volatile Japan struggles to contain its post-ZIRP doom loop. In other words, the storm may be arriving in earnest.

The yield curve represents the difference in interest rates between long and short-term bonds, and every time it steepens after becoming inverted, a recession soon follows. It’s become a popular indicator because of its surgical accuracy, and because it tends to flash clear and reliable predictions before other datasets can do the same.

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Source: Bloomberg