|

[Markets]

Hershey’s beats on earnings as Reese’s Caramel, Dot’s Pretzels boost sales

“We are off to a strong start and remain on track to deliver our business strategies and financial commitments for the year,” the company’s CEO said Friday.

Published:5/3/2024 10:56:15 AM

|

|

[Markets]

Tesla retreat from EV charging leaves growth of U.S. network in doubt

Tesla’s retreat from EV charging is a blow for the whole U.S. network, which relied on Tesla superchargers.

Published:5/3/2024 10:31:51 AM

|

|

[Markets]

These three things released bond market 'pressure': Strategist

Stocks are on the rise as bond yields slump following the April jobs report. Morgan Stanley Investment Management Co-Head of Broad Markets Fixed Income Vishal Khanduja joins Morning Brief to break down what the weaker-than-expected report means for the economy. April saw an unexpected jump in unemployment as hiring and wage growth both slowed. Khanduja notes that following the Fed's decision to leave rates unchanged, the bond market is at a point "where it releases a lot of that pressure that was building up." Khanduja says there were three things that happened this week to help relieve that pressure: the US Treasury's quarterly refunding announcement, a more "dovish FOMC," and the cooler April employment report. He tells Brad Smith and Akiko Fujita that two to three more reports like April's could guide the Fed's decision to move toward cuts. For more expert insight and the latest market action, click here to watch this full episode of Morning Brief. This post was written by Melanie Riehl

Published:5/3/2024 10:31:51 AM

|

|

[Markets]

Cemeteries get a new lease on life as dog parks, antique markets and picnic grounds

“As cemeteries run out of space, they are going to have to adapt or die.”

Published:5/3/2024 10:31:51 AM

|

|

[Markets]

Audit firm BF Borgers charged with massive fraud. Trump Media is a client.

Published:5/3/2024 10:31:51 AM

|

|

[Markets]

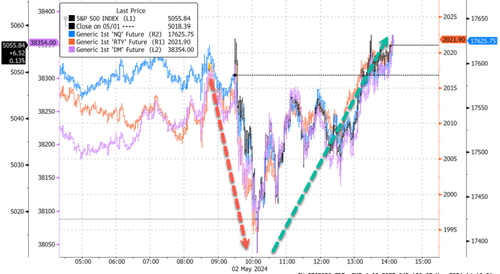

GLOBAL MARKETS-Stocks jump, yields fall on hopes U.S. labor tightness ebbing

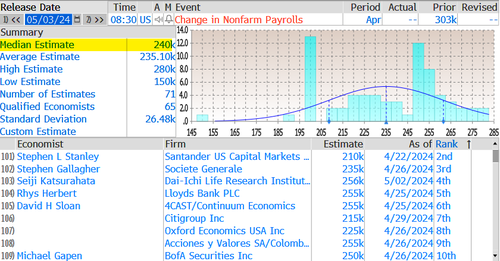

Wall Street followed global shares higher on Friday after news that U.S. nonfarm payrolls grew less than expected last month, easing investor anxiety that tight labor markets and stubborn inflation would not let the Federal Reserve cut rates soon. Treasury yields fell, as did the dollar, after the Labor Department said nonfarm payrolls increased by 175,000 jobs in April, healthy but short of expectations for an increase of 243,000, according to economists polled by Reuters. The unemployment rate stood at 3.9% compared with expectations that it would remain steady at 3.8%.

Published:5/3/2024 9:57:53 AM

|

|

[Markets]

SEC charges firm that audits Trump’s Truth Social with ‘massive fraud’ affecting hundreds of filings

The regulatory agency said that hundreds of audits done by BF Borgers CPA PC contained “deliberate and systemic failures” that included false documentation to make it appear their reports complied with standards set by the Public Company Accounting Oversight Board.

Published:5/3/2024 9:57:53 AM

|

|

[Markets]

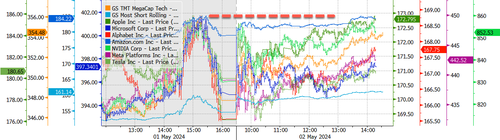

Dow Jones Soars 400 Points As Amgen, Apple Surge; Nvidia Jumps Again, Tempts New Buyers

Buyers dictated the action in the stock market today. The Nasdaq gapped powerfully above a key level on news of soft job growth in April.

Published:5/3/2024 9:49:37 AM

|

|

[Markets]

US STOCKS-Wall St gains after soft jobs data allays rate jitters

Wall Street's main indexes advanced on Friday after a softer-than-expected jobs report revived hopes of the Federal Reserve cutting interest rates this year, while gains in Apple and Amgen on upbeat corporate updates added support. U.S. job growth slowed more than expected in April and the increase in annual wages fell below 4% for the first time in nearly three years, while the unemployment rate stood at 3.9% compared with expectations that it would remain steady at 3.8%.

Published:5/3/2024 9:41:21 AM

|

|

[Markets]

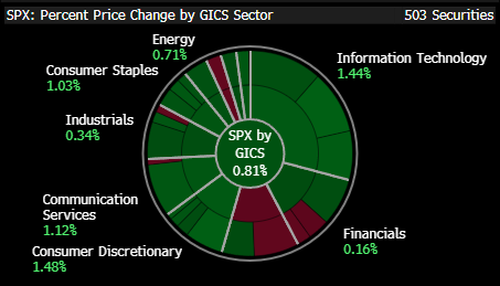

Stocks surge on cooling jobs data for April

All three of the major market averages (^DJI, ^IXIC, ^GSPC) are surging Friday morning after a cooler-than-expected jobs report for the month of April, adding 175,000 jobs in the month, below estimates of 240,000. The Nasdaq Composite shot up as high as 2% following the market open. Morning Brief Co-Hosts Akiko Fujita and Brad Smith review the market and sector gains this morning. For more expert insight and the latest market action, click here to watch this full episode of Morning Brief. This post was written by Luke Carberry Mogan.

Published:5/3/2024 9:33:11 AM

|

|

[Markets]

Trump calls jobs report ‘horrible.’ Biden says it reflects ongoing recovery.

Published:5/3/2024 9:33:11 AM

|

|

[Markets]

‘He’s holding all the cards’: My mother, 86, has dementia. Her partner of 30 years is on the deed to her home. How can I gain control of her finances?

“I asked to be put on the deed to my mother’s home and I was met with a swift ‘no’ from her partner. He said that since he had paid off the mortgage, the house is his.”

Published:5/3/2024 9:01:48 AM

|

|

[Markets]

ISM service-sector gauge weakens sharply in April

The Institute for Supply Management said on Tuesday that its service-sector PMI dropped sharply to 49.4% in April from 51.4% in the prior month.

Published:5/3/2024 9:01:48 AM

|

|

[Markets]

11 stocks that mattered most this earnings season

The busiest two weeks of first quarter earnings season are over. Here are the most significant reports.

Published:5/3/2024 8:53:34 AM

|

|

[Markets]

Financial experts told consumers to stop ‘wasting’ money eating out. They’re finally listening— and companies are rattled.

“Americans need to reprioritize their cash flow in difficult times,” according to one financial planner. “McDonald’s and Starbucks will survive.”

Published:5/3/2024 8:53:34 AM

|

|

[Markets]

Fed governor Bowman suggests an interest-rate increase remains on the table

Published:5/3/2024 8:53:34 AM

|

|

[Markets]

April jobs data, Apple earnings, Block and bitcoin: 3 Things

US stock futures (^DJI, ^IXIC, ^GSPC) are ripping higher ahead of Friday's session open after the US Bureau of Labor Statistics reported 175,000 jobs were added to the US economy, a cooler print than previous months seen so far in 2024. What does this mean for interest rate cut hopes? Apple (AAPL) stock is rising in pre-market trading after topping fiscal second-quarter earnings estimates on Thursday, despite reporting falling iPhone sales year-over-year. Lastly, Block (SQ) shares are popping after reporting plans to focus more on bitcoin (BTC-USD) in its latest earnings report. For more expert insight and the latest market action, click here to watch this full episode of Morning Brief. This post was written by Luke Carberry Mogan.

Published:5/3/2024 8:32:37 AM

|

|

[Markets]

‘This is the jobs report the Fed would have scripted’: investment strategist

Published:5/3/2024 8:32:37 AM

|

|

[Markets]

Apple vs. the world: Can the tech giant survive a global regulatory onslaught?

Published:5/3/2024 7:02:43 AM

|

|

[Markets]

Booming labor market poised to reach milestone for low unemployment

The booming labor market is expected to extend a remarkable milestone in April, matching the last longest period of low unemployment on record.

Published:5/3/2024 7:02:43 AM

|

|

[Markets]

April jobs report preview: Wages, job gains set to slow while unemployment holds steady

After a strong winter for the US labor market, economists expect hiring to have slowed in April.

Published:5/3/2024 4:19:11 AM

|

|

[Markets]

Societe Generale and Credit Agricole shares rally as French banks beat profit forecasts

The French banks both outstripped analysts’ expectations, causing their share prices to surge

Published:5/3/2024 4:19:10 AM

|

|

[Markets]

French banks Societe Generale and Credit Agricole rally after results

Published:5/3/2024 4:19:10 AM

|

|

[Markets]

3 Dow Stocks That Are No-Brainer Buys in May

The 30-component Dow Jones Industrial Average is housing three phenomenal deals that are hiding in plain sight.

Published:5/3/2024 3:48:38 AM

|

|

[Markets]

Amgen set to give bigger boost to the DJIA than Apple

Published:5/3/2024 3:40:18 AM

|

|

[Markets]

Anglo American shares rise on report Glencore may make rival offer

Shares of Anglo American rose on Friday after a report that Glencore was considering making a rival offer for the mining company.

Published:5/3/2024 3:14:55 AM

|

|

[Markets]

FTSE 100 LIVE: London near all-time high as Asia stocks surge

FTSE 100 is heading for another record after Apple helped steady Wall Street overnight

Published:5/3/2024 2:49:04 AM

|

[Markets]

"Very Solid": Trump Scores $1.8 Billion Windfall After Significant Increase In Truth Social Stake

"Very Solid": Trump Scores $1.8 Billion Windfall After Significant Increase In Truth Social Stake

Donald Trump has added roughly $1.8 billion more to his net worth after regulatory filings show that he increased his stake in Truth Social by a significant degree - bringing the former president's ownership to nearly 65% in Trump Media & Technology Group (TMTG).

Trump secured an additional 36 million shares of TMTG, bringing his stake to 114.75 million shares, according to an April 30 filing with the SEC. According to the latest price of nearly $50 per share, Trump's stake in TMTG is valued at around $5.7 billion.

The additional $1.8 billion was secured through 36 million additional "earnout shares" granted if TMTG hit certain performance metrics over a certain period, according to an April 15 filing. That said, Trump can't sell any shares due to a six-month lockup agreement.

As the Epoch Times notes further, TMTG shares have been on a roller-coaster ride since the company listed on Nasdaq last month through a merger with a special purpose acquisition company (SPAC) and was snapped up by Trump supporters and speculators.

‘Very Solid’

Following the merger and initial public offering (IPO) at the end of March, market interest exploded in TMTG, which trades under the ticker symbol DJT. Its stock price soared above $79 per share on its first day of trading, sending the company’s market cap to over $7 billion.

After the initial surge of interest, TMTG shares pulled back to around the $62 mark, where they traded until news broke on April 1 that, in 2023, the company suffered a $58 million loss.

Word of the loss sent its stock price on a downward trajectory, to $22.84 by April 16, which marked a bottom.

Since then, TMTG shares have rallied, with only one meaningful pullback between April 19–23, and are now trading at $49.90 per share, the highest since an April 3 close of $48.81.

Much of the $58 million loss that sent the stock price falling on April 1 appears to be related to an interest expense of $39.4 million on its outstanding debt, according to the 8-K filing. In 2022, the company made a net profit of $50.5 million.

The former president said on April 4 that media fixation on the $58 million loss was misguided. He touted TMTG fundamentals—which he said include over $200 million cash and no debt—as “very solid.”

TMTG CEO Devin Nunes echoed that in an April 1 statement: “Closing out the 2023 financials related to the merger, Truth Social today has no debt and over $200 million in the bank, opening numerous possibilities for expanding and enhancing our platform.”

“We intend to take full advantage of these opportunities to make Truth Social the quintessential free-speech platform for the American people,” he added.

TMTG’s meteoric rise and subsequent wobble sparked massive interest in shorting the stock—meaning betting money on its potential price decline.

Mr. Nunes recently asked Congress to investigate allegations that TMTG stock was being manipulated by traders betting on its downfall.

‘Anomalous Trading’

In a recent letter to top House Republicans, Mr. Nunes urged lawmakers to open an investigation into “anomalous trading” and possible even “unlawful manipulation” of TMTG stock.

Mr. Nunes expressed concern about “naked” selling of TMTG stock, which is the practice of traders selling shares of a company without borrowing them first, according to the letter.

The tech CEO added that the company has become the “single most expensive stock to short in U.S. markets” as of early April, arguing that traders now “have a significant financial incentive to lend non-existent shares” of the stock.

Pressing the issue further, TMTG issued a notice to DJT investors on April 23, highlighting steps they can take to prevent the lending of their shares by brokerage firms for the purpose of short selling.

“TMTG wants to clarify that brokerage firms may facilitate short selling in DJT shares by lending DJT shareholders’ shares held in margin accounts,” the notice reads.

“Through this practice, brokerage firms earn an alternative source of revenue by ‘lending’ shares to sophisticated and institutional investors who are betting that the stock’s price will fall. If the stock price in fact falls, then the brokerage firm and the sophisticated and institutional investors will profit while retail investors will not,” it added.

To prevent their shares from being loaned out for the purpose of short selling, DJT investors were advised to hold their shares in cash accounts at their brokerage firms, rather than in margin accounts.

They should also opt out of any securities lending programs, according to the notice.

|

|

[Markets]

RBA’s policy options are running short, says JBWere

With inflation proving sticky, the Reserve Bank of Australia doesn’t have the option of simply holding interest rates higher for longer, with further increases now looking likely, a leading forecaster says.

Published:5/2/2024 9:55:18 PM

|

|

[Markets]

Poletti: Forget AI. Apple’s plan to restore confidence is a $110B stock buyback.

Published:5/2/2024 8:17:20 PM

|

[Markets]

Jim Jordan Drops "Smoking Gun" Over White House 'Lab Leak' Suppression At Facebook

Jim Jordan Drops "Smoking Gun" Over White House 'Lab Leak' Suppression At Facebook

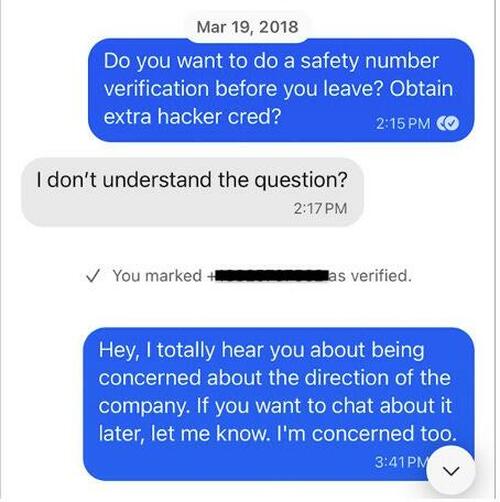

Rep Jim Jordan (R-OH) has released several new pieces of previously unseen information revealing what Elon Musk called a "smoking gun" in regards White House pressure on Facebook to censor the lab leak theory of Covid-19.

First, Jordan shares a text message from Mark Zuckerberg to Sheryl Sandberg, Nick Clegg and Joel Kaplan - the company's highest-ranking executives at the time, in which he asks if Facebook can tell the world that "the [Biden] WH put pressure on us to censor the lab leak theory?" - hours after Biden accused Facebook of "killing people."

Clegg responded that the Biden White house is "highly cynical and dishonest," while Sandberg said that they were being scapegoated because the White House wasn't hitting its vaccination numbers.

Facebook felt, in fact, that they had been 'combating misinformation,' (aka censoring Americans) all year.

Then in late May of 2021, Facebook finally stopped removing content regarding the lab leak theory - though they did demote it. When employees told Zuckerberg about the reversal and explained why they censored the lab leak theory in the first place, Zuckerberg replied that this is what happens when Facebook "compromises [its] standards due to pressure from an administration."

According to Elon Musk, this is a "Smoking gun First Amendment violation."

We know the feeling!

|

|

[Markets]

Forget AI. Apple’s plan to restore confidence is a $110 billion stock buyback.

It’s been a rough year, but Apple shows confidence in itself and investors approve — for now.

Published:5/2/2024 7:57:55 PM

|

[Markets]

Apple Soars After iPhone, China Sales Drop Less Than Feared; Unveils Record-Breaking $110 Billion Buyback

Apple Soars After iPhone, China Sales Drop Less Than Feared; Unveils Record-Breaking $110 Billion Buyback

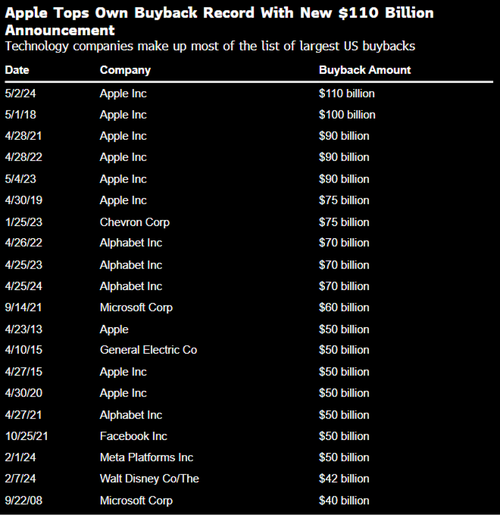

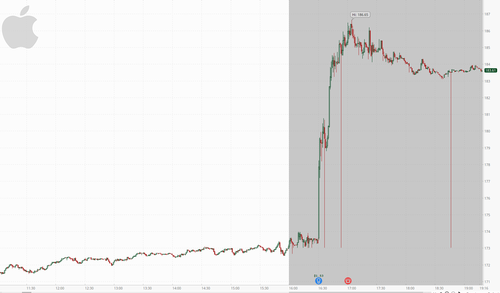

With most of the megatechs having already released earnings, all eyes were on the last Mag7 to report during the heart of earnings season (there is still Nvidia, but due to a calendar quirk that's not for a month) which is also the company which until recently was the undisputed market cap world champion until it was overtaken by the mAIcrosoft juggernaut: Apple. Having failed to enjoy the same AI-driven euphoria some of its giga cap peers, Apple stock had languished for months and was in fact relegated by Goldman recently to the Meh 3 (AAPL, GOOGL, TSLA) and away from the Fab 4 (META, NVDA, MSFT, AMZN). But much of that was recovered after hours when AAPL not only reported blowout earnings but unveiled a massive, record-breaking $110 billion stock buyback program (because when your best product is the 5 pound neck brace known as the Vision Pro you have no choice but to buy your own stock since nobody else will do it for you) which sent the stock soaring after hours.

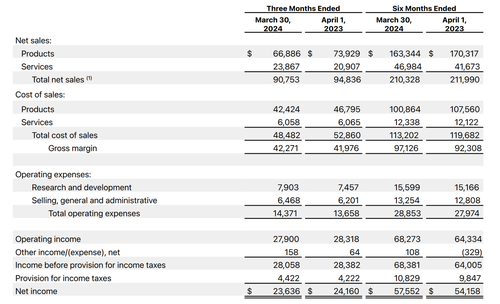

Here is what AAPL reported for the quarter ended March 31:

- EPS $1.53 vs. $1.52 y/y, and beating the estimate $1.50

- Revenue $90.75 billion, down 4.3% y/y primarily on China weakness, but beating the recently lowered estimate of $90.33 billion

- Products revenue $66.89 billion, -9.5% y/y, just missing the estimate $66.95 billion

- IPhone revenue $45.96 billion, -10% y/y, beating estimate $45.76 billion

- Mac revenue $7.45 billion, +3.9% y/y, beating the estimate $6.79 billion

- IPad revenue $5.56 billion, -17% y/y, missing estimate of $5.91 billion

- Wearables, home and accessories $7.91 billion, down 9.6% y/y, and badly missing estimate $8.29 billion now that the Vision Pro is a confirmed flop

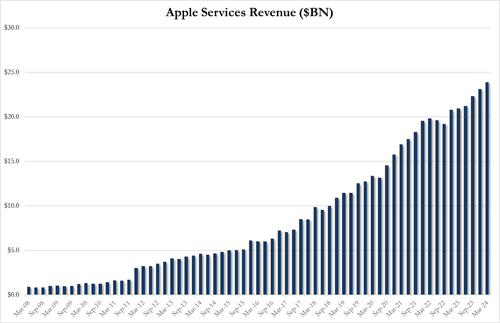

- Service revenue $23.87 billion, +14% y/y, beating the estimate $23.28 billion

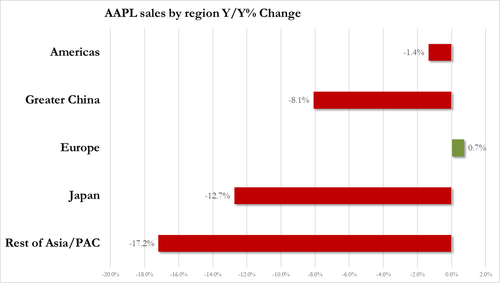

- Greater China rev. $16.37 billion, -8.1% y/y, beating the estimate $15.87 billion. This was probably the one item everyone was closely watching due to the big swing impact the recent plunge in China sales would have on the company. It ended up being not as bad as feared.

Going down the line:

- Total operating expenses $14.37 billion, higher than the estimate $14.33 billion

- Gross margin $42.27 billion, +0.7% y/y, higher than the estimate $42.01 billion

- Cash and cash equivalents $32.70 billion, below the estimate $36.83 billion

And so on.

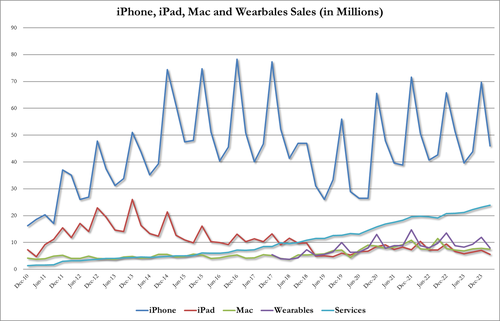

Looking at a breakdown of sales by product category we find that, as expected, iphone sales dropped 10% in a quarter which most knew would be ugly for the iphone maker, but at $46bn they just barely beat expectations of $45.8 billion. The rest of the product suite was mixed with Macs surprisingly beating estimates while both iPads and wearables missed. In any case the trend is clear: while sales may not be plunging, they have certainly topped out and the only ting that is still rising is Services.

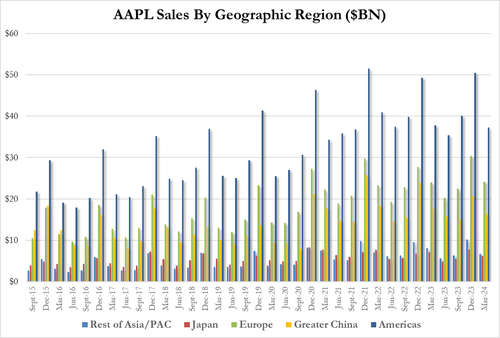

Looking at a geographic breakdown we find that while sales declined across almost every region, with the notable exception of Europe...

... the 8.1% drop in China sales was not nearly as bad as consensus expected, which fear a double digit drop was coming.

CFO Maestri said that the China concerns were overblown. “We were happy with our results in China,” he said. “The reality is different from maybe what you read at times.”

CEO Cook also pushed back on the idea that the iPhone was suffering in the country, saying that revenue from the device actually grew in mainland China. The weakness stemmed from other parts of the business, he said.

“Other products didn’t fare as well,” he said on a conference call. “And so we clearly have work there to do.”

At the same time, Bloomberg notes that Apple hasn’t shown that new product categories can reinvigorate growth. It canceled work on a self-driving car in February, eliminating a project that some had hoped could become one of its famous “next big things.”

Services were a relative bright spot, growing 14% to $23.9 billion in revenue. That topped Wall Street expectations of $23.3 billion: the category includes Apple Music, the TV+ streaming platform and iCloud subscriptions, but its revenue primarily comes from the App Store. But that business is under pressure from regulators, with Apple being forced to allow third-party marketplaces and payment services in the European Union. Depending on how Apple fares in a legal battle with the Justice Department, it may have to make changes in the US as well.

The company did push into the mixed-reality headset market this year, with the Feb. 2 debut of the Vision Pro. But that product is off to a slow start and could take years before it adds meaningfully to Apple’s revenue. Apple didn’t disclose Vision Pro sales figures on Thursday, but said that the device is generating interest among corporate customers.

But while the results were solid, and beat reduced estimates it's what was not part of the income statement that stunned investors: the company announced a mind-blowing new stock buyback program, of $110 billion, beating the previous record set by - who else - Apple, and which itself is bigger than the market cap of Boeing (although now that all Boeing whistleblowers have died, expect BA to soar), and also bigger than both GM and Ford combined!

If that wasn't enough, AAPL also predicted a return to growth in the current period, sparking optimism that a slowdown is easing. A lack of innovative new devices has contributed to slow sales at Apple, but the company looks to begin fixing that on May 7. That’s when it plans to unveil new iPads — the first updates to its tablet line in 1 1/2 years.

The results came as a relief to investors, who have been waiting for the iPhone maker to pull out of a long slump. Apple has posted sales declines in five of the past six quarters, hurt by a sluggish smartphone market and headwinds in China. The company had warned analysts in February that revenue in the latest period would be down about 5% from a year earlier.

In the current period, Apple expects sales to climb by a percentage in the low single digits. The company predicted that both its iPad and services business would grow by a rate in the double digits, but declined to give a forecast for the iPhone — its flagship product.

But wait there's more: the iphone maker also is planning a long-awaited push into generative artificial intelligence. In June, Chief Executive Officer Tim Cook is expected to lay out Apple’s AI strategy at its annual Worldwide Developers Conference.

“We are making significant investments in the space,” Chief Financial Officer Luca Maestri told Bloomberg Television’s Emily Chang. “We believe we are well-positioned.” Cook said Thursday that Apple will stand out from its AI rivals by tightly integrating hardware and software, using in-house chips, and making privacy and security a priority.

AAPL shares soared as much as 7.9% in extended trading Thursday before easing back a bit. Apple had been down 10% to $173.03 this year through the close, and is now still down modestly for the year.

|

[Markets]

North Carolina Shooting: Democrats Blame Guns While Letting Repeat Offenders Run Free

North Carolina Shooting: Democrats Blame Guns While Letting Repeat Offenders Run Free

Whatever happened to the media coverage of the mass shooting of police officers in Charlotte, NC this week? Only moments after the attack which took the lives of four law enforcement officers and injured four others, mainstream news feeds and social media sites were flooded with calls from journalists as well as Democrat politicians demanding that "something be done" about assault weapons and high capacity magazines. Joe Biden quickly issued a White House statement calling for swift gun control measures and (ironically) more funding for police.

Then, suddenly, everything went quiet. Why?

We all know why; because this has happened so many times in the past and the outcome is now laughably predictable. The eventual reveal of the alleged assailant's identity derailed progressive gun control efforts. His race and background did not fit the narrative mold that Democrats are looking for (the unhinged white male gun nut, preferably conservative).

Terry Clark Hughes Jr. already had a long rap sheet in North Carolina well before he killed four police officers this past week in Charlotte. With multiple warrants spanning several years as well as being involved in a high speed chase in January of 2024, Hughes should have been buried in the prison system for a very long time. Sadly, this was not the case - North Carolina is a blue state and Charlotte is a Democrat run city notorious for its soft treatment of repeat criminals.

Vi Lyles, the Mayor of Charlotte since 2017, is the city's first black female mayor and a Democrat. The city council is predominantly progressive and has been pursuing "defund the police" measures since 2020. And this is the kind of political environment that you will consistently find in nearly every city in the US with high crime rates and mass shootings. It's not a theory, it's a rule.

Since at least 2017 Charlotte has been suffering from what many residents call a "revolving door" when it comes to prosecutions and prisons. Critics have accused the city leadership of engaging in "high profile arrests and low profile releases" in order to keep crime stats down. This includes a myriad of sex offenders and violent criminals set free in the past few years, only to have them victimize even more people not long after.

For example, only two weeks ago Shareef Sudan Thompson, 36, was released from jail on bond despite facing charges in a violent stabbing last week in Uptown Charlotte. Local journalists discovered he has an extensive criminal history and police continue to question why extremely dangerous offenders are treated with such accommodations. City officials offer no clear answers, except to suggest that the bond system is to blame.

After the election of Vi Lyles, Charlotte soon rose through the ranks of most violent cities in the nation. It recently jumped to a list of the top 15 cities in the US with the fastest growing homicide rates.

Leftists and gun control advocates blame guns every time there's a high profile shooting, yet they conveniently ignore the history of the shooters and who is in charge of the cities and criminal policies the shootings take place in. The Democrat policy of catch and release when it comes to the worst possible criminals is the biggest contributor by far to violent assaults and murders across the country.

Roughly half of all crimes in the US are perpetrated by a small percentage of offenders with pervasive criminal histories. Locking these people up for extended sentences should be the primary solution to the problem, but progressives absolutely refuse. Most likely, these releases are designed to obscure a growing crime epidemic in blue cities across the country. Meaning, if we want shootings like the one in Charlotte, NC to stop, Democrat officials must be removed from power first.

|

|

[Markets]

Whistleblower for Boeing contractor Spirit AeroSystems dies

Family members said that Joshua Dean, who alleged Spirit AeroSystems fired him after he raised concerns about manufacturing flaws on the Boeing 737 Max, died after a brief illness.

Published:5/2/2024 6:25:46 PM

|

|

[Markets]

Airbnb is debuting an ‘Up’ house that levitates and 10 other pop-culture-themed rentals

After its ”Barbie” Malibu Dreamhouse house last year lit up the internet, Airbnb Inc. wants to make going viral a more regular thing.

Published:5/2/2024 6:25:46 PM

|

|

[Markets]

IRS says audits for rich people and corporations are about to ramp up

Published:5/2/2024 6:25:46 PM

|

|

[Markets]

Dow Jones Futures Rise As Stock Market Rallies Into Jobs Report; Apple Jumps On Buyback

The stock market rallied heading into Friday's key jobs report. Apple popped late on earnings and massive stock buyback.

Published:5/2/2024 6:25:46 PM

|

|

[Markets]

‘I see my greedy in-laws as misogynists’: I was a stockbroker in the 1980s and always kept my money separate from my husband’s. Is such self-protection justified?

“The biggest surprise when we got married was that my husband’s family saw me as a paycheck, even though they are all educated.”

Published:5/2/2024 5:19:36 PM

|

|

[Markets]

Amgen ‘very encouraged’ by preliminary data from weight-loss drug trial, stock jumps

Shares of Amgen Inc. rallied in the extended session Thursday after the drugmaker posted adjusted earnings above expectations and executives said they are “very encouraged” by preliminary data from a trial of an injectable weight-loss drug.

Published:5/2/2024 5:10:20 PM

|

|

[Markets]

Mall giant Macerich likely to start defaulting on maturing loans, says Barclays

Published:5/2/2024 5:10:19 PM

|

[Markets]

Whistleblower Reveals How "New Knowledge" Cybersecurity Firm Created Disinformation In American Election

Whistleblower Reveals How "New Knowledge" Cybersecurity Firm Created Disinformation In American Election

Authored by Paul D. Thacker via The Disinformation Chronicle,

Some of the shine on the disinformation industry has gone dull in recent years, as many misinformation experts having been caught trafficking in misinformation themselves, or exposed for their ties to intelligence agencies. This should not come as a shock.

It’s a basic tenet of “mirror politics” and practitioners of propaganda to accuse others of the very same actions they plan to commit.

In late 2018, the New York Times and Washington Post reported on a leaked document discussing a secret project by Democratic Party operatives that falsely accused Republican candidate Roy Moore of support by Russians, while he was running in a tight race for the Senate in Alabama. The scheme linked the Moore campaign to thousands of Russian accounts on Twitter and drew national media attention.

“We orchestrated an elaborate ‘false flag’ operation that planted the idea that the Moore campaign was amplified on social media by a Russian botnet,” the New York Times reported that the leaked documents stated.

The documents linked a relatively unknown company called New Knowledge to the Alabama disinformation campaign, although New Knowledge’s chief executive Jonathon Morgan said the company was not involved, and he worked on “Project Birmingham” in his personal capacity. Morgan also reached out at the time to Renee DiResta, a self-styled expert on disinformation, who told the New York Times she disagreed with such tactics, and later joined New Knowledge sometime, but only after Project Birmingham ended.

New Knowledge later changed names to Yonder, while DiResta joined Stanford University as an expert in disinformation. However, New Knowledge could not stop landing in the media spotlight.

In early 2023, journalist Matt Taibbi released a “Twitter Files” drop about “Hamilton 68,” a public dashboard created by New Knowledge. Hamiton 68 tracked hundreds of Twitter accounts to monitor the spread of purported pro-Russian propaganda online, but screenshots of emails sent by former Twitter executive, Yoel Roth, voiced alarm that the dashboard was creating, not tracking disinformation.

“I think we need to just call this out on the bullshit it is,” Roth wrote.

The “Hamilton 68” dashboard had spurred dozens of stories in major media outlets that accused conservatives of trafficking in Russian disinformation, but when Twitter looked into the dashboard’s accuracy, they found it was garbage in, garbage out.

Former FBI counterintelligence official Clint Watts headed the Hamilton 68 dashboard and Jonathon Morgan of New Knowledge had helped to build it, along with J.M. Berger at the Alliance for Securing Democracy (ASD), housed by the German Marshall Fund.

“No evidence to support the statement that the dashboard is a finger on the pulse of Russian information ops,” one Twitter official wrote of Hamilton 68.

The internal Twitter emails were so damaging that the Washington Post later posted corrections to multiple stories that reported on Hamilton 68 and its findings.

But every story about disinformation elites caught creating disinformation contains critical missing facts and minor elements of disinformation planted by the very experts being exposed. New Knowledge is no different.

Starting a month ago, I began discussing what the media got wrong about New Knowledge and Hamilton 68 with Betsy Dupuis, a former New Knowledge employee who worked on Hamilton 68. Dupuis tells me she was fired from New Knowledge after expressing misgivings upon discovering the company that branded itself “the world’s first platform for defending online communities from social media manipulation” was itself engaging in blatant social media manipulation.

To back up her claims, Dupuis provided internal documents and photos from her time at New Knowledge, as well as screenshots of texts messages. Some of those we are publishing today.

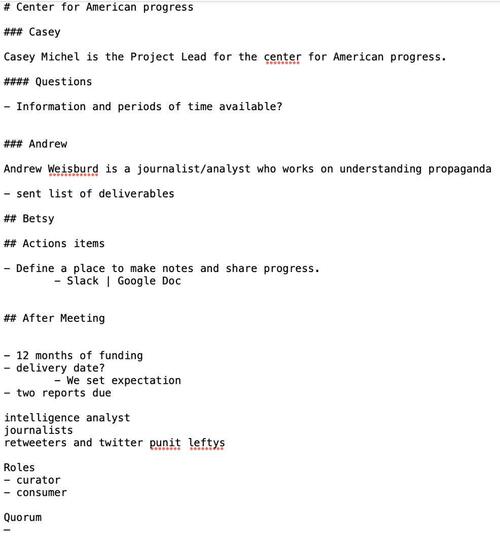

New Knowledge poached Dupuis from another company and set her to work improving the Hamilton 68 dashboard, which was planned as a product for groups aligned with the Democratic Party. The development was underwritten with a year of funding by the Center for American Progress, a think tank and lobby shop run by party political operatives.

Dupuis says she enjoyed her work updating Hamilton 68, but she became concerned when people in the office discussed the “Alabama Project” and she began wondering if this had anything to do with Roy Moore, a Republican candidate running for Senate. When she had joined the company, Jonathon Morgan had assured her that New Knowledge would only monitor, never create disinformation.

But then several former employees from the National Security Agency (NSA) joined New Knowledge.

Out for company drinks, former NSA employees explained to Dupuis how agencies get around federal laws that ban the U.S. government from spying on and censoring Americans: they contract with companies like New Knowledge to do their dirty work. By the time New Knowledge announced they had secured a Department of Defense contract to create automated disinformation, Dupuis had had enough.

She met with Jonathon Morgan to discuss her concerns and was fired days later.

Speaking with me from her home in Austin, Dupuis says that neither Jonathon Morgan, nor Stanford’s Renee DiResta have come clean with journalists about what happened in Alabama to create disinformation during an American election. But she says she is tired of being scared and the time has come for her to speak up. “Silence doesn’t buy you safety, Dupuis says. “People will still come after you because of what you know.”

“I just kept quiet, until now, because I didn’t want to be accused of spreading a conspiracy theory,” Dupuis tells The DisInformation Chronicle. “After I was fired, I was just like, ‘You know what? This is so crazy. Nobody's ever going to believe me. I'm never going to talk about this again.’”

Jonathon Morgan did not return multiple requests for comment sent to his current job and personal cell phone number. This interview has been condensed and edited for clarity.

* * *

THACKER: What caused you to get fired at New Knowledge?

DUPUIS: When they hired me, they said that we would never do disinformation. And I felt the grounds I'd been hired on had been violated. So I went to Jonathon Morgan, who was the CEO. I had a good relationship with him, or at least I thought I did.

I told Jonathon, “Hey, this is unethical. I'm concerned about this.”

I knew there were other people who were also concerned, very disturbed about what was going on, but I didn't bring them up.

I told Jonathon, “You said we would track disinformation, but we wouldn't do disinformation.”

And he told me, “If we don't do it, somebody else will.”

Which sounds like a very classic James Bond villain. What a great way of revealing your evil plan.

THACKER: This conversation happens on a Friday, night. Then what happens to you on Monday?

DUPUIS: Well, I went home, and at this point, I really didn't want to work there anymore. I had already been talking to friends about this, and I went out to the lake with a friend.

I got a message from Sandeep Verma that I needed to come in at—I think it was 8 a.m.—which is really early in tech time. This was very confusing, so I asked if they wanted to do it remote, but I was told I needed to come in early on Monday.

They had hired this really young women to be, I think it was VP of Marketing, but also HR. She was a nepo baby: her parents had given her a bunch of money to start a fashion line that failed. And now she's an executive at my tech company.

She and Sandeep are there, and Sandeep… I don't know, he was trying to look really positive, but he looked sad also.

He said, “We're letting you go. We no longer need the position. We're going to give you a month severance if you sign this NDA.” I had to sign the NDA right there on the spot, before I left, or else I wouldn’t get severance.

I told him, “I left another job to come to this company.” He said he knew, and then I signed it and left. If they want to come after me for doing this interview, I was coerced to sign the NDA.

I felt pressured to sign it. I didn't really have a choice because of how insane things were. What am I supposed to do? Not take the severance, and not be allowed to collect unemployment because I refused to sign their agreement and then maybe tell people that there's a conspiracy going on.

THACKER: Right?

DUPUIS: What happened was so crazy. Things that people would not believe is true.

DUPUIS: I'm mid-thirties, so that puts me smack dab in the middle of millennial territory, and I grew up with internet. I was one of those kids that learned to make their own web pages and interact with the internet even before Myspace.

THACKER: When I started at UC Davis in 1994, that was the first year that University of California students were required to have an email. I learned how to type having discussions on a UC Davis chat group.

When people started to come out with this idea, about seven years back, that they had discovered there was “disinformation” on the internet, I was like, “Wait, I've been on the internet for decades. From the very beginning I saw people behave like assholes and throw crap up on the internet.”

DUPUIS: Well, there was this progression from “Do not use anything from the internet for any paper; it has to be from Ebsco or Britannica. Some trusted encyclopedia.”

You were supposed to vet sources. Now with Gen Z kids, they don't even know what plagiarism is.

THACKER: So you started off at around age ten. You're on the computer, but it was still kind of a thing for weird dudes in the basement.

DUPUIS: I kept it kind of a secret, and then MySpace came out when I was in high school. But the internet was still for nerds. I gave up pursuing a career in programing because my parents had read a bunch of articles in newspapers saying that the internet was a fad.

THACKER: But you still got involved.

DUPUIS: I got into photography in high school, and I started shooting for iStockphoto which was an early internet start-up in online stock photography. Before them, you had to order a stock photo catalog.

I was doing work for them when I was teenager making like $1,000 a month, which for a high school kid is a hell of a lot of money. I could rent an apartment $300 at the time. I thought this is going to be my job. And then the stock market crashed in 2007 and everything went away.

So, I went to college and studied art, and when I graduated the market still really sucked.

I went to go visit some friends during South by Southwest—the big music festival in Austin—to see about jobs and opportunities in 2012.

I was like, “I’m moving here.” I was kind of homeless for about a year, worked for a few random start-ups, and became part of this industry.

THACKER: But then you land your dream job at New Knowledge.

DUPUIS: I would not say it was a dream job. I was really skeptical of this company to begin with.

THACKER: You’re this young woman working in the tech industry in Austin. Why New Knowledge?

DUPUIS: I was at an oil and gas data analytics company that owned some old data sets which are very valuable. My title was software engineer, but I was working mostly as a designer, building the front end of the software. I was designing a dashboard that allowed you to build reports and interface with their data. It wasn't super advanced stuff.

It was fine, but then New Knowledge reached out to me on Angel List and, when I met with them, they were immediately ready to hire me.

I think New Knowledge was interested in me because, “Oh, you can do some of the programing, but then you can also know how data works and can do the data visualization stuff.”

I think that's what I was qualified to do for New Knowledge, but I wasn't really qualified to do this disinformation stuff.

THACKER: Did you research them to find out what they were all about?

DUPUIS: I'd never heard of them before and the politics they were involved in. My way of looking into politics was going on Facebook and subscribing to every spectrum of political ideology: Democrat, Republican, Libertarian, Green Party, whatever. I just read whatever because I wanted to see what everybody was thinking.

Politics was not a big deal to me, but I would casually absorb things. I knew that Russian disinformation was in the news, and stuff about Trump.

THACKER: Of course, you knew about Russian disinformation and Trump, because that's all the media wrote about for four years.

DUPUIS: Yes. But it wasn’t something I really followed. I just wanted to have intelligent conversations about what was in the news.

New Knowledge told me they do all this stuff with disinformation. Jonathon had some State Department role under the Obama administration. Sandy was a friend from high school or something from their time in Houston. He was the Chief Technical Officer (CTO.) I guess you know how that works, right?

THACKER: Well, no. From what I understand about the tech industry, people get these jobs they’re not really qualified for, but they know someone, or have some weird skill that nobody else has in the office. The programming guy who likes talking to people can suddenly become head of marketing.

I get the sense that titles are very nebulous in tech start-ups.

DUPUIS: Sandy had a degree, and I think he was serious about being a tech guy. But I don't think he had the work experience to be a CTO. But that's often the case at start-ups.

They told me about their funding and trying to get all these contracts with companies that were doing this disinformation thing. I had a vague idea about this stuff from what I was reading about Trump and just from being online for so long.

People make stuff up.

But they said they were going to build this AI tool and I was kind of skeptical.

I previously worked at a company that had done some AI thing back in 2013. A lot of times people tell you they have artificial intelligence to do some chore, but it’s really just a bunch of humans doing all the work. Which is really expensive.

Eventually, you get found out

THACKER: There’s a lot of nonsense and pretense in tech. Amazon dropped their "Just Walk Out" AI technology which automated what you bought. It was really just 1,000 workers in India acting as remote cashiers.

DUPUIS: These companies pretend to have computer automated intelligence, but it's a sham. Real people do the work it because they don't know how to make software good enough to automate the task.

So I was a little bit skeptical of that, but they had all these PhDs so maybe they could make it work. I asked, “Hey, will you guys ever want to do disinformation?”

And they said, “No, it's completely against our ethics.” I also asked if they were only going to point out disinformation whenever Republicans do it, or when both sides do it.

And they said, “We're bipartisan. In fact, we have Republicans that we've worked with for a long time.”

THACKER: How was their business set up? Who was funding them?

DUPUIS: DARPA. Jonathon had gotten his seed money from DARPA, and he had actually been through several iterations of trying to get the company off the ground. Apparently, a whole other set of co-founders had left the company. I can’t remember why.

He had a podcast called Partially Derivative and some nonprofit organization called Data for Democracy.

There was a weird thing with people in the office, people that weren't in the office, people working as contractors. Some of the contractors had this aura around them. The same as what I've heard of Renee DiResta: “We're just really passionate about disinformation!”

One contractor was just involved in building scrapers.

THACKER: Explain what scraping means. I think it means an automated system to go out and collect or scrape data off the internet, instead of doing it manually.

DUPUIS: Instead of having a person go and copy/paste everything from a website, you use a computer that collects all the data.

I knew someone who had a scraping company that the State Department, FBI and other agencies use, and they could have saved a lot of money using him. Instead, they hired this contractor to learn how to scrape Twitter.

Twitter kept denying New Knowledge access to scrape, because it costs them money when you’re pulling too much data, and they didn't have an established partnership. New Knowledge was using a lot of their bandwidth.

THACKER: Tell me about working on the Hamilton 68 disinformation dashboard.

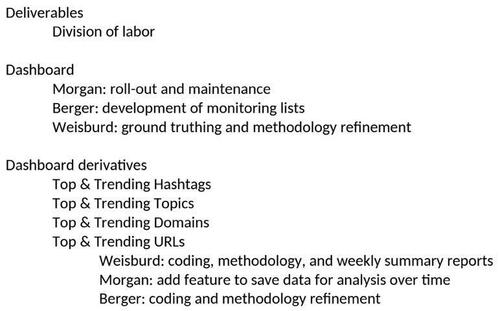

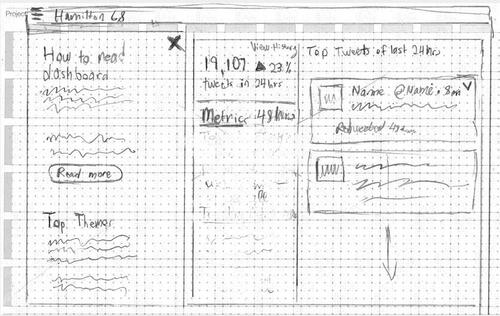

DUPUIS: We eventually had a meeting with J.M. Berger with the German Marshall Fund. There were other people on the Zoom, but the German Marshall Fund had done this dashboard and I was supposed to redesign it.

It was ugly and looked like a programmer designed it. I was supposed to repackage it into a better dashboard and allow them to sell that as a product. They were going to sell it to the Center for American Progress.

THACKER: Just to let readers know, the Center for American Progress (CAP) is a Democratic Party think tank and lobby shop. They're most famous for being the ones who basically ran Hillary Clinton's campaign in 2016. Simon Clark is a former member of CAP who now chairs the Center for Countering Digital Hate, a bogus “disinformation group” that works closely with the Biden Administration.

According to your notes from the time, the lead on this dashboard redesign at CAP was Casey Michel, who worked at their news site, Think Progress. Another was Andrew Weisburd, who was working at the German Marshall Fund and is now at Microsoft’s Threat Context.

And in the dashboard deliverables you were given, it says that J.M. Berger, who also had ties to the Brookings Institute, was developing the communities or lists of people to track.

What did the German Marshall Fund want you to make better?

DUPUIS: The dashboard was called Hamilton 68 because it had something to do with Alexander Hamilton, some paper he wrote, or something esoteric. You know how people name something after some esoteric fact to make it sound important?

THACKER: Right.

DUPUIS: The German Marshall Fund owned Hamilton 68, which was something Jonathon Morgan had built for them. I think with his previous business partners.

J.M. Berger was there because he was somehow involved with the Center for American Progress getting their own version. They were going to launch it on Think Progress, which was CAP’s news organization, but is now defunct.

I wrote specifically in my notes that Center for American Progress was giving us 12 months of funding. I don't know what that meant in terms of actual money.

THACKER: I’m gonna guess that Center for American Progress won’t tell me how much funding they were putting out for this. (The Center for American Progress did not respond to questions asking how much money they provided to upgrade Hamiltion 68 and whether they still use the system.)

DUPUIS: My job was to take Hamilton 68 and repackage it with a better design. I think I did a good job of it.

THACKER: What did this upgraded Hamilton 68 allow them to do?

DUPUIS: They could observe emerging trends on Twitter, trending hashtags, trending topics and track what people were linking to.

Click here to continue reading...

|

|

[Markets]

Dow Jones Futures: Stock Market Rallies Into Jobs Report; Apple Jumps On Record Buyback

The stock market rallied heading into Friday's key jobs report. Apple popped late on earnings and massive stock buyback.

Published:5/2/2024 4:51:21 PM

|

|

[Markets]

Having iPhone alarm issues? Here’s why you should switch to an old-fashioned alarm clock.

You may get a better night’s sleep going the old-school wake-up route.

Published:5/2/2024 4:51:21 PM

|

|

[Markets]

Fortinet’s stock falls after cybersecurity company’s quarterly billings drop

Published:5/2/2024 4:51:21 PM

|

|

[Markets]

Stocks eye rate hike chances, Treasury yields: Top Takeaways

US equities (^GSPC, ^DJI, ^IXIC) closed Thursday higher after a sluggish April session. The S&P 500 managed to end the day higher for the first time in three sessions. The market is seemingly pricing in Federal Reserve Chair Jerome Powell's comments over the improbability of rate hikes. Yahoo Finance Markets Reporter Josh Schafer joins Market Domination Overtime to discuss the top takeaways for the trading day on May 2. For more expert insight and the latest market action, click here to watch this full episode of Market Domination Overtime. This post was written by Nicholas Jacobino

Published:5/2/2024 3:49:01 PM

|

|

[Markets]

DraftKings reports surge in revenue, hikes full-year sales guidance

Published:5/2/2024 3:49:01 PM

|

|

[Markets]

Coinbase had over $1 billion in quarterly profit after crypto-trading explosion. Elevated costs have come with it.

A boom in crypto trading during the first quarter led cryptocurrency exchange Coinbase Global to a dramatic reversal of fortunes from the prior year, but the company warned of “elevated expenses” in the second quarter as it tries to handle the flood.

Published:5/2/2024 3:49:01 PM

|

|

[Markets]

Mall giant Macerich likely to start defaulting on maturing loans, says Barclays

The Federal Reserve’s extended period of higher interest rates is hitting home for mall owners with maturing debt.

Published:5/2/2024 3:39:52 PM

|

[Markets]

Markets Chop As Wall Street Awaits Apple Earnings After Bell, NFP Friday For Market Direction

Markets Chop As Wall Street Awaits Apple Earnings After Bell, NFP Friday For Market Direction

US equities ended their two-day slide as tech companies surged late in the session. The trading day has been choppy, with Wall Street now turning its attention to Apple's earnings after the bell. Some analysts anticipate Apple will reveal a major buyback program to offset potentially disappointing earnings amid countless reports from research firms in recent months about slumping iPhone sales overseas.

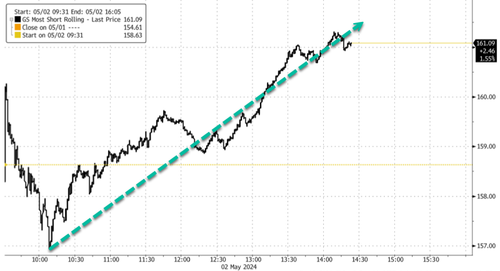

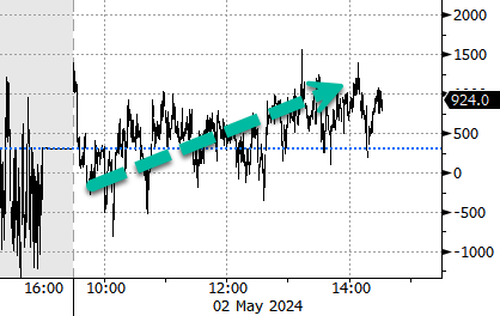

Let's begin with the choppy session in main equity index futures. Futs tumbled at the start of the cash session and caught a bid about 30 minutes later, or around 1000 ET. Since then, price action has been mostly higher into the late afternoon trade.

Despite the chop, Goldman's Most Shorted index (GSCBMAL) surged higher, up 4% on the session. Names like Carvana Co. were up 32% late in the session after a better-than-expected first-quarter earnings release. The company is heavily shorted, with about 27.6% of the float short, contributing to the surge in price.

Within the S&P500, consumer discretionary and technology stocks were up 1.49% and 1.39%, respectively. Almost green across the board.

Regarding the chop, most S&P500 sectors are still below levels after Wednesday's late session pump and dump.

NYSE TICK data shows that most buy programs were out ahead of Apple's earnings.

Again, more chop with individual names in the tech sector & Mag7.

Ahead of Apple earnings, here's Goldman's preview:

All eyes on AAPL tonight. We have positioning at a 7 out of 10, with a recent uptick in interest in the name (altho remains a BM underweight). Focus commentary 1) China trends in March qtr (cons has China revs -11% y/y in March vs the -13% y/y last qtr) .. 2) commentary on AI.. 3) Services visibility (including TAC + App Store)

In the macro world, Wall Street traders are preparing for Friday's announcement of March non-farm payrolls data. The median estimate tracked by Bloomberg is 240k.

22V Research polled investors and found that 30% of respondents believe Friday's jobs report will be "risk-on," 27% expect a "risk-off" reaction, and 43% said "mixed/negligible."

Meanwhile, the S&P500 is wedged between the 100-day Simple Moving Average (4979) and the 50-day Simple Moving Average (5129). A combination of Apple earnings (after the bell) and jobs data (Friday) could determine the next direction in price action.

One day after the Federal Reserve kept the target range for the benchmark rate at 5.25% to 5.5%—after serious concern that the US is headed for stagflation—bond yields across the curve leaked lower late in the session.

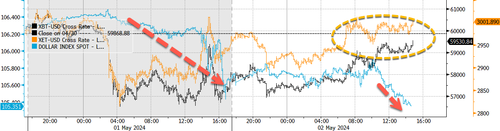

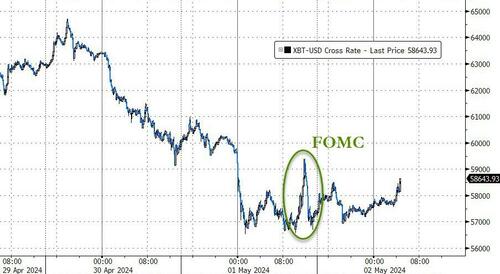

In FX, the greenback is on pace for its biggest drop this year as yields continue sliding. Cryptos, such as Bitcoin and Ethereum, trade mainly in chop. BTC/USD is trying to recover the $60k handle late in the cash session.

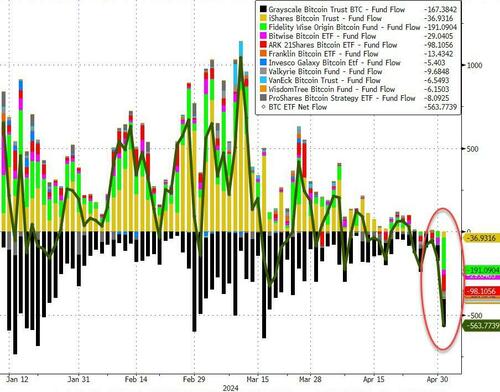

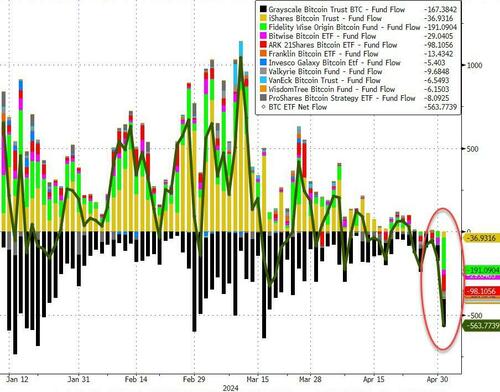

We noted early that BlackRock's ETF saw around $37 million in outflows for the first time, while the remaining spot Bitcoin ETFs collectively notched over $526.8 million in outflows.

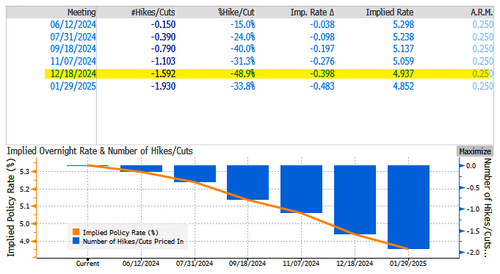

Rate traders have priced in about 1.6 cuts this year—up from 1.15 yesterday—but down from nearly 7 earlier this year. There has been dramatic repricing in Fed cuts due to sticky inflation.

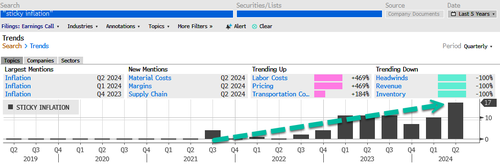

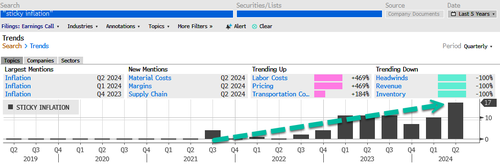

On inflation, using Bloomberg data, the number of mentions in earnings calls for "sticky inflation" surged to record highs in this earnings season. Several mega-corporations like Starbucks and McDonald's have warned about struggling working poor consumers.

Here's the recap of some of today's top corporate news (courtesy of Bloomberg):

-

Peloton Interactive Inc. said Chief Executive Officer Barry McCarthy is stepping down as the company undergoes a major restructuring that will reduce its global workforce by 15% in an effort to slash costs.

-

MGM Resorts International reported first-quarter sales and earnings that beat analysts' projections, benefiting from the post-pandemic recovery in Macau and a new partnership with Marriott International Inc. that helped fill hotel rooms.

-

Carvana Co. reported stronger earnings with revenue topping expectations as the company digs into its restructuring plan and regains sales momentum.

-

DoorDash Inc., the largest food delivery service in the US, offered a disappointing profit forecast for the current quarter as the company invests in expanding its list of non-restaurant partners and improving efficiency.

-

Moderna Inc. reported a narrower first-quarter loss than Wall Street had expected, as the biotech giant's cost-cutting helped offset a steep decline in its Covid business.

-

Apollo Global Management Inc. reported higher first-quarter profit as the firm raked in more management fees and originated a record $40 billion of private credit, a key area of growth.

By the way, Boeing shares continued to surge even after another Boeing whistleblower died.

A recap of this morning's macro data:

.... and it's an election year - remember that... We cited a note from Goldman's Adam Crook that points out the Fed and US Treasury are in 'full-blown stock support mode'... Powell can't let Biden's stock market crash... Pro subs read here.

Anyways, all eyes are on Apple after the bell.

|

|

[Markets]

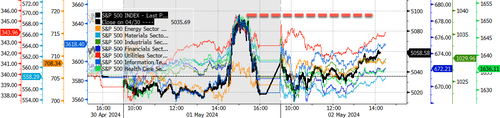

How major US stock indexes fared Thursday, 5/2/2024

The S&P 500 climbed 0.9% Thursday, a day after swinging sharply when the Federal Reserve said it’s likely delaying cuts to interest rates. The Dow Jones Industrial Average also rose 0.9%, and the Nasdaq composite added 1.5%. The Nasdaq composite rose 235.48 points, or 1.5%, to 15,840.96.

Published:5/2/2024 3:29:42 PM

|

|

[Markets]

Block’s stock shoots higher as Square parent boosts its earnings outlook

Also contributing was momentum across the company’s two main business areas, the Cash App mobile wallet and the Square merchant business.

Published:5/2/2024 3:29:42 PM

|

|

[Markets]

Block’s stock shoots higher as Square parent boosts its earnings outlook

Published:5/2/2024 3:29:41 PM

|

|

[Markets]

Stocks jump, close higher coming off of Fed's rate hold

US stocks pop Thursday as market indices (^DJI, ^IXIC, ^GSPC) close the session higher, the Dow Jones Industrial Average rising by 323 points and the Nasdaq Composite up by 1.51%. Market Domination Overtime Anchor Julie Hyman reviews the day's market performance after the Federal Reserve announced it will be holding interest rates steady yesterday. For more expert insight and the latest market action, click here to watch this full episode of Market Domination Overtime. This post was written by Luke Carberry Mogan.

Published:5/2/2024 3:13:45 PM

|

|

[Markets]

Dow ends 300-plus points higher, Treasury yields fall ahead of Apple earnings

Published:5/2/2024 3:13:45 PM

|

|

[Markets]

IRS says audits for rich people and corporations are about to hit a whole new level. Buckle up.

The tax agency announced goals Thursday in an effort to show what it’s doing to maximize the billions of dollars provided by the Inflation Reduction Act.

Published:5/2/2024 3:13:45 PM

|

|

[Markets]

US STOCKS-Wall Street ends higher as Fed signals dovish bias; jobs report eyed

U.S. stocks rallied on Thursday as investors weighed the Federal Reserve's more dovish-than-expected interest rate guidance on Wednesday against a plethora of mixed earnings and economic data. All three indexes ended in positive territory, with the tech-heavy Nasdaq enjoying a healthy boost from chip stocks after Qualcomm reported quarterly sales and profit above analyst expectations. Markets continued to parse Fed Chair Jerome Powell's assurances on Wednesday that the central bank's next policy move will be to lower its key policy rate, after it left rates unchanged at the end of its monthly meeting.

Published:5/2/2024 3:01:42 PM

|

|

[Markets]

Dave & Buster’s allowing arcade gambling raises ‘significant concerns,’ advocacy group says

One problem-gambling organization is concerned about ‘youth exposure’ to betting at Dave & Buster’s.

Published:5/2/2024 2:53:30 PM

|

|

[Markets]

GLOBAL MARKETS-Stocks rally after Fed, US data; yen strengthens

A gauge of global stocks climbed on Thursday after the Federal Reserve indicated it was keeping a dovish tilt, while the yen retreated after another suspected round of intervention by the Bank of Japan. On Wall Street, U.S. stocks gained slightly in early trading, after Fed Chair Jerome Powell said that while recent inflation readings mean it will likely take longer than expected for central bank officials to become comfortable that inflation will resume its decline, interest rate increases also remained unlikely. Markets have consistently scaled back the timing and amount of rate cuts this year from the Fed as inflation has proved to be sticky and the labor market remains on solid footing.

Published:5/2/2024 2:39:06 PM

|

|

[Markets]

Avis’s stock soars as robust demand and improved pricing fuel revenue beat

Shares of Avis Budget Group Inc. rocketed Thursday, bouncing from a three-year low, after the car-rental company reported first-quarter revenue that beat expectations for the first time in a year as what it called continued robust travel demand led to record rental volume.

Published:5/2/2024 2:19:23 PM

|

|

[Markets]

Options traders ‘did not take Powell completely at his word’ on rate hike

Published:5/2/2024 1:54:47 PM

|

|

[Markets]

May is usually a good time to buy Treasurys. Why investors may want to disregard this seasonal noise.

One of Wall Street’s oldest adages — “sell in May and go away” — has tempted stock-market investors into dumping equities this month and returning to the market in November. The opposite of this seasonal pattern exists in the U.S. government-debt market.

Published:5/2/2024 1:54:47 PM

|

[Markets]

"Sticky Inflation" Mentions On Earnings Calls Hits New High As Big Brands Warn About Buckling Consumers

"Sticky Inflation" Mentions On Earnings Calls Hits New High As Big Brands Warn About Buckling Consumers

On Wednesday, Fed Chairman Jerome Powell dismissed the idea that the economy could slide into "stagflation" despite multiple warning signs of a slowing economy and inflation reaccelerating higher.

"I was around for stagflation, and it was 10% unemployment, it was high-single-digit inflation," Powell said, noting, "Right now we have 3% growth, which is pretty solid growth, I would, say by any measure, and we have inflation running under 3%."

Powell then claimed he didn't see "stag" or the "flation" anywhere.

However, Powell has been very wrong before. He missed the initial surge in inflation in the months following the virus pandemic after the government helicopter dropped trillions of dollars on the economy. More recently, Powell prematurely pivoted on the interest rate hiking cycle before having to backtrack.

Meanwhile, America's largest companies are warning consumers are buckling due to the weight of inflation. This comes amid the failure of Bidenomics, where a new Gallup poll has shown a parabolic surge in households complaining about inflation-related financial problems.

On Wednesday, Starbucks logged the largest single-day crash since early Covid, nearly exceeding the 16.2% level that would've made it the worst drawdown since the Dot Com bust. The reason is simple: Earnings were a complete disaster as misses were reported across the board due to headwinds of a "cautious consumer."

Earlier in the week, McDonald's CEO Chris Kempczinski warned the burger chain faced "broad-based consumer pressures persist around the world."

"Consumers continue to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending," Kempczinski said.

Clearly, a $15 Big Mac combo meal is too expensive for many working poor folks. Plus, the food quality is junk.

Moving on to the 3M Company, the maker of Scotch tape and Post-it Notes, top executives told analysts during an earnings call that it "continued seeing softness in consumer discretionary spend."

As for Newell Brands, the owner of Rubbermaid, Yankee Candle, Coleman, Paper Mate, and many others, warned, "Consumers continuing to carefully manage their discretionary spend as the cumulative impact of inflation on food, energy and housing cost has outpaced wage growth."

Looking at Bloomberg data, the term "sticky inflation" has surged to a record 17 mentions in earnings calls. Other topics on the rise include "inflation" and "interest rates" and "labor costs."

But don't worry, Powell has glanced over the mounting stagflation threat because it's an election year...

|

|

[Markets]

US STOCKS-Wall Street gains as Fed signals dovish bias; jobs report eyed

U.S. stocks rallied on Thursday as investors dissected the Federal Reserve's interest rate guidance on Wednesday, a plethora of earnings and economic data. All three indexes were higher, with the tech-heavy Nasdaq enjoying a healthy boost from chip stocks after Qualcomm reported quarterly sales and profit above analyst expectations. Investors continue to parse Fed Chair Jerome Powell's assurances on Wednesday that the central bank's next policy move will be to lower its key policy rate, after it left rates unchanged at the end of its monthly meeting.

Published:5/2/2024 1:54:47 PM

|

[Markets]

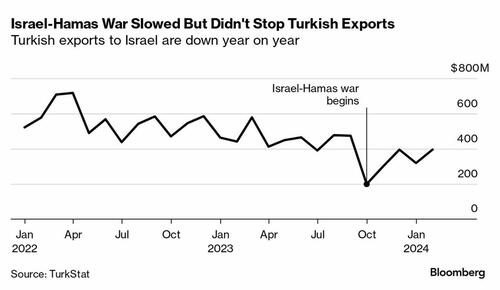

Turkey Halts All Trade With Israel As Relations At Breaking Point

Turkey Halts All Trade With Israel As Relations At Breaking Point

For months, relations between Turkey and Israel have been on the brink of breaking point. Already there has been the recalling of ambassadors, inflammatory rhetoric exchanged between leaders, and then things got more serious when Turkey a month ago moved to restrict 54 products from being exported to Israel until a Gaza ceasefire can be reached.

But Turkey's government on Thursday has taken the next big step, halting all exports and imports to and from Israel, according to Bloomberg which cited Turkish government officials. It has begun effective today, but Ankara has yet to officially announce the dramatic move.

Israeli Foreign Minister Israel Katz has confirmed that the breaking headlines are accurate. He said that Ankara has already begun to block Israeli imports and exports at Turkish ports.

Katz has ordered the foreign ministry to immediately pursue alternatives for trade which focus on "local production and imports from other countries."

Bilateral trade volume between the two countries, which prior to Oct.7 were enjoying warmer relations, had stood at $5.4 billion last year.

- Turkey sells $5B-$7B of exports to Israel every year.

- Israel sells $2B-$3B of exports to Turkey every year.

But President Recep Tayyip Erdogan has been unrelenting in his attacks on Israel and directed against Netanyahu personally.

In March, he went so far as to suggest the Israeli prime minster should be assassinated for overseeing war crimes in Gaza and against Muslims.

In a prior election rally the Turkish president vowed to "send [Netanyahu] to Allah to take care of him, make him miserable and curse him."

This week Turkish Foreign Minister Hakan Fidan announced Turkey will join South Africa’s case against Israel before the Hague-based International Criminal Court (ICC).

Source: Bloomberg Source: Bloomberg

So it appears at this point Turkey is waging both full-scale diplomatic and economic war on Israel. This is unprecedented for a NATO member, which also happens to have the second largest military within the Western military alliance, and is sure to put Western officials in an awkward spot.

|

|

[Markets]

Gazprom swings to £5bn loss in blow to Putin

Russian natural gas giant Gazprom plunged to a loss of 629 billion roubles (£5.5bn) last year as its sales to Europe more than halved following Vladimir Putin’s decision to invade Ukraine.

Published:5/2/2024 12:19:49 PM

|

|

[Markets]

Etsy is today’s sharpest S&P 500 decliner. Here’s why.

Published:5/2/2024 12:19:49 PM

|

|

[Markets]

We’re all paying a high price for letting corporations have free rein over us

Deliberately weakening social protections has created greater financial and economic insecurity.

Published:5/2/2024 12:19:49 PM

|

|

[Markets]

Organic walnuts recalled over E. coli outbreak

A California-based supplier of organic foods said it is recalling walnuts sold in 19 states after it was notified of 12 recorded cases of E. coli.

Published:5/2/2024 11:15:50 AM

|

|

[Markets]

Stock market today: Stocks climb as Fed rate-hike fears fade, with Apple on deck

Investors are accentuating the positive in Jerome Powell's policy comments and looking ahead to Apple earnings.

Published:5/2/2024 11:07:39 AM

|

|

[Markets]

Car sales in the U.S. inch up to four-month high

After a sluggish start in 2024, sales of new cars and trucks in the U.S. rose in April to a four-month high, despite higher interest rates.

Published:5/2/2024 10:59:26 AM

|

|

[Markets]

Car sales in U.S. accelerate to four-month high

Published:5/2/2024 10:59:26 AM

|

[Markets]

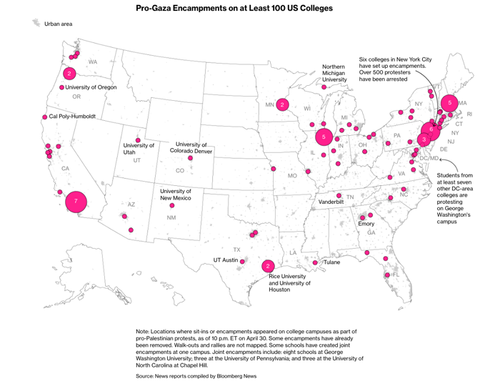

"No Change In Middle East Policy": Biden Deliver Unscheduled Remarks Over Campus Protests

"No Change In Middle East Policy": Biden Deliver Unscheduled Remarks Over Campus Protests

Update: Sure enough, it is about the protests, which apparently have had zero impact on anything as expected:

- *BIDEN: RULE OF LAW, FREEDOM OF SPEECH MUST BOTH BE UPHELD

- *BIDEN: DISSENT MUST NEVER LEAD TO DISORDER, DENIAL OF RIGHTS

- *BIDEN: RIGHT TO PROTEST DOESN'T MEAN RIGHT TO CAUSE CHAOS

- *BIDEN: NATIONAL GUARD SHOULD NOT INTERVENE ON CAMPUS PROTESTS

- *BIDEN: NO CHANGE IN MIDDLE EAST POLICY OVER CAMPUS PROTESTS

* * *

The White House has announced that President Biden will deliver unscheduled remarks at 10:30am ET (so he is already about 30 minutes late). It is unclear what Biden's handlers will feed the teleprompter but it is a very safe bet that the university protests around the country will be a key topic... pause.

|

|

[Markets]

Shell to focus on share buybacks to boost stock over New York listing, CEO Wael Sawan says

Shell committed to a $3.5 billion share-buyback program after it beat expectations.

Published:5/2/2024 10:27:59 AM

|

|

[Markets]

Markets see 'shallow' rate cut path through 2026: Strategist

The Federal Reserve announced its decision to hold interest rates at their current levels on Wednesday. Fed Chair Jerome Powell reiterated the central bank's need to observe further progress in taming inflation before initiating a rate-cutting cycle. Joining the Morning Brief to provide insights into the rate cut outlook is UBS Global Management Head of Taxable Fixed Income Strategy Leslie Falconio. Falconio highlights that the market had adopted a hawkish stance leading up to the Fed meeting, effectively pricing out numerous rate cuts — with markets now factoring in just one rate cut in 2024 and "a very shallow cutting path" in 2025 and 2026. She acknowledges the market's speculation about a potential rate hike, emphasizing that "the important part" was Fed Chair Powell's clarification on the path forward for rate cuts. Addressing the inflation target, Falconio emphasizes the Fed's need for "continued progress lower" in economic data. While the target remains at 2%, she believes that the exact figure may not necessarily need to be attained, as long as the disinflationary trend persists. For more expert insight and the latest market action, click here to watch this full episode of Morning Brief. This post was written by Angel Smith

Published:5/2/2024 10:11:41 AM

|

|

[Markets]

Biden expected to speak from White House on campus protest wave

Published:5/2/2024 10:11:41 AM

|

[Markets]

Bitcoin ETFs Suffer Worst Day Ever

Bitcoin ETFs Suffer Worst Day Ever

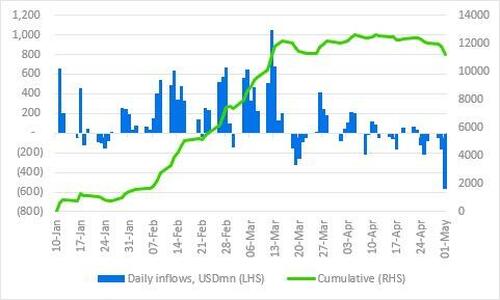

Despite the lack of total carnage in spot bitcoin prices, yesterday was an ugly (nay the ugliest) day for the newly minted ETFs (although bitcoin is down over 10% this week).

Most notably, BlackRock’s ETF saw around $37 million in outflows for the first time, while the remaining spot Bitcoin ETFs collectively notched over $526.8 million in outflows.

The largest outflow for the day was the Fidelity Wise Origin Bitcoin Fund, which saw $191.1 million in net outflows. The Grayscale Bitcoin Trust took the second spot with outflows of $167.4 million.

This means the total net inflow since inception has fallen to USD11.2bn.

On the crypto-specific we have now had 6 days in a row of outflows from the US spot ETFs and, as importantly, we are now below the average ETF purchase price of around 58k...

Source: Geoffrey Kindrick

Bloomberg ETF analyst James Seyffart noted that the Bitcoin ETFs are still “operating smoothly across the board” and that “inflows and outflows are part of the norm in the life of an ETF.”

Coinglass data shows that there has been around $200mm in 'long liquidations' in the last coupled of days...

“Bitcoin is our favorite canary,” ByteTree Asset Management Chief Investment Officer Charlie Morris wrote in a note.

“It is warning of trouble ahead in financial markets, but we can be confident it’ll bounce back at some point.”

But this is not a time to panic, as CoinTelegraph reports, ETF Store president Nate Geraci pointed out that the iShares Gold ETF and SPDR Gold ETFs have had $1 billion and $3 billion in outflows so far this year.

Yet, gold is up 16% year-to-date, Geraci noted in a May 2 X post.

As CoinDesk reports, the current lull is likely to be followed by a new wave from a different type of investor, said Robert Mitchnick, head of digital assets for BlackRock, the world's largest asset-management company.

The coming months will probably see financial institutions such as sovereign wealth funds, pension funds and endowments start to trade in the spot ETFs, Mitchnick said in an interview. The firm is seeing “a re-initiation of the discussion around bitcoin,” which turns on the topic of allocating to bitcoin (BTC) and how to think about it from a portfolio construction perspective.

“Many of these interested firms – whether we're talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices – are having ongoing diligence and research conversations, and we're playing a role from an education perspective,” Mitchnick said.

And finally, Geoffrey Kendrick - who correctly predicted $4k in ETH few months ago - is sticking with his 150k target for year-end 2024 and 200k for year-end 2025 (with chance of overshoot to 250k).

“The next three to four months will be less bullish and more risk-oriented, with the market closely monitoring inflation, employment and economic data for any unexpected shocks or to gain confidence about potential rate cuts,” said Youwei Yang, chief economist and vice president of crypto miner BIT Mining Ltd.

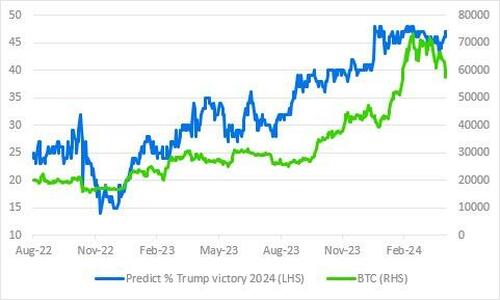

But, Kendrick notes, the next leg higher may take some time and require us to be closer to the US election.

At that time we would expect BTC to rally into year-end, particularly if a Trump presidential election victory becomes more likely, as a Trump administration will be more crypto friendly than a Biden one.

|

|

[Markets]

GLOBAL MARKETS-Stocks rise modestly after Fed, US data; yen slightly stronger

A gauge of global markets gained on Thursday after the Federal Reserve indicated it was keeping a dovish tilt, while the yen retreated after another suspected round of intervention by the Bank of Japan. On Wall Street, U.S. stocks gained slightly in early trading, after Fed Chair Jerome Powell said that while recent inflation readings mean it will likely take longer than expected for central bank officials to become comfortable that inflation will resume its decline, interest rate increases also remained unlikely. "The outcome of the statement, plus the press conference was for slightly more rate cuts to be priced in, not necessarily sooner, but by the end of the year," said Brian Nick, senior investment strategist at the Macro Institute.

Published:5/2/2024 9:53:59 AM

|

|

[Markets]

US STOCKS-Wall Street rises as Fed rate-hike concerns alleviate

Wall Street's main indexes advanced on Thursday, a day after the Federal Reserve left interest rates unchanged and allayed worries around potential rate hikes, with focus moving to a crucial job report later in the week. While Fed Chair Jerome Powell indicated that stubbornly high inflation would see a long-expected U.S. rate cut pushed back, he refused to entertain talk that rates might actually need to go up again. "The outcome of the (Fed) statement, plus the press conference was for slightly more rate cuts to be priced in, not necessarily sooner, but by the end of the year," said Brian Nick, senior investment strategist at the Macro Institute.

Published:5/2/2024 9:37:10 AM

|

|

[Markets]

Dow Jones Rises After Jobless Claims; Carvana Rockets 37% On Earnings

Stock Market Today: The Dow Jones rose Thursday after jobless claims. Carvana stock soared, while Apple earnings are next.

Published:5/2/2024 9:26:24 AM

|

[Markets]

'Unity': Pro-Israel And Pro-Palestine Supporters Chant "F**k Joe Biden" In Solidarity As Democrats In 'Panic Mode'

'Unity': Pro-Israel And Pro-Palestine Supporters Chant "F**k Joe Biden" In Solidarity As Democrats In 'Panic Mode'

How it started:

How it's going:

In early March, President Biden and the Democrats called for the "Unity of all Americans."

Fast forward to the Marxist revolution spreading like stage four cancer at the nation's colleges and universities, anti-Israel and counter-protesters found common ground, or perhaps a glimpse of solidarity, when both sides were heard chanting "F**K Joe Biden" this week at the University of Alabama.

"It finally happened. Joe managed to get both sides of the protest to hate him for different reasons," X user Alex The Ghost wrote.

Others on X agreed...