Authored by David B. Collum, Betty R. Miller Professor of Chemistry and Chemical Biology - Cornell University (Email: dbc6@cornell.edu, Twitter: @DavidBCollum),

This Year in Review is brought to you by healthcare, broken markets, law-and-order, and the case for a multi-year bear market...

Every year, David Collum writes a detailed “Year in Review” synopsis (2022, 2021, 2020, 2019, 2018) full of keen perspective and plenty of wit. This year’s is no exception, with Dave striking again in his usually poignant and delightfully acerbic way.

Contents

Part 1 (Read Part 1 here)

-

Introduction

-

Contents

-

My Year

-

Healthcare

-

Investing – Gold, Energy, and Materials

-

Gold and Silver

-

Broken Markets

-

Multi-Decade Bull Market: 40 Years of Recency Bias

-

The Case for a Multi-Decade Bear Market

Part 2 (see below)

Part 3 (coming in January of 2024)

Download a pdf of Parts 1 and 2 here.

* * *

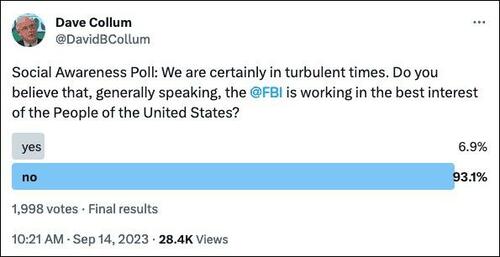

Law and Order

We have a law-and-order problem in which some facets look seriously problematic and others beyond repair. It is the perfect storm:

-

The opioid epidemic is raging unchecked. Although the Sackler family and big-cap pharma deserve credit, but massive fentanyl flows from China might be profit-driven or a Sun Tsu strategy (and maybe payback for the opium wars).

-

The response to Covid not only destroyed lives, it allows guys to walk into stores fully concealed by masks and nobody bats an eye. Crime becomes T-ball.

-

We have opened the borders to unimaginable numbers of undocumented immigrants. These are not the old-school Hispanics from South of the Border looking for work to send money home but rather military-aged men from around the world. Credible eyewitness accounts estimate 98% are non-Hispanic.1

-

Defunding the police in 2020 in the wake of the George Floyd riots emanated from the neo-Marxist brain trust. Add to that officers quitting because the job carries legal risks and you have gutted police forces. 911 calls go unanswered. Even in my small college town of Ithaca, NY the police force has been gutted. 911 calls at unsafe locations requiring police escorts are going unanswered.

-

We are long overdue for an economic downturn with all the accompanying pain and suffering, but it hasn’t started yet. Society is supposed to exit the top of economic cycles euphoric. I would call this dysphoric.

-

The current administration has politicized and weaponized the justice system from top to bottom with potentially profound consequences. This is a hot-button issue for me that distinguishes Biden et al. as uniquely treasonous.

-

A six-year-old Alabama boy was suspended from school and had his “permanent record” threatened for making ‘finger guns’ during a game of cops and robbers.2

-

Some good news: Three men accused of planning to kidnap Gov. Gretchen Whitmer were acquitted on all counts.3 The other twelve unindicted conspirators—all working for the FBI—never saw the inside of a courtroom. The lives of William Null, Michael Null, and Eric Molitor will never be the same. The twelve FBI agents who set the trap should rot in hell. If I was a religious guy I would be quite optimistic. Do I sound mad?

Immigration

Our profound immigration crisis is squarely on the Biden administration and the psychiatric wing of the democratic party. See Invaded: The Intentional Destruction of the American Immigration System by J. J. Carroll in “Books”. The rallying cry to support open borders because “we are a nation of immigrants” is specious. We had vast unpopulated acreage for expansion westward, and the welfare state had not yet been invented. You cannot run an overdeveloped welfare state with open borders. The political right accuses the left of recruiting voters but that seems asinine; these undocumented democrats can’t vote legally for years if not decades, right? Well, the ass-clowns inside the beltway—the City Council—passed a law granting voting rights in local elections to undocumented aliens. It is said that Congress could have intervened, but they didn’t.4

When a man flees war, he takes his family with him. When a man heads to war, he leaves his family behind. Our Nation is being infiltrated by Military-Aged Men from every corner of the globe.

~ Kari Lake, lingering United States Senate candidate from Arizona

You can’t blame America’s border crisis on incompetence (Hanlon’s razor) because nobody is that incompetent. This is hauntingly similar to the immigrant invasion of Europe a few years back.5,6 My best guess is that globalists are trying to destroy the US, the primary bulwark against a New World Order. You begin by shredding the concept of borders. A darker consequence is described by a veteran border agent who was charged with grabbing military-aged men on terror lists called special interest aliens (SIAs) and deporting them. They were exceedingly rare and all of them were deported. This changed in 2020. He now estimates that over 100,000 of these SIAs have crossed the border in the last two years.7 That is a lot of sleeper cells. Let’s hope his theory that we will suffer relentless terror attacks is dead wrong. For now, let’s peek at the messes that pale in comparison.

The immigrants hit the welfare state immediately. They are given a $2,200 per month allowance or a $5,000 debit card,8 bus and plane tickets, housing, food, and medical services.9 “They used to do the monitors on the ankles, and those were being cut off. So now they give them phones.” Unmarked buses deliver them to destinations in the middle of the night to avoid blatant detection and minimize the optics.

They take our phones, but they don’t take our phone calls.10

~ Congressman Barry Moore, responding to testimony immigrants are given cell phones but then disappear

Sanctuary cities like New York City came up with wildly progressive “Right to Shelter” laws, jamming immigrants into what used to be hotels and nursing homes. The mayor claims that half of New York City’s hotels (or at least what were hotels) are filled with immigrants living on the local taxpayers’ dime.11 The democrats, including NY Governor Kathy Hochul, are back peddling on this one. Bill Clinton declared, “It’s broken. We need to fix it… It doesn’t make any sense.”12 Then Adams lost his mind or played reverse psychology brilliantly and proposed that people invite these SIAs into their homes with rent paid by tax dollars. “It is my vision to take the next step to this faith-based locale and then move to a private residence.” The State of Massachusetts made a similar plea for AirBNB service from homeowners.13 Boston hotel reservations for a veteran-rich fan base to see the Army-Navy football game got canceled to house illegals.14 This is what they fought for?

ABC sends reporters to Ukraine but advises their reporters to stay away from San Francisco.15

~ Jesse Watters

Looting

California is the home of many bad ideas including a particularly oleaginous dynastic douche bag whose presidential aspirations will be riding the wave of disasters on his watch. San Francisco authorities are a particularly brain-damaged crew. They decided that minor crimes like shoplifting should go unpunished as long as the tab stays below a $1000 threshold. These undocumented shoppers predictably morphed into flash mobs that could clear out a store like Biblical locusts. What the bliss ninnies in California failed to realize is that a functional system of law and order system is part bluff—the fine citizens far outnumber the cops—and the masses called their bluff. Major retailers pulling businesses out of Shit City include Nordstrom,16 John Chachas,17 165-year-old Gump’s,18 and Whole Foods.19 I imagine every other store will eventually leave. San Francisco is now Detroit but without Detroit’s charm.

Stores like Walgreens and Walmart are chaining up their cabinets like an antique emporium, a failed business model requiring a massive staff to supervise and assist customers.20,21 The icty now has a real live pirate problem—argh!—in which thieves steal boats to steal other shit.22 San Francisco belatedly ended its mask mandate, but landlords are still waiting to charge rents.23 The city’s problems have it on the cusp of insolvency, looking at over $200 million in budget cuts to avoid a “doom loop.”24

We’ll look carefully to see whether this is a one-off situation and they’re fundamentally law-abiding people…

~ Larry Krasner, progressive Philadelphia district attorney on arrested looters

The devil is in the details:

-

While doing a story on the deplorable condition of San Francisco, the CNN truck under heavy surveillance by paid guards got ripped off in four seconds.25 Pit crews at the Indy 500 are studying the footage.

-

One ambitious guy got arrested ten times in one month. His tenth was at the police station, when he tried to retrieve his property with a stolen car.26

-

The Cruise robo-taxi startup supposedly running autonomous taxis in San Francisco—I did not know they existed yet—has discovered they are excellent for both amateurs and pros for quickies.27 I get the name “cruise”.

-

Police are urging people to carry air horns.28

-

Five percent of Target’s inventory somehow bypasses the barcode scanners.

It should come as no surprise that looting spread to other cities when the locals realized that San Francisco didn’t lack the laws but rather the manpower to stop flash mobs.

-

Name-brand items like Tide detergent are not being carried because there is a strong black market for the good stuff….by the Tide Podlers.29

-

Portland, Oregon lost Walmart, REI, and Nike because of shoplifting.30,31 This is Kharma for the Portland lefties. Cracker Barrel is pulling out because there are too many lefties and not enough crackers.32

Efforts to mitigate the damage ushered in by bad decisions led to more bad decisions and goofy solutions worthy of bullets:

-

Baltimore is suing Kia and Hyundai because their cars are too easy to steal.33

-

The democratic brain trust in Chicago came up with a great plan: ask the criminals to only shoot guns between 9 PM and 9 AM to minimize the risk of innocent people.34 That’s right up there with a proposal to have city-owned grocery stores as Walmart and Whole Foods exits, leaving behind “food deserts.”35

-

D.C. Mayor Muriel Bowser has decided her call to defund the police was boneheaded and is calling for more police to stem the soaring murder rate.36

-

A union in Los Angeles wants to fill all hotel rooms left vacant at 2:00 PM into rooms to be provided to the homeless.37 That would be all hotel rooms.

-

A prominent Minnesota Democrat changed her tune on defunding and dismantling the police department after a carjacker put some whoop-ass on her.38 “These men knew what they were doing. I have NO DOUBT they have done this before. Yet they are still on OUR STREETS.” Where is Kyle Rittenhouse when you need him?

-

The Austin, Texas police have urged robbery victims not to call 911 but rather call 311, the line for non-emergencies.39

-

The entire police force of Goodhue, Minnesota resigned.40

-

A left-wing Philadelphia journalist relentlessly mocked those concerned with rising crime in Democrat-run cities. In one tweet he was chortling at some guy predicting he would be dead if Biden got elected. He was shot to death in his home.

Frontier Justice

My dad told me a story of a friend who was being shaken down by a two-bit thug. The cops said he could defend himself, so he bought a gun and, during the next shake-down, emptied it into the punk. Problem solved. Twitter is beginning to be populated with videos of store owners defending their property—exercising “castle doctrine.”

When I was in NYC in the late 70s, Curtis Sliwa and the Guardian Angels patrolled the subway system to restore law and order. In a recent looting, a couple of patrons at Home Depot tackled a looter and constrained him with zip ties until the cops arrived. Meanwhile, to avoid legal risk, corporate America is firing employees who defend the stores.

Are we entering a period in which vigilante justice is our only option? Such a turbulent period may be unavoidable, but invisible forces are opposing this response. Take the shopkeeper who got the drop on a thief threatening to pull a gun and managed to beat the crook with a stick. It was quite the win for the good guys until the district attorney decided to prosecute the shopkeeper for assault.42 That district attorney is worthy of the business end of a Louisville Slugger. When we punish the law-abiding citizens for defending their rights, society has stage-III syphilis.

The Saga of Daniel Penny

This brings us to the sad and ominous story of Daniel Penny and Jordan Williams. Mentally unstable Jordan Neely gets on the subway in NYC and starts threatening people: “I don’t care if I have to kill the motherfucker, I will. I’ll go to jail, I’ll take a bullet” recalled him saying by one passenger. “The people on the train, we were scared. We were scared for our lives.” Neely had been arrested 44 times43 for various subway assaults, including rearranging the face of an old lady. Riders panicked and dialed 911, which requires quite a risk to trigger 911 calls from New Yorkers.44,45 One of the witnesses who filmed the event told NBC that Neely got on the train and “began to say a somewhat aggressive speech, saying he was hungry, he was thirsty, that he didn’t care about anything, he didn’t care about going to jail, he didn’t care that he gets a big life sentence.”46

After some delay, ex-marine Daniel Penny joined forces with African-American Jordan Williams to subdue Neely. Let me digress for a moment by explaining what this means. My wife has, on several occasions, delivered some ‘tude to a stranger that could have been avoided. (I especially appreciated the guff given to a heavily tattooed gentleman at a demolition derby.) I explained the flaw in her thinking as follows (paraphrased from memory, of course):

Here is the deal, Sweet Potato: you could have left me with no option but to get physical. At that point, I am in a life-and-death situation. I have no choice but to get the drop on my would-be assailant and incapacitate him, possibly permanently, because I can’t afford to exchange punches. I will then end up in court and possibly even prison, so please stop picking fights for me.

This may sound rash if you are a cloistered nitwit who has no idea how brutal street fights can be. I suggest you check out Twitter feeds including @FightMate or search “Fights at IHOP” on YouTube. The key message is that physical intervention is a serious step into the darkness. In the case of subduing an angry assailant, it can get worse owing to what is called “excited delirium” in which the state of the assailant’s agitation enables superhuman strength and irrational behavior. From a research paper in Police Practice and Research:47,48

Researchers recognized excited delirium as “a state of extreme mental and physiological excitement, characterized by extreme agitation, hyperthermia, hostility, exceptional strength and endurance without apparent fatigue….Intervention options are less effective against people experiencing excited delirium. Unfortunately, this may mean more force will be necessary to overcome resistance, and with more force, there is an increased risk of officer and suspect injury…Excited delirium encounters can be dangerous medical emergencies that simultaneously place officers, subjects, and communities at risk. It’s recommended that officers who intervene in cases involving probable excited delirium respond with containment and quick, coordinated, multiple restraint techniques that minimize the suspect’s exertion and maximize their ability to breathe.

From the above excerpt and all those videos I urged you to watch, if you release the constraint prematurely, you may die. Here is a good samaritan who paid a price:

The bottom line is that if you get into it with some whackjob, you may have to kill him. A witness said that Penny “refrained from jumping in and using force to subdue Neely until there was a threat of violence,” but eventually Penny and Williams moved to constrain Neely. Some witnesses were concerned that Neely was looking a little sketchy (choking on his spit), but Williams (the black dude) assured them they were not choking him: “He’s not squeezing,” said Williams. Neely eventually stopped struggling and Penny and Williams released him 90 seconds later—I timed it49—and immediately positioned him on his side to optimize his breathing. He either died on the spot or died at the hospital, depending on your source. You might even be able to see Neely take a breath after Penny released him but that could be the non-scientific “death rattle.”50 Witnesses on the scene said Penny and Williams were heroes. “Mr. Penny cared for people. That’s what he did…This isn’t about race. This is about people of all colors who were very, very afraid and a man who stepped in to help them.”51

The liars in the press looking to stir up a race war decided to create George Floyd 2.0 by vilifying Penny as a murderer while leaving the role of African-American Williams oddly in the shadows. (I keep saying African-American because some mouth breathers lack the intellectual minetailings to spot the racial motivations of the authorities.) They said Penny choked Neely for “15 minutes” rather than 90 seconds,52,53 ignoring the 13.5 minutes of excited delirium and that a real choke hold can knock somebody out in under 20 seconds. In 2020, I dug into what it takes to kill a guy by choking him while examining the Floyd death and the role of Derek Chauvin.54 It takes more than five minutes, not 90 seconds, before death becomes a risk. Daniel Penny described how the events played out.55

Penny was charged with manslaughter. What about Williams who teamed up with Penny? They worked together as a team. Well, after a protracted couple of weeks, they eventually realized they had to pretend to indict him, but then all charges were dropped.56 So this is pure racism by the prosecutor. Did the district attorney succumb to public pressure? Not really. The district attorney who brought the charges was Alvin Bragg,57 the same Morlock who weaponized the judicial system for political gain by going rogue on Trump.58 He is a despicable opportunist. A piece of shit. Go get your fourth booster Mr. Bragg.

The family that let Neely wander the subway and be homeless for a decade without finding a way to assist him suddenly decided that they cared about him quite deeply after all and have sued Daniel Penny for wrongful death.59 Good luck collecting after he is destroyed by legal bills.

Why make such a big deal of this one event? First, this is January 6th revisited for me. The weaponization of the justice system will be a major contributor to the downfall of our nation. If you don’t think so, just wait until “the other team” is in power and they start putting your sorry ass in the slammer. More importantly, Bragg’s moves have sent a very clear message: never help a person in distress because you will end up being prosecuted. Just pull out your cell phone like every other coward in society whose testicles never descended and film the atrocity. It’s a shame Daniel Penny doesn’t have Alec Baldwin’s street creds. Well, time to move on cause this ship isn’t gonna sink itself.

Robert F. Kennedy, Jr.

Ideas that are annealed in the furnace of debate.

~ Robert F. Kennedy, Jr.

The media serves up an AI-generated image of Robert F. Kennedy, Jr. telling you what he says and thinks. He is a total crank. Just ask the mainstream media filled with well-seasoned prostitutes trying to take him down. If, however, you actually listen to what he says, it creates a very different picture. He is this election cycle’s rising dark-horse progressive. Maybe I am not being fair to Vivek Ramaswamy who says all the right things from the right wing, but Vivek seems too produced, manifesting the authenticity of a boy-band. RFK Jr is the most exciting entrant to the political arena with no chance of inheriting the Oval Office. I have a long-shot bet that the DNC accepts their responsibility to serve up a potentially credible leader as their candidate and bites the bullet with a Kennedy nomination.

Much the way Trump weaponized Twitter for his presidential run, RFK Jr and Ramaswamy have tapped the Age of the Podcast. Kennedy will do any podcast including Greenwald,1 Dave Smith,2 Lex Fridman,3 as well as such luminaries as Alex Jones (which I can no longer find), Mike Tyson,4 and Dane Wigington (of Chemtrails fame).5 Having binge-watched many podcasts and even spent some time on a Zoom call with Kennedy, I will say that he is not the perfect candidate but is attempting to express his ideas clearly and honestly. He is by no means a crank but rather an outspoken progressive who has been scarred by fights with powerful forces over decades as he legally battled regulatory capture. There have been stumbles, corrections, and maybe a few fibs, but he is also a very quick learn on complex subjects and can openly and frankly change his stance. For those who have an aversion to one of his views, chin up: he may learn and change.

So let’s take a quick peek at my takes on his takes. This, of course, is paradoxical because I admonished you seconds ago not to read about what he said, but at least I provide the links to help you check.

Anti-vaccine quack RFK Jr. has filed paperwork with the Federal Election Commission to run for president as a Democrat… Kennedy is such a healthcare menace, in 2019, even his cousins wrote an op-ed criticizing his anti-science views on life-saving vaccines.6

~ Jake Tapper, CNN talking head, DNC shill, and all-around jackwagon

Vaccines.

Kennedy’s views on vaccines are the stuff of legend. I will reiterate a couple but urge you to read The Real Anthony Fauci to understand his multi-decade battles with pharma that have left him bruised and battered with a deep-seated disdain for Fauci. I doubt any reasonable person can read 100 pages without getting irate. Kennedy’s public stance is that he supports all vaccines that are safe and effective, but he trusts few of them. He takes serious issue with their excessive use and with the manufacturers, after getting hit with $35 billion of legal penalties, demanding and getting a complete backstopping of all culpability by the government. When pharma is immune to the consequences of vaccine injuries, they will promote unsafe vaccines without fear of consequences.7 I agree with Kennedy.

Lockdowns.

He emphatically declared the lockdowns to have been unwarranted and the $16 trillion cost prohibitive.8 He refers to the pandemic and the State’s response to it as a coup d’etat, coming off as more libertarian than bark-eating liberal.9

Only two families said they were claiming political persecution. The rest just told us openly they were coming here to make money, coming here for a better life. So, they didn’t even have that claim. And those immigrants shouldn’t be allowed into the country. We should stop that at the border…. They get extorted. They get raped. They get robbed.10

~ Robert F. Kennedy, Jr.

Immigration.

RFK was an open-border supporter. His sister Rory Kennedy created an award-winning 2010 documentary The Fence making a case against The Wall. But then he visited the border for two days in 2023 and morphed into an advocate of immigration control.11 On his visit, he found only two families claiming persecution with arguments that reached the legal bar. Hispanics were AWOL, with North Africans and Chinese representing the vast percentage of immigrants.

I went down to the border feeling that Trump has made a mistake on the wall, but I feel like people need to be able to recalibrate their worldview when they’re confronted with evidence.

~ Robert F. Kennedy, Jr.

Social programs.

He is a classic social democrat, proposing programs for those not living the American dream that sound good but have little history of working. On the heels of his relatively new views on restricted immigration, one can’t help but wonder what his views on the homeless might become. His openly stated desire to bring US spending under control, however, causes him to overtly denounce solutions involving big-government programs. An old-school liberal with a fear of budget overrun is arguably not an old-school liberal.

We must provide Israel with whatever it needs to defend itself — now.

~ Robert F. Kennedy, Jr.

Israel.

RFK’s stance on the Israel-Palestine conflict cannot possibly be a minor campaign issue nor is it likely to be static over time given that the conflict is looking quite kinetic. He has, however, come out squarely in support of Israel:12,13,14,15 This might be shaped by an awkward moment in which he casually noted that the Chinese and the Jews showed a greater resistance to Covid.16 Those at the table flinched. On cue, he was immediately pegged as anti-semitic. It just so happens that he was quoting a scientific paper that showed the biochemical basis of his statement.17,18,19 What he learned that day is something Dave Chappelle relayed to Kanye West: nothing good comes from putting two words together—“the” and “Jews.”

I have been fighting engineering solutions to environmental problems.20

~ Robert F. Kennedy, Jr.

Climate Change.

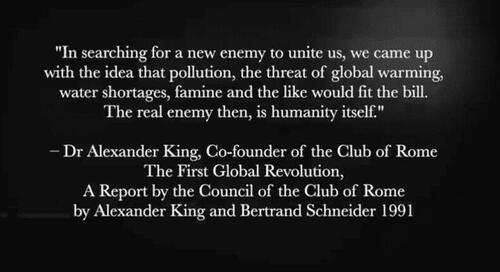

This is a hot-button topic for me, and my first exposure to Kennedy’s ideas appeared to be place him squarely in opposition. (See the section on “Climate Change.”) A video showed him threatening to jail climate deniers, which sounds like it might include me:21

I think they should be enjoying three hots and a cot at the Hague with all the other war criminals that are there. I think those [politicians] are selling out the public trust. I think those guys that are doing the Koch Brothers bidding and who against all the evidence of the rational mind are saying that global warming doesn’t exist that they are contemptible human beings, and I wish there were a law you could punish them under. I don’t think there is a law that you can punish those politicians under, but do I think the Koch Brothers should be punished for reckless endangerment? Absolutely. That’s a criminal offense, and they ought to be serving time for it.

He responded by pointing out that it was taken out of context and parsed very conveniently.21 I found his explanation in which he was referring to overt polluters to be extreme but not psychotic. Where it gets interesting is that he notes in other statements that climate issues are being “exploited” to impose “totalitarian controls” over the populace, drawing an analogy to Covid.22

Climate issues and pollution issues are being exploited by … mega billionaires…The same way that Covid was exploited to use it as an excuse to clamp down top-down totalitarian controls on society and then to give us engineering solutions.ref yy

~ Robert F. Kennedy, Jr.

Bitcoin.

As a bitcoin agnostic, I don’t care too much but in a podcast with a bitcoin enthusiast he left me slack-jawed by his grasp of the nuances of cryptocurrencies.24 As noted above, he is a fast learner.

If the government has the capacity to shut down your bank account and starve you to death and get you thrown out of your home and make it so you can’t feed your children, it has the capacity to make slaves of all of us.25

~ Robert F. Kennedy, Jr.

Chemtrails.

In a rather remarkable podcast, RFK chats with Dane Wigington, one of the more legendary promoters of how those streaks in the sky are nefarious actions of the New World Order. RFK largely played devil’s advocate on the existence and purpose of chemtrails. I will touch on this topic again, but Kennedy neither endorses nor summarily dismisses the chemtrail narrative.

Ukraine.

Kennedy laid out in detail that our foreign policy in Ukraine is atrocious and we should get the hell out of there.26,27 His position squares nicely with mine laid out in lurid detail in 202228 and amplified below. He also admits in the same Greenwald interview that he got duped by the Russia collusion story used to attack Trump and has now done a 180.29

I would put a statue of Snowden in Washington. What Snowden released nobody in our country knew about. That the intelligence agencies were mining all of our data and spying on Americans…Assange I’m going to pardon.30

~ Robert F. Kennedy, Jr.

Opposition.

As noted, I don’t think RFK is getting near the Oval Office. He got pushback that was reminiscent of Ron Paul in 2008 on almost every topic. Here are some examples of opposition showing its true colors:

-

The democrats tried to stop him from testifying to Congress on the evils of censorship.31 The irony of censoring talks on censorship was lost only on the Congressional democrats. He proceeded to beat them like rented mules in his testimony. He noted that the 101 Congressmen and women who signed the letter to censor him played the anti-Semite card.

-

RFK’s interview by Mike Tyson describing how the CIA whacked his father and how the case against Sirhan Sirhan would have crumbled had it gone to court was deleted by YouTube.32 As is becoming patently obvious, the CIA has the final say on all online media sites.

-

In an ABC interview, RFK got massively censored (edited) with a follow-up disclaimer that we are not allowed to see what he said because he made false claims about the vaccine.33 That is what worthless sacks of shit called “mainstream media” do in authoritarian states.

-

The DNC declared that they had “no plans to sponsor primary debates,” even with multiple candidates vying for the party’s nomination.34 They provided their full support to that child sniffing,35 compulsively lying,36 and underachieving former senator who is 51 cards short of a full deck. (Yes: I am fed up with Potus.) The DNC decided that the primary votes accrued by any candidate who even sets foot in Iowa or New Hampshire would default to President Brandon.37

The CIA is the world’s biggest sponsor of “journalism.”38

~ Robert F. Kennedy, Jr.

Many are unaware that the DNC is a private not-for-profit with the power to pick candidates any way they want. They were kept in check historically by two restoring forces: (1) anybody with a half of a brain would abandon them and start a new party, and (2) I could imagine that RICO charges could be levied for raising funds using pretenses. (Of course, the DNC has weaponized the Department of Justice, so that would never happen…unless the RNC regains power.) The superdelegate system is so lopsided that an interloper like Kennedy has no chance of commandeering the nomination; he is now an independent. I hope he does some damage. It is quite clear that the DNC has lost all moral or legal obligation to offer us a candidate even minimally capable of leading the nation. Cornpop39 would be an improvement over Biden.

They’ve passed a rule that says any candidate who actively campaigns in New Hampshire that the delegates they win will not be allowed into the convention. It’s not a good template for Democracy.40

~ Robert F. Kennedy, Jr.

Assassinations.

It seems pretty clear to many that if RFK got even a whiff of the presidency he would follow in the family tradition and get his ass capped by the CIA to the applause of Big Pharma. He has been inflicting huge reputational damage to the CIA by accusing them of killing his uncle (JFK)41 and his father (RFK, Sr.) After years of turning a blind eye, he looked at the case against Sirhan Sirhan and suggested that Sirhan Sirhan was a product of MKUltra,42 the CIA’s program for brainwashing assassins-in-training and patsies. (Sorry folks, but MKUltra is real and, in my opinion, still today.)

I have determined that Secret Service protection for Robert F Kennedy, Jr is not warranted at this time.43

~ Alejandro Mayorkas, Secretary of Homeland Security, after 88 days of stalling

All viable presidential candidates have been offered Secret Service protection since his father was shot, but RFK, Jr was denied.44 When Joe Rogan asked him what he thought would happen if he managed to get into office, Kennedy replied, “I gotta be careful. I’m aware of that danger. I don’t live in fear of it — at all. But I’m not stupid about it, and I take precautions.” I suspect he would release the last of the Warren Commission papers, the ones that Tucker Carlson claims show the CIA did it.45 Watch for those little red laser dots on your chest, Bobby. I also fear that his flame burned brightly and dimmed too early. His social media presence may have peaked. The Onion showed why the Babylon Bee is the New King.

Jeffrey Epstein.

It turns out RFK, Jr. rode on the Lolita Express twice. Oh, here come the Guardians of Gotcha! Welp, it turns out to have been in 1993, the trips were to Florida, and he brought his wife and kids. Kinda puts the damper on the pervy shit.46

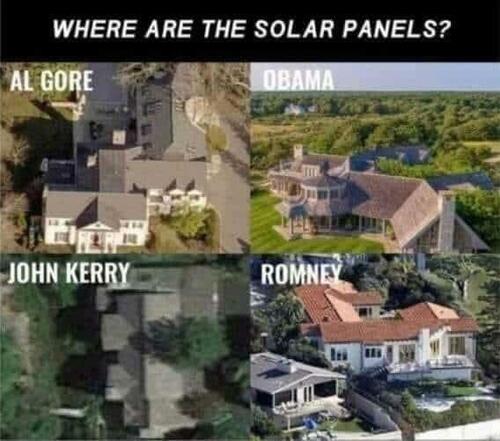

Climate Change–Epilogue

The Only Way to Get to 1.5 Degrees of Global Warming is Money, Money, Money, Money, Money, Money, Money.1

~ John Kerry, US climate Czar

As of 2016, I was largely on board the climate change narrative owing to my faith in the scientific community. After I was challenged to question that stance by my brother and a digital acquaintance, Dr. David Walker, I have done a U-turn and am sanguine with my current stance that climate change is the largest hoax in the history of science to paraphrase Richard Lindzen, geophysicist at MIT. The hoax is fueled by a combination geopolitical forces and tens of trillions of dollars of government largesse—an estimated $150 trillion over the next decades2—to buy adherents of many and complicit silence from others.

“You don’t believe in climate change? What a Luddite!” is the rallying cry of the cultists, and I do not use the term cultists loosely. I wrote about my journey in 2019 (pg 53).3 This grift demanding an urgent response to ward off catastrophe decades from now will obstinately persist because it will always be decades from now. One of the early denialists, Michael Crichton, reminds us to read headlines from decades ago and ask how many catastrophic predictions played out as the panicky press declared.4 We are forever being shamed to do it for our children and grandchildren.

I will not adjudicate the case again for my climate denial stance, but each year I top off my denial narrative with fresh tidbits. Here is a decent primer for those who did not realize it was a debate and not just “The Science.”5 For serious analyses and fabulous archival data, check out Watts Up With That?6 I also did a podcast with climate denialist, Tom Nelson, that touched upon climate change before I drove it off a cliff into darker topics.6a

How can I possibly spit in the face of a massive scientific community that has reached a nearly perfect 97% consensus? Let’s begin with that 97% consensus narrative as one of the biggest lies. It stems from a horrifically bad survey of the literature in which half the papers were irrelevant, and by the miracles of statistical massaging, 0.4% of the papers claiming climate change is a crisis was spun into a 97% consensus.7,8,9 This garbage is cited widely by a community willing to knowingly live with the lie. There are many more lies. Princeton physicist and former presidential advisor, Will Happer, laments that they keep changing the data from the past to fit the narrative.10

If you have to lie to make your point you don’t have a very good point.

~ Jimmy Dore

The absence of credible scientists denying climate change is another whopper. A few hours of thoughtful pursuit will reveal that many prominent scientists—especially a large population of elite physicists—have nothing but scorn for the field (pg 53).11,12 Those doing good climate science—and there are undoubtedly many—are forced to sell their scientific souls through willful blindness and unwillingness because their professional lives depend on not calling out the con artists. The authorities and their captured media lied us into every military conflict for over a century. Metaphorical Wars on Drugs, Terror, Poverty, and Communism are designed to be fought at considerable cost but never won. Replace “War” with “Grift” and you are getting closer to the truth. The Gell-Mann amnesia effect—our ability to doubt the media on subjects we understand but to believe all the others—allows these narratives to move forward unimpeded.

Precious few are willing to question credentialed experts. We just witnessed a wholesale delusion because scientists and doctors were unwilling or professionally unable to challenge even a shard of the Covid narrative. Trust The Science.TM We never witnessed open and active debate. Those who questioned the narrative suffered massive destruction of their careers and livelihoods. To quote Elon Musk, to those who foisted the lie on otherwise decent people, “Go fuck yourselves.” Climate scientists who step in front of the climate narrative suffer a similar fate. To those pushing this narrative by preventing open and honest debate, “Go fuck yourselves.”

The following nuggets are not intended to convince Eric Hoffer’s “True Believers”13 to re-evaluate their position—it would take an act of God to do that—but to throw more shade on the narrative to assist and perhaps entertain those already in doubt. Meanwhile, the Associated Press and other news agencies will continue to accept bribes to push the catastrophe narrative.14 The Flagulents will continue to stop rush-hour traffic by gluing themselves to the road,15 deface priceless paintings,16 vandalize gas-guzzling SUVs,17 and even block London’s pride parade.18 PBS will teach us to cope with “climate anxiety.”19 (Let me help: turn off PBS.)

Claims

The press is a goldmine of preposterous claims illustrating the triumph of ignorance. Climate change is the default for brain addled journalists incapable of forming coherent thoughts on their own. Here are some of the ideas spewing from their brain stems:

- Increasing CO2 in the atmosphere leads to more plants growing more quickly. Because plants don’t consume all the CO2 they absorb, that means more plants are releasing even more CO2 into the atmosphere!20 Nobody would buy this crap right? Think again…

- There were 500 more major league home runs because of climate change over the last decade.21 So much for Big-League Science. For the sake of humanity, stop injecting the trees with steroids.

-

Climate change is causing kidney stones in children owing to dehydration.22 They say hospitals are opening up “stone clinics.”23 They are, no doubt, to be subsidized by money allocated to fight the crisis. Given that a couple-hundred-foot change in elevation or a few hundred miles north or south can alter the average temperature, parents should choose where they raise their kids carefully. If you live in New York, do not move to Pennsylvania.

-

The Messenger Business tells us climate change is ruining the quality of your beer (unless you still drink Bud Light, which has been declared turtle piss as of this year.)24

The natural instinct of the entire world to blame every hiccup on climate change leads to a rhetorical question that haunts me. Recall all the problems we have faced and solved through clear-headed reckoning. Imagine that we were facing the loss of the raptors in the world because DDT was thinning their shells, causing a massive collapse in their populations. If that problem from the 1960s surfaced today, would we be able to get to that conclusion or simply blame it on climate change? Answer: We would royally fuck it up.

Solutions and Mitigation

Because of the pandemic of juvenile kidney stones and major-league home runs, we must do something. Some shockingly stupid solutions are being batted about:

-

The crowd blaming trees for expelling CO2 has recommended mass deforestation.25

-

Britain’s Climate Change Committee (CCC) told the Limeys not to heat their homes in the evening. To get to the Net Zero target by 2030 either home heating or private jets are gonna have to go.26 To say the enthusiasm for the plan was muted would be an understatement.

-

Scotland chopped down 16 million carbon-sequestering trees to build windmills.27

-

Many support geoengineering as our savior. That is where you intentionally blanket the earth with a cloud of shit (aluminum particles, for example), to block the sun’s rays.28 I cringe at the damage they could do to the planet but chuckle at how blocking the sun would undermine that grand scheme to exploit solar energy. All of the solutions to the problems caused by bad weather rely on predictably good weather. In a 1995 Simpsons episode, Mr. Burns built a giant shade to block the sun as part of a plan to force the city to rely on his power plant,29 which explains why Bill Gates likes the idea so much. This idea is so insane that the solar-powered bright bulbs of Congress are now interested.30

-

Democrats in the State of Washington State want incarceration for those using gas-powered leaf blowers and edgers.31

-

Klaus Scwab’s daughter seems to be carrying the authoritarian standard into the fray by promoting “climate lockdowns.” She is from a mutant lineage. There are tons of fact checks denying this one. Collum’s Law: the more fact-checks, the more somebody is hiding something.

-

In one of the more comical chapters, the People’s Republic of California proposed a total replacement of gas-powered vehicles by electric vehicles (EVs) the same week that they asked the citizenry to abstain from charging their EV’s owing to the fragile grid.32 On the not-so-improbable chance Gavin Newsom rides in to save the Democratic ticket on a solar-powered steed, remember: you are voting for a member of a crime family.

-

Some Scientologists suggest it is time to bring back food rationing.33,34

Green energy has two problems: it’s not really green, and it’s not really energy.

~ Alex Epstein

-

Gasoline cars spew out 3% of global CO2 emissions,35 so go ahead and buy that Tesla, but you better check into the cost of replacement batteries (up to $20,00036) and generic repair work before you plunk down the cash. Also, hope it doesn’t blow the hell up.37

-

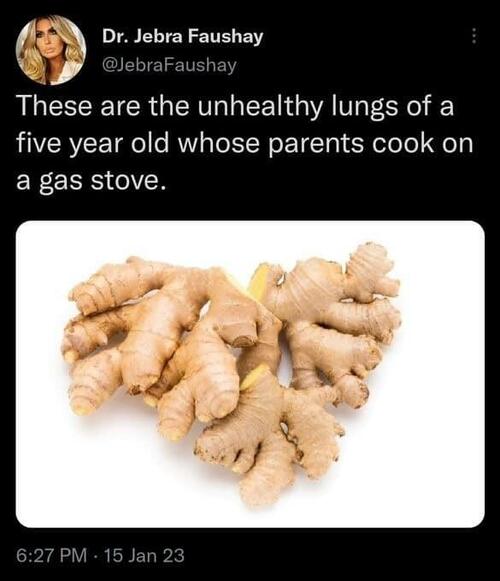

Get rid of gas stoves! This idea also came out of the Bad Idea Factory, California, but found its way inside the Beltway fast.38,39

-

RedState says couples are passing up having kids altogether.39 If you decide you don’t want to have any children, just call John Podesta to take them off your hands.

-

The Los Angeles Times endorses the occasional blackout.40

-

Daily Mail says some doctors suggest that using less anesthetic during surgery would measurably reduce our carbon footprint.41 Some doc tries that on me, and I will pull out of my shallow stupor and personally reduce their carbon footprint.

-

Introduce climate taxes.42 This one is already here and growing.

-

Gigantic solar-powered air conditioners could cool the Earth. OK. I made that one up, but it’s no dumber than some of the others.

-

The Federal Reserve has decided that climate change mitigation is under their jurisdiction now that they have gotten control over inflation and dollar debasement.43

-

The New York Times suggests that if we mate with shorter people this will decrease the carbon footprint of our offspring.44 It has added perqs if the little lady has a flat head.

-

We could elect a new president:

It’s only gonna get worse with global warming and climate change ’cause people can’t live in certain parts of this world.45

~ Joy Bahar

The Climate Grift

At the turn of the century, the titans of industry and carpet baggers bribed politicians to stay out of their way. In the modern era with huge government budgets, politicians are bribed to hand over huge sums of what was formerly your money. We are in the Age of Grift, and climate change is running neck-and-neck with the War Machine.

-

The carbon baggers at JPMorgan Chase are going green by purchasing $200 million of carbon credits from several companies building a pipeline to ship CO2 from somewhere to somewhere else. It’s kind of like the bathtub ring in The Cat in the Hat. The businesses haven’t any carbon and nobody has a clue what to do with it anyway, but the carbon credits (a generous grift from the government) will “neutralize the bank’s environmental footprint” whatever the hell that means. This clown show promises to be profitable as JPM cleans up by moving bathtub rings.46 The Fed hikes will do wonders to reduce carbon footprints of regional banks.

-

The Biden administration is increasing the tax credit for solar and wind facilities in low-income areas.47 Will that make the farmers wealthy—I presume they are not installing them in “the hood”—or cause them to lose their farms by eminent domain?

-

A new $4 billion electric vehicle (EV) battery factory in Kansas is powered by enough coal to light up a small city (200–250 megawatts.)48 Leaving the idea of free market capitalism aside, why does a “$4.7 billion” plant need $6.8 billion subsidy from the ironicly named, “Inflation Reduction Act?”

-

China has fields packed with thousands of undriven electric cars left to rot (or explode).49

-

Batteries that consume huge natural resources, rely on massive child slave labor in the Congo, inflict environmental damage, and risk fires are a small price to pay for green soon-to-be toxic waste dumps masquerading as solar farms.

If you actually have a superior product, you don’t need the government to force it on people. If someone has a competitor to the iPhone, we would never say, ‘Oh, let’s just give them some $10 billion in subsidies.50

~ Alex Epstein (@AlexEpstein), climate pragmatist but naïve on “free market subsidies”

New Science

A few bits of scientific insight crossed my field of view despite my best efforts to stop consuming my relatively limited ATP and time on the issue. Some are new and others are new to me or just new perspectives.

-

Evidence from Greenland ice cores provides no support whatsoever of man-made climate change.51

-

Even as a chemist, it surprised me to learn that there’s more argon than CO2 in the atmosphere.

-

Arctic sediments show it was warmer 10,000 years ago and ice-free in the summers.52

-

Maine researchers noted a one-month spike of sea temperatures above the norm and declared a disaster.53 Check your gauges. Run a few controls. Statistically speaking, the odds of your panic being justified are 1/astronomical.

-

CO2 is 0.04% of the atmosphere. 3% of that came from humans and 5% of that 3% came from the US. Ergo, CO2 from the US is 0.00006% of the atmosphere.54 And if you drive an electric car it will change this math by 1/1.0 google.

-

Over the last 10 years, the US has witnessed a statistically random (average) number of temperature records.55 “The 1930s are still champs!” according to climatologist John Christy.

There are all kinds of myths and pseudoscience all over the place. I may be quite wrong, maybe they do know all these things, but I don’t think I’m wrong. You see, I have the advantage of having found out how hard it is to get to really know something, how careful you have to be about checking the experiments, how easy it is to make mistakes and fool yourself. I know what it means to know something, and therefore I see how they get their information, and I can’t believe that they know it. They haven’t done the work necessary, haven’t done the checks necessary, haven’t taken the care necessary. I have a great suspicion that they don’t know, that this stuff is [wrong] and that they’re intimidating people.

~ Richard P. Feynman, The Pleasure of Finding Things Out (1999).

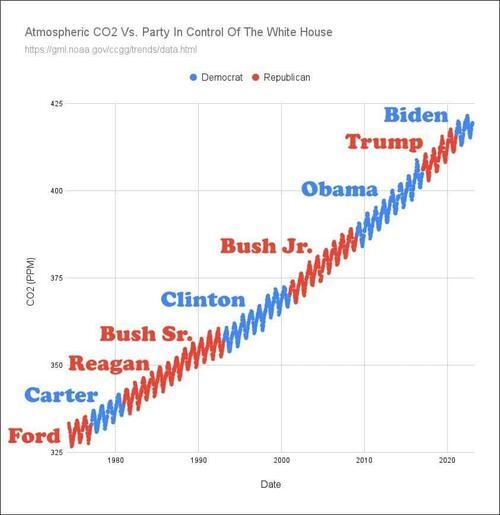

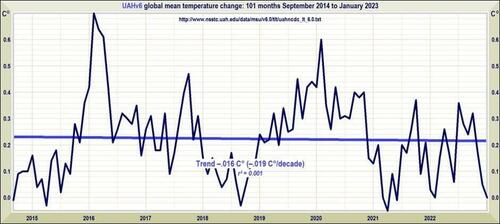

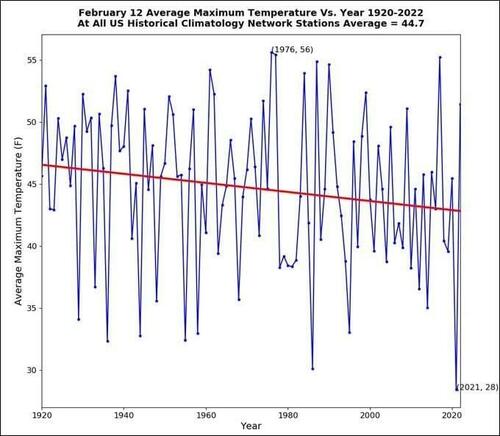

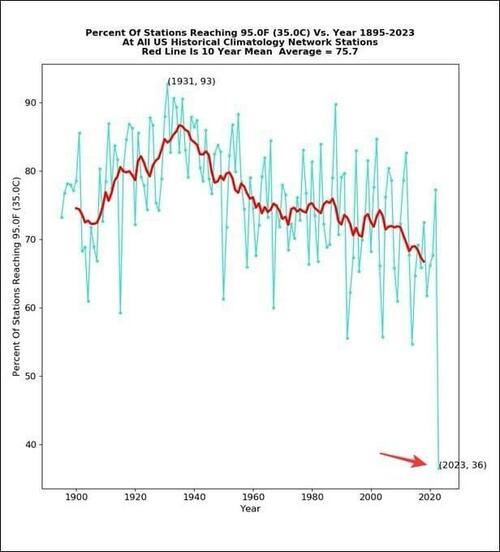

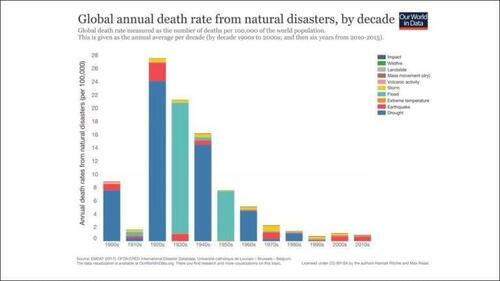

Now let’s look at a few charts for laughs.

The average temperature over the last 10 years…

The average temperature in all climate stations in February back to 1920…

…or the number of record highs reported across all weather stations back to 1920…

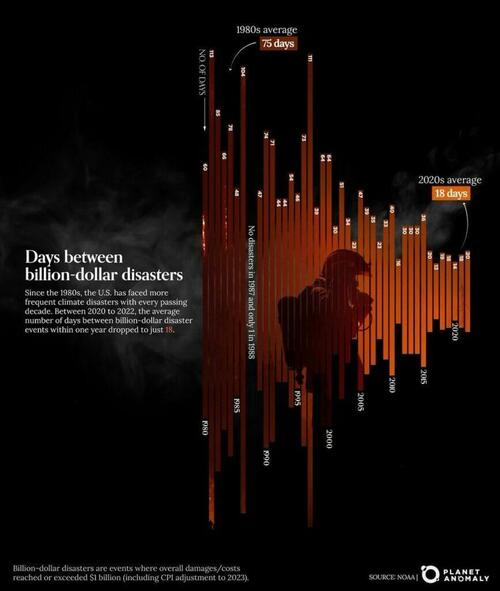

OK. This isn’t working. Let’s try average days between billion-dollar disasters over four decades…

Bingo! Eat that, Dave, you climate denier! Now correct for changes in the US population (up 1.5-fold), real rather than corrupted CPI-based inflation, and monotonically expanding coastal land development, and you realize this plot is total bullshit.56 Ignore it, or chuck some tomato soup on a Renoir.

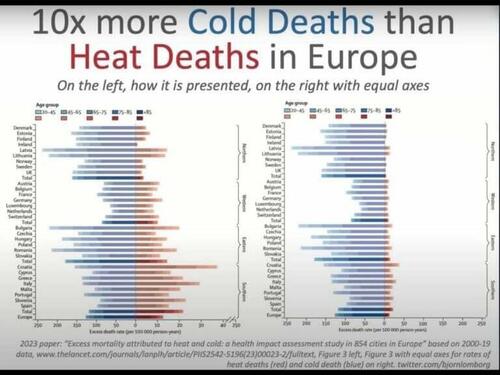

Even if that plot were legit, let’s gander at deaths in Europe, a continent with some legendary wholesale death stats over the centuries, attributable to temperature extremes

How ‘bout global deaths attributed to all extreme weather events…

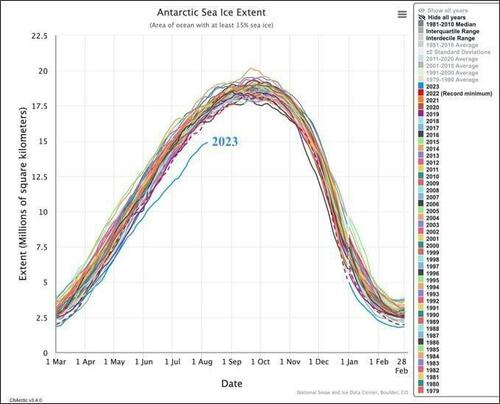

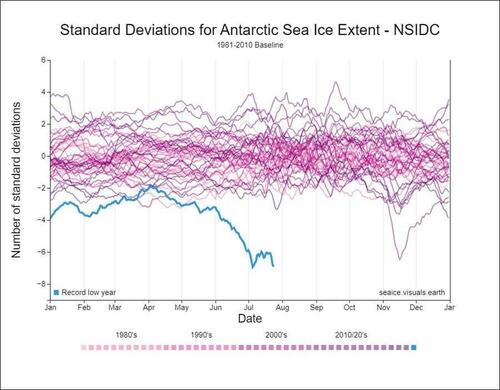

There is one stat that really got the Cult’s underwear in a bunch. NASA says that the Antarctica ice coverage has been growing for over a decade,57,58 but everybody’s underwear shot right up their asses this year when the quantity of Antarctica sea ice plummeted. The first figure below shows the drop that Helen Keller could see. The figure after that shows the much more useful and monumental drop in units of standard deviations.59 Six standard deviations is a one-in-a-billion event. This is extraordinary, especially in the absence of any foreshadowing. But first, take a peek at that other year in which it also dropped six standard deviations in November but then fully recovered in a month. Seems improbable, eh? Also, if you Google this story, you find plots with different fine structures—different jiggles and wiggles. This does not happen with real data.

To explain this result, we bring out a modified version of Nassim Taleb’s story of Fat Tony:

Vinnie: “Hey Fookin’ Tony. I have a legitimate coin and flip it heads 30 times in a row. [That’s a 1-in-a-billion probability.] What are the odds if I flip it again I’ll get tails?

Tony: Zero.

Vinnie: Nope. It’s 50:50 odds.

Tony: It’s zero. The coin is rigged.

Vinnie: I said the coin was legitimate.

Tony: You lied.

I don’t know what went wrong with their data, but somebody lied. The other maxim is that when data deviates from your model by six standard deviations, it’s time to get another model (said in the voice of Bullwinkle Moose.) A more thoughtful analysis says that the ice got pushed by high winds poleward, causing the mass to remain constant, but the thickness change went undetected.60 It still seems like 1-in-a-billion probability that the climate scientologists inadvertently failed to account for ice thickness, so I am going with, “you lied.”

Opposition

The overwhelming impression conveyed is one of impending disaster riding in on the menace of global warming.61 The U.N. Secretary-General António Guterres refers to it as “global boiling.”62 Could you be anymore hyperbolic than that, Tony? I pay attention to prominent climate deniers if for no other reason than to feel like one of the cool kids. And I am seeing more and more papers challenging the climate clowns continue to surface. (I suspect the horrific performance of the scientific community’s handling of Covid might be growing some spines.) I find it especially encouraging there were some interesting cameo appearances by those willing to ponder alternative narratives.

-

Outspoken climate change expert and critic, Roger Pielke Jr., called it “one of the most egregious failures of scientific publishing that I have seen” when a top academic journal retracted published research doubting a climate emergency after negative coverage in legacy media.63

-

I had been waiting for Bret Weinstein and Heather Heying to take a stand on climate change. While not prominent scientists in the usual sense, they are fearless and pedagogically brilliant. I was not disappointed as they tore at the scientific adipose hanging off the narrative.64 I tried to get Joe Rogan to take it on a few years back, but he balked and replied: “Is this anything you’ve ever spoken about publicly? It’s such a land mine discussion.” Getting on a Rogan podcast is my Holy Grail.

-

The winner of the 2022 Nobel Prize in Physics, John Clauser, joins a long list of elite physicists calling bullshit on climate change.65 His big gripe is the total failure to account for clouds, which are estimated to be 200 times more important than CO2,66,67 noting that many are proferring “very dishonest information” and are guilty of “breaches of dishonesty.” “We’re talking about trillions of dollars…powerful people don’t want to hear that they’ve made trillion-dollar mistakes.” Of course, the climate community jumped on him immediately, noting he was just another old, white physicist who is not a member of The Cult. Once his views on climate change went viral, his scheduled talk at the International Monetary Fund was cancelled.68

-

A prominent climate scientist named Patrick Brown wrote an op-ed about the amount of bullshit he recently had to sling to get a climate change paper published in the elite journal, Nature.69,70 He admits to the hyperbole, omission of less flashy details, and focus on the flashy and spectacular parts necessary to “publish or perish.” It was a refreshingly honest confession, but as a 20-year veteran journal editor, I am unconvinced he understood the magnitude of the fraud he committed. He left academia a year ago “partially because I felt the pressures put on academic scientists caused too much of the research to be distorted.” He may have inadvertently left the publishing world altogether and maybe his current job too.

-

John Stossel interviewed Judith Curry.71 as part of her book tour.72 Judith was an elite climate scientist who broke from the narrative and was left to scientifically die on a (melting) ice flow.

-

Berlin voters appear to have had enough green activism, voting 82% to bag the idea of attaining Net Zero by 2030.73

-

Senator John Kennedy (R, Louisiana) hammered two cluelessness climate experts who were promoting tens of trillions of dollars in spending to repel global warming.74 They had no idea what would be done, the cost, and the effect. They were also incapable of predicting what the big polluters—China and India—would be doing during our period of great sacrifice.

-

The Climate analog of the Great Barrington Declaration—a petition to declare climate change is not an emergency—was passed around to carefully vetted elite scientists. It got over 1,800 signatures, including mine.75 (OK. Maybe not “elite” but carefully vetted.) I know names that are not there that should be, so this is a work in progress.

-

A University of Chicago poll shows that the belief in the climate narrative has slipped from 60% to 49% in the last five years. A more global poll showed 40% now believe the changes are natural.76 “The ‘official narrative’ on man-made climate change has been vehemently amplified by every single major government entity, corporation, media outlet and cultural institution in existence.”76a I’ll repeat, overplaying Covid and the vaccine may have come at a considerable loss of scientific credibility. How does the scientific community get its credibility back? Simple: stop lying your fucking asses off and clean the charlatans out of the field. Otherwise, GFY.

-

Fed Governor Christopher Waller has dared to proclaim that climate change does not pose “significantly unique or material” financial stability risks that the Federal Reserve should treat it separately in its supervision of the financial system. “Climate change is real, but I do not believe it poses a serious risk to the safety and soundness of large banks or the financial stability of the United States…I believe risks posed by climate change are not sufficiently unique or material to merit special treatment.”77

-

Michael Shellenberger, famous conservationist turned climate denier, testified to Congress this year on media censorship78 and gives brilliant talks about third rails.79,80

Conclusion

While Greta was faking arrests81 in a vain attempt to keep her carbon footprint well-funded and the fact-checkers were busting keyboards protecting her legacy, the globalists pushing the climate narrative for fun and profit appear to be replacing Greta with Stanford student Sophia Kianni as the face, voice, and physique of the climate movement.82 It is a tactical mistake, in my opinion, but I can see serious merits—an activist with benefits

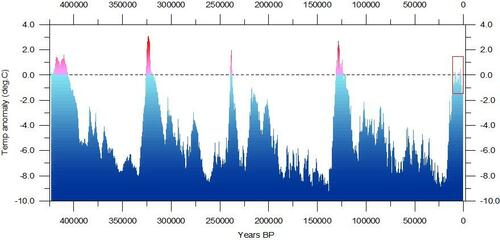

In moments of maximum frustration, I take an alternative approach by suggesting to my unsuspecting victims (formerly called friends) that we accept the climate predictions and ask, Do you really think you can see evidence of climate change by looking out the window? If the temperature is rising at some fraction of a degree per year, does the fact that your’s or Sophie’s ass was dripping sweat last summer tell you anything? (Is it getting warmer or is that just me?) Can you see where that heat spell in your hometown would fit on this long-term plot? See that flicker at the end? That is us emerging from what is referred to as “the Little Ice Age.”83

Weber’s law states that the change in a stimulus that will be just noticeable is a constant ratio of the original stimulus. It has been shown not to hold for extremes of stimulation.84

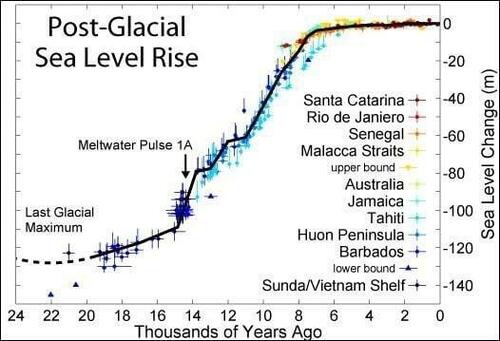

And if the sea level is rising 3 mm per year (which it has been doing for almost two centuries85), can you see it in the floods near your house? Can you see it in the chart below?

Deaths Caused By Hurricane Hillary To Be Labeled Suicides.

~ Babylon Bee

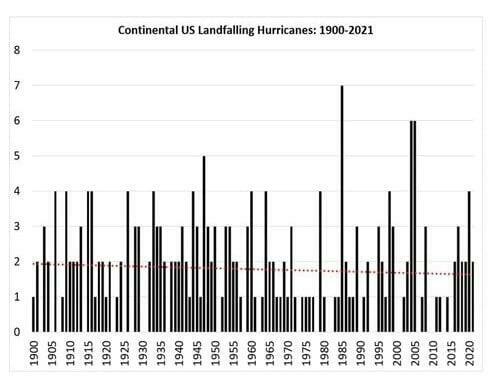

Will your beach house still be there in 50 years even if the sea level is not rising at all or hurricanes are not more frequent? Speaking of which, can you see the marked increase in hurricanes that is so obvious to Cultists and fear-mongering pundits?

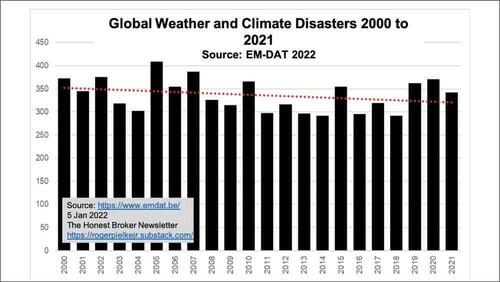

Finally, can you really detect the ramping up of natural disasters in general?

If you answered yes to any of those questions, get your urologist to check you for kidney stones, breed with flat-headed hobbits, and buy a Tesla. The only electric vehicle that I would ever consider owning would be a two-seater with drink holders and room for two sets of golf clubs on the back.

Let me close this chapter on a somber note. I used to think the climate cultists were comical, but their prevalence stems from a much deeper, darker plot playing a central role in rising neo-Marxism and authoritarianism. The globalists will be monitoring and curbing your carbon footprint while the bankers and the techies consolidate an increasing percentage of the global wealth.86 The merging of corporate and government interests is the definition of fascism. Despite a noticeable stalling this year, Environmental, Social, and Governance (ESG) scoring will be used to allocate bank credit only to the politically correct and connected. The bankers are telling corporations to “get woke or go broke.” You will either toe the line—endorse the narrative—or lose access to the banking system.87 Hey Larry Fink: GFY.

Brandon Smith88 via Zerohedge89 noted that French President Emmanuel Macron says “the world needs a public finance shock” to fight global warming, noting the “the spiraling cost of weather disasters intensified by global warming”—a claim unsupported by any hard data—”is destabilizing.” Another globalist chimed in: “What is required of us now is absolute transformation and not reform of our institutions.” UN leader Antonio Guterres suggests tackling climate issues would “take a giant leap towards global justice.” Of course, trillions of dollars of “emission taxes” are locked and loaded for redistribution. The most authoritarian “Central Bank Digital Currencies” will be central to the globalists’ coup.

Farming needs to stop because it is the biggest driver of climate change.

~ Young man on the street displaying the IQ of a walnut

There is a war on farmers couched in the language of climate change. Farmers in Ireland and in Northern Europe have been nearly destroyed by the War on Farmers90,91,92 as brilliantly laid out by the Epoch Times.93 The claim is that farmers are creating nitrogen pollution from all that fertilizer. That is total horse shit. This thinly veiled authoritarian move superficially centralizes food production but also strips away farmland and slashes food production for reasons I cannot yet grasp. (One theory asserts that major tracts of farmland are being flushed free of farmers to make way for “smart cities.”)94 This “eating bugs” bullshit may be true, but it is also a distraction. The too-big-to-fail banks are already lining up to tell us what we can eat by controlling the money used to purchase food.95 John Kerry says that “food and agriculture can contribute to a low-methane future by improving farmer productivity and resilience,” but he is a clueless liar.96 Gates is the largest owner of farmland in the US, but I cannot yet grasp what evil lurks in the skull of this Club of Rome eugenicist by birth and by actions.97 I wrote dozens of pages on rising authoritarianism back in 2021 (pg 242).98 It is coming faster than I thought.

Let’s redo that and finish on a positive note. Here is the transcript of a compelling speech given to the Oxford Union by brilliant political satirist, Konstantin Kisin, who I had the extraordinary pleasure of sitting down for a chat this fall. I would have led with the speech, but it renders my analysis unneeded. I recommend listening to it,99 but here is the transcript. What is extraordinary is that I did not have to clean up the grammar, only add punctuation. He talks like this.

Konstantin Kisin Oxford Union speech:100

I want to talk to those of you who are woke and who are open to rational argument, a small minority I accept, because one of the tenets of wokeness, of course, is that your feelings matter more than the truth, but I believe in you. I believe there are those of you here who are woke, who are open to rational arguments. So let me make one. We are told that your generation cares more than any other about one issue in particular, and that issue’s climate change. We’re told that many of you suffer from climate anxiety. You wish to save the planet and, for tonight and tonight only, I will join you. I will join you in worshipping at the feet of Saint Greta of Climate Change.

Let us all accept right here right now that we are living through a climate emergency, and our stocks of polar bears are running extremely low. I join you in this view. I truly do. Now what are we to do about this huge problem facing humanity? What can we in Britain do? We can only do one thing. You know why? This country is responsible for two percent of global carbon emissions, which means that if Britain was to sink into the sea right now it would make absolutely no difference to the issue of climate change. You know why? Because the future of the climate is going to be decided in Asia and in Latin America by poor people who couldn’t give a shit about saving the planet. It’s going to be decided by poor people in Asia and Latin America who don’t care about saving the planet. No thank you. No thank you. You know why? Because they’re poor. Because they’re poor. I come from Russia, which is not a poor country. It’s a middle-income country.

Twenty percent of households in Russia do not have an indoor toilet. What they have is an outdoor toilet, and I don’t mean one of those nice porta loos that we get here. I don’t even mean a Glastonbury porta loo. I mean a wooden shack with a hole in the ground. The hole’s a collected fermented memory of the last 10,000 visits. How many of you are going to go home tonight and say, “Let’s rip out our bathroom and erect a Siberian shithouse in the back Garden”, and if you’re not why should they? 120 million people in China who do not have enough food? I don’t mean that they don’t get dessert. I mean they suffer from malnutrition; that means that their immune system is breaking down because they don’t have enough food. You’re not going to get them to stay poor.

Imagine Xi Jinping, the leader of China. When you were ten years old there was a revolution—a cultural revolution in your country—and people came, and they threw your father in prison, your mother had to denounce him, your sister killed herself, and you, no longer enjoying the protection of your formerly powerful father, were sent to a village where you lived in a cave house. And here you are decades later; you have clawed your way up the bloody and greasy pole of Chinese politics to be the undisputed supreme leader of the very Communist Party that destroyed your family, and you know that the main thing you have to do to survive and to stay in power is to deliver the one thing that the people of China want: prosperity—economic growth. Where do you think climate change ranks on XI Jinping’s list of priorities? A third of all children who live in extreme poverty in the world live in India. That means they are starving and dying of preventable diseases now.

Now about 15 months ago my wife got pregnant—not me, because we’re old school—and for nine months we talked about what our boy would look like, what he might do when he grows up. We looked at baby scans and videos on YouTube about what the fetus looks like at nine [weeks] and 12 [weeks] and 20 [weeks] and eventually he was born, and he is this cute little bundle of joy. He’s cuter than about eighty percent of puppies, right? Now if you said to me that I had a choice: either my son had a serious risk of starving or dying from a preventable disease in the next year or I could press a button and he would live, he would go to school, he would bring his first girlfriend home, he’d go to university and graduate and become a woke idiot. And then he’d get a job and get married and have children and become a man. But all I have to do is press this button and for every day of my son’s life, a giant plume of CO2 is going to get released into the atmosphere. Now you’re all very young, and most of you are not parents. Let me tell you something: there is not a parent in the world who would not smash that button so hard their hand bled. You are not going to get these people to stay poor. You’re not even going to get them to not want to be richer.

And so I put it to you, ladies and gentlemen: there is only one thing we can do in this country to stop climate change, and that is to make scientific and technological breakthroughs that will create the clean energy that is not only clean but also cheap. And the only thing that wokeness has to offer in exchange is to brainwash bright young minds like yours to believe that you are victims, to believe that you have no agency, to believe that what you must do to improve the world is to complain, is to protest, is to throw soup on paintings. And we on this side of the house are not on this side of the house because we do not wish to improve the world. We sit on this side of the house because we know that the way to improve the world is to work, is to create, is to build, and the problem with work culture is that it has trained too many young minds like yours to forget about that.

Thank you very much.

[loud applause]

News Nuggets

I love collecting news nuggets that tickle my fancy. They are usually a tad edgy. I was torn about whether to include them in part 2 on the logic that they are really part of the year being reviewed or holding them until the belated part 3, when sorting through more notes is likely to dredge up more human folly. I’ve chosen the former.

Nuggets are presented randomly as follows:

-

A Chinese weather balloon flew across the country while people were mesmerized at how stupid we are. Seems likely that the entire story is slathered with bullshit. In an effort to regain public confidence the military shot down a kid’s high school science project,1 prompting Eddie Snowden to muse, “please tell me the white house did not spend the month of february scrambling jets to fire $400,000 missiles at the local hobby club’s TWELVE DOLLAR BALLOON.”

-

A 22-foot submarine taking tourists to the Titanic disappeared with all those onboard, which included the CEO of the OceanGate, the modern era’s Davy Jones. He didn’t want to hire “50-year-old white guys” noting that, they weren’t “inspirational” and that “anybody can drive the sub.” Although that was a bad call, Mate, at least you were politicaly correct.2 Titanic director James Cameron, who visited the Titanic 33 times onboard a submersible, suggested this was pretty stupid.3

-

As Elizabeth Holmes of Theranos infamy struggled to stay out of prison we discovered her deep throaty voice was also faked.4,5 An excellent Holmes imitation surfaced.6 I still wonder if Cristine Blasey-Ford’s squeaky voice was real.

-

Sam Bankman-Fried, also known as Sam Bankrupt-Fraud or SBF for short, founder and destroyer of the FTX Crypto Exchange, was looking at serious jail time because he “misappropriated billions of dollars in customer money, defrauded investors, and violated campaign finance laws.”7,8 (This was covered in detail in the 2022 YIR.9) It should come as no surprise as the second biggest Democrat donor in the 2022 midterms and money launderer of Federal funds through Ukraine for the DNC that he is shedding charges faster than Hunter Biden (especially all campaign finance charges.10) A ruling in the Bahamas appeared to allow him to challenge the rest11 and even get his legal fees reimbursed.12 FTX hopes to restart its crypto exchange in 2024.13 He got some convictions and we await sentencing.

-

As many of you may recall, Paul Pelosi got hammered at the end of 2022. I would get hammered if I were married to Nancy, but this was by an assailant under highly suspicious circumstances delineated in the 2022 YIR. In 2023, the video of the incident surfaced.14,15,16 One is struck by two details: (1) it took long enough that one could fathom that the video was staged; and (2) while getting whacked with a hammer as the cops entered the Pelosi house, Paul did not spill his drink. Bravo! Nancy magnanimously noted that the assailant “has the right to a trial to prove innocence”, prompting Ben Shapiro to note “Uh it’s…innocent until proven guilty.”

-

In 2020, I took a risky tact by laying out why convicting Derek Chauvin for the murder of George Floyd could be tricky because I thought the evidence was strong that Floyd died of an overdose. Well, I was wrong on two counts. The obvious one is that they convicted him. The less obvious is that according to the expert witness in the civil trial—a doc with considerable experience in treating this type of problem—said that Floyd definitely did not die from an OD or the knee on his neck, but rather two knees on his back. The owners of those knees got some time but nothing like Derek. Curiously, that obscure doctor would become rather famous in his views on Covid: it was Pierre Kory.17 Chauvin got stabbed over 20 times in prison this year. The surprising parts are that he lived and that the assailant was an FBI informant.18 Chauvin is appealing his conviction.19

-

Hobbyhorsing is claimed to be an environmentally friendly and much cheaper sport than equestrian events. “The main difference from equestrian sport is the replacement of a live horse with a plastic one.” Finnish teenagers who started this grueling sport hope to make it an Olympic event.20 The Canadians are considering it to train their Mounties.

-

Teenagers who took to swallowing Tide Pods have discovered they were gateway drugs to Benedryl—the “Benedryl Challenge”—to “trip their asses off.”21 It would be safer to vaccinate.

-

The train wreck in East Palestine dropping car loads of vinyl chloride caught the world’s attention and became clickbait for the ages. Attempts to block reporters from on-site coverage brought up first-amendment issues.22 There is no question that East Palestine has a problem—they are now a toxic waste dump23—but the horrors of it being a widespread catastrophe24 were put to rest by an analysis from blogger Doomberg noting that the hyperbole was over the top.25 I know who Doomberg was in his previous career and can say that nobody is more qualified to make such an assertion. The RNC Twitter feed turned it into a daily tally of the days since Biden did not visit the site. It is not obvious to me that is in his job description. The Babylon Bee wryly noted that Ilhan Omar withdrew her support of East Palestine after discovering it’s in Ohio.26

-

Mosquitoes were in the news. Four people from Sarasota, Florida got malaria. No biggie. It’s easily treated. On a more somber note, scientists concluded they can solve this problem by releasing mosquitoes genetically engineered to cause death in the female offspring to reduce the malaria risk.27 I went through the math and believe that the technology will not just cull the population but necessarily cause that particular species to go extinct. Of course, there are 3,500 more species of mosquitoes, but somehow, yet again, scientists appear to be underestimating the consequences of their interventions. This Michael Crichton talk is a phenomenal tutorial on why it is not nice to mess with Mother Nature.28 One scientist noted that “there is little doubt their full extinction could have indirect effects.”29

-

176 pound, 5’ 5” Deuce Vaughn was drafted by the Dallas Cowboys in the sixth round. Recall that other loser, Tom Brady, went in the sixth round. The Deuce is Loose and jersey’s with the Galloping Toddler’s name and #42 were moving even faster. So far, The Deuce is not pummeling opposing teams, racking up 68 total offensive yards.

-

‘Super Pigs’ are coming south from Canada.30 They are a cross between domestic pigs and European wild boars, weighing up to 600 pounds. They are said to be meaner than Canadian hockey players and more intelligent than the boneheads who created them.

-

It leaked out that Ebay ran a formal harassment/death squad to deal with news site founders who were not friendly to Ebay.31,32 Kinda makes you wonder what they were selling on Ebay.

-

A Delta flight spent 3 hours on the Arizona tarmac without air conditioning.33 Passengers were told they could leave but might not get to their destination for days. Paramedics wheeled three out on gurneys. Delta came clean with a mea culpa: “We apologize for the experience…which ultimately resulted in a flight cancellation.”

-

Baron Trump is now 12 feet tall.

-

John Lennon’s assassin, Mark David Chapman, is now suspected to have been innocent.34 It was similar to RFK’s argument as to why Sirhan Sirhan could not have killed his father.35 It has the fingerprints of the CIA’s notorious mind-control program MK-ULTRA and its legion of psychiatrists all over it. They create patsies.

-

Michael Block became the only club pro in history to make the cut in the PGA Championship.36 Entering the final round in eighth place, he slipped up but then dropped an ace on 15, finishing high enough to make $300,000 and an automatic qualification for next year.

-

Speaking of golf, the Saudis have set up the LIV Tour and have been buying up exclusive rights to some of the best players with petrodollars. Desperate PGA execs were squealing about the Saudis’ human rights violations. Discussed mergers of the two leagues were sketched out in which the PGA would be in charge of holes 1-8 and 12-18 with the Saudis responsible for 9-11.

-

Tennis phenom Novak Djokovic won the U.S. Open after being banned because he was unvaccinated by beating another unvaccinated player. ESPN’s “Shot of the Day” was sponsored by Moderna.37

-

A historically literate 12-year-old kid was suspended from school for wearing the Gadsden flag from the Revolutionary War—”Don’t tread on me.”38 The school said it has “origins with slavery,” which is a claim completely void of facts. The kid looked smug even by teenager standards. Mom showed she shouldn’t be treaded on either…as did the Colorado governor and the Heritage Foundation. He should have worn a Che Guevara T-shirt. It kept the Twitter Memosphere active for days.

- After a spectacular performance of providing four of the most illustrious anti-Fauci/anti-lockdown/anti-vaxxers on the planet—Jay Bhattacharya, Scott Atlas, John Ionnides, and Victor Davis Hanson—in 2021, Stanford regressed to the mean. Their president was brought to his knees by a diligent freshman newspaper writer calling out fraud.39 At least he left before he could come under scrutiny of Congressional testimony about Hamas. Their entering class of neurosurgical residents managed to have no white men (outdoing the NBA), representing either great progress of the underrepresented or improbable discrimination.40 The Stanford Law School invited an elite judge to speak and then managed to humiliate themselves by denying him the right to speak with one of their deans leading the charge.41 You’d think the law school would teach about the Constitution. This is all coming on the heels of Stanford faculty members’ role in the 2022 FTX collapse42 and epiphanies that Stanford’s Internet Observatory is a CIA outpost and hub of censorship.43 There are more problems at Stanford delineated here.44

Historically, the claim of consensus has been the first refuge of scoundrels; it is a way to avoid debate by claiming that the matter is already settled…There is no such thing as consensus science. If it’s consensus, it isn’t science. If it’s science, it isn’t consensus. Period.

~ Michael Crichton

-

Neil DeGrasse Tyson tried to take over Stanford’s dominant lead single-handedly by taking on Del Bigtree on the vaccine debate and getting annihilated as he preached to Del about consensus science.45 In another podcast, he banged out support for transgender going against Michael Shermer, trying to make scientific arguments and arguing that separating boys and girls will “seem silly in the future.”46,47,48 Consensus—there is that word again—is that Neil’s brush with multiple accusations of inappropriate behavior some years back has put him over a barrel.49,50,51 I root for the guy because I think he does a great service, but he should stop digging.

-

The world’s smallest “Louis Vuitton” handbag just sold for $63,000 at Sotheby’s. It is 0.66 x 0.22 x 0.7 millimeters. It is not actually by Louis Vuitton. The NFT sold for almost twice that but is now worth zero.