Authored by Paul D. Thacker via The Disinformation Chronicle,

Some of the shine on the disinformation industry has gone dull in recent years, as many misinformation experts having been caught trafficking in misinformation themselves, or exposed for their ties to intelligence agencies. This should not come as a shock.

It’s a basic tenet of “mirror politics” and practitioners of propaganda to accuse others of the very same actions they plan to commit.

In late 2018, the New York Times and Washington Post reported on a leaked document discussing a secret project by Democratic Party operatives that falsely accused Republican candidate Roy Moore of support by Russians, while he was running in a tight race for the Senate in Alabama. The scheme linked the Moore campaign to thousands of Russian accounts on Twitter and drew national media attention.

“We orchestrated an elaborate ‘false flag’ operation that planted the idea that the Moore campaign was amplified on social media by a Russian botnet,” the New York Times reported that the leaked documents stated.

The documents linked a relatively unknown company called New Knowledge to the Alabama disinformation campaign, although New Knowledge’s chief executive Jonathon Morgan said the company was not involved, and he worked on “Project Birmingham” in his personal capacity. Morgan also reached out at the time to Renee DiResta, a self-styled expert on disinformation, who told the New York Times she disagreed with such tactics, and later joined New Knowledge sometime, but only after Project Birmingham ended.

New Knowledge later changed names to Yonder, while DiResta joined Stanford University as an expert in disinformation. However, New Knowledge could not stop landing in the media spotlight.

In early 2023, journalist Matt Taibbi released a “Twitter Files” drop about “Hamilton 68,” a public dashboard created by New Knowledge. Hamiton 68 tracked hundreds of Twitter accounts to monitor the spread of purported pro-Russian propaganda online, but screenshots of emails sent by former Twitter executive, Yoel Roth, voiced alarm that the dashboard was creating, not tracking disinformation.

“I think we need to just call this out on the bullshit it is,” Roth wrote.

The “Hamilton 68” dashboard had spurred dozens of stories in major media outlets that accused conservatives of trafficking in Russian disinformation, but when Twitter looked into the dashboard’s accuracy, they found it was garbage in, garbage out.

Former FBI counterintelligence official Clint Watts headed the Hamilton 68 dashboard and Jonathon Morgan of New Knowledge had helped to build it, along with J.M. Berger at the Alliance for Securing Democracy (ASD), housed by the German Marshall Fund.

“No evidence to support the statement that the dashboard is a finger on the pulse of Russian information ops,” one Twitter official wrote of Hamilton 68.

The internal Twitter emails were so damaging that the Washington Post later posted corrections to multiple stories that reported on Hamilton 68 and its findings.

But every story about disinformation elites caught creating disinformation contains critical missing facts and minor elements of disinformation planted by the very experts being exposed. New Knowledge is no different.

Starting a month ago, I began discussing what the media got wrong about New Knowledge and Hamilton 68 with Betsy Dupuis, a former New Knowledge employee who worked on Hamilton 68. Dupuis tells me she was fired from New Knowledge after expressing misgivings upon discovering the company that branded itself “the world’s first platform for defending online communities from social media manipulation” was itself engaging in blatant social media manipulation.

To back up her claims, Dupuis provided internal documents and photos from her time at New Knowledge, as well as screenshots of texts messages. Some of those we are publishing today.

New Knowledge poached Dupuis from another company and set her to work improving the Hamilton 68 dashboard, which was planned as a product for groups aligned with the Democratic Party. The development was underwritten with a year of funding by the Center for American Progress, a think tank and lobby shop run by party political operatives.

Dupuis says she enjoyed her work updating Hamilton 68, but she became concerned when people in the office discussed the “Alabama Project” and she began wondering if this had anything to do with Roy Moore, a Republican candidate running for Senate. When she had joined the company, Jonathon Morgan had assured her that New Knowledge would only monitor, never create disinformation.

But then several former employees from the National Security Agency (NSA) joined New Knowledge.

Out for company drinks, former NSA employees explained to Dupuis how agencies get around federal laws that ban the U.S. government from spying on and censoring Americans: they contract with companies like New Knowledge to do their dirty work. By the time New Knowledge announced they had secured a Department of Defense contract to create automated disinformation, Dupuis had had enough.

She met with Jonathon Morgan to discuss her concerns and was fired days later.

Speaking with me from her home in Austin, Dupuis says that neither Jonathon Morgan, nor Stanford’s Renee DiResta have come clean with journalists about what happened in Alabama to create disinformation during an American election. But she says she is tired of being scared and the time has come for her to speak up. “Silence doesn’t buy you safety, Dupuis says. “People will still come after you because of what you know.”

“I just kept quiet, until now, because I didn’t want to be accused of spreading a conspiracy theory,” Dupuis tells The DisInformation Chronicle. “After I was fired, I was just like, ‘You know what? This is so crazy. Nobody's ever going to believe me. I'm never going to talk about this again.’”

Jonathon Morgan did not return multiple requests for comment sent to his current job and personal cell phone number. This interview has been condensed and edited for clarity.

* * *

THACKER: What caused you to get fired at New Knowledge?

DUPUIS: When they hired me, they said that we would never do disinformation. And I felt the grounds I'd been hired on had been violated. So I went to Jonathon Morgan, who was the CEO. I had a good relationship with him, or at least I thought I did.

I told Jonathon, “Hey, this is unethical. I'm concerned about this.”

I knew there were other people who were also concerned, very disturbed about what was going on, but I didn't bring them up.

I told Jonathon, “You said we would track disinformation, but we wouldn't do disinformation.”

And he told me, “If we don't do it, somebody else will.”

Which sounds like a very classic James Bond villain. What a great way of revealing your evil plan.

THACKER: This conversation happens on a Friday, night. Then what happens to you on Monday?

DUPUIS: Well, I went home, and at this point, I really didn't want to work there anymore. I had already been talking to friends about this, and I went out to the lake with a friend.

I got a message from Sandeep Verma that I needed to come in at—I think it was 8 a.m.—which is really early in tech time. This was very confusing, so I asked if they wanted to do it remote, but I was told I needed to come in early on Monday.

They had hired this really young women to be, I think it was VP of Marketing, but also HR. She was a nepo baby: her parents had given her a bunch of money to start a fashion line that failed. And now she's an executive at my tech company.

She and Sandeep are there, and Sandeep… I don't know, he was trying to look really positive, but he looked sad also.

He said, “We're letting you go. We no longer need the position. We're going to give you a month severance if you sign this NDA.” I had to sign the NDA right there on the spot, before I left, or else I wouldn’t get severance.

I told him, “I left another job to come to this company.” He said he knew, and then I signed it and left. If they want to come after me for doing this interview, I was coerced to sign the NDA.

I felt pressured to sign it. I didn't really have a choice because of how insane things were. What am I supposed to do? Not take the severance, and not be allowed to collect unemployment because I refused to sign their agreement and then maybe tell people that there's a conspiracy going on.

THACKER: Right?

DUPUIS: What happened was so crazy. Things that people would not believe is true.

DUPUIS: I'm mid-thirties, so that puts me smack dab in the middle of millennial territory, and I grew up with internet. I was one of those kids that learned to make their own web pages and interact with the internet even before Myspace.

THACKER: When I started at UC Davis in 1994, that was the first year that University of California students were required to have an email. I learned how to type having discussions on a UC Davis chat group.

When people started to come out with this idea, about seven years back, that they had discovered there was “disinformation” on the internet, I was like, “Wait, I've been on the internet for decades. From the very beginning I saw people behave like assholes and throw crap up on the internet.”

DUPUIS: Well, there was this progression from “Do not use anything from the internet for any paper; it has to be from Ebsco or Britannica. Some trusted encyclopedia.”

You were supposed to vet sources. Now with Gen Z kids, they don't even know what plagiarism is.

THACKER: So you started off at around age ten. You're on the computer, but it was still kind of a thing for weird dudes in the basement.

DUPUIS: I kept it kind of a secret, and then MySpace came out when I was in high school. But the internet was still for nerds. I gave up pursuing a career in programing because my parents had read a bunch of articles in newspapers saying that the internet was a fad.

THACKER: But you still got involved.

DUPUIS: I got into photography in high school, and I started shooting for iStockphoto which was an early internet start-up in online stock photography. Before them, you had to order a stock photo catalog.

I was doing work for them when I was teenager making like $1,000 a month, which for a high school kid is a hell of a lot of money. I could rent an apartment $300 at the time. I thought this is going to be my job. And then the stock market crashed in 2007 and everything went away.

So, I went to college and studied art, and when I graduated the market still really sucked.

I went to go visit some friends during South by Southwest—the big music festival in Austin—to see about jobs and opportunities in 2012.

I was like, “I’m moving here.” I was kind of homeless for about a year, worked for a few random start-ups, and became part of this industry.

THACKER: But then you land your dream job at New Knowledge.

DUPUIS: I would not say it was a dream job. I was really skeptical of this company to begin with.

THACKER: You’re this young woman working in the tech industry in Austin. Why New Knowledge?

DUPUIS: I was at an oil and gas data analytics company that owned some old data sets which are very valuable. My title was software engineer, but I was working mostly as a designer, building the front end of the software. I was designing a dashboard that allowed you to build reports and interface with their data. It wasn't super advanced stuff.

It was fine, but then New Knowledge reached out to me on Angel List and, when I met with them, they were immediately ready to hire me.

I think New Knowledge was interested in me because, “Oh, you can do some of the programing, but then you can also know how data works and can do the data visualization stuff.”

I think that's what I was qualified to do for New Knowledge, but I wasn't really qualified to do this disinformation stuff.

THACKER: Did you research them to find out what they were all about?

DUPUIS: I'd never heard of them before and the politics they were involved in. My way of looking into politics was going on Facebook and subscribing to every spectrum of political ideology: Democrat, Republican, Libertarian, Green Party, whatever. I just read whatever because I wanted to see what everybody was thinking.

Politics was not a big deal to me, but I would casually absorb things. I knew that Russian disinformation was in the news, and stuff about Trump.

THACKER: Of course, you knew about Russian disinformation and Trump, because that's all the media wrote about for four years.

DUPUIS: Yes. But it wasn’t something I really followed. I just wanted to have intelligent conversations about what was in the news.

New Knowledge told me they do all this stuff with disinformation. Jonathon had some State Department role under the Obama administration. Sandy was a friend from high school or something from their time in Houston. He was the Chief Technical Officer (CTO.) I guess you know how that works, right?

THACKER: Well, no. From what I understand about the tech industry, people get these jobs they’re not really qualified for, but they know someone, or have some weird skill that nobody else has in the office. The programming guy who likes talking to people can suddenly become head of marketing.

I get the sense that titles are very nebulous in tech start-ups.

DUPUIS: Sandy had a degree, and I think he was serious about being a tech guy. But I don't think he had the work experience to be a CTO. But that's often the case at start-ups.

They told me about their funding and trying to get all these contracts with companies that were doing this disinformation thing. I had a vague idea about this stuff from what I was reading about Trump and just from being online for so long.

People make stuff up.

But they said they were going to build this AI tool and I was kind of skeptical.

I previously worked at a company that had done some AI thing back in 2013. A lot of times people tell you they have artificial intelligence to do some chore, but it’s really just a bunch of humans doing all the work. Which is really expensive.

Eventually, you get found out

THACKER: There’s a lot of nonsense and pretense in tech. Amazon dropped their "Just Walk Out" AI technology which automated what you bought. It was really just 1,000 workers in India acting as remote cashiers.

DUPUIS: These companies pretend to have computer automated intelligence, but it's a sham. Real people do the work it because they don't know how to make software good enough to automate the task.

So I was a little bit skeptical of that, but they had all these PhDs so maybe they could make it work. I asked, “Hey, will you guys ever want to do disinformation?”

And they said, “No, it's completely against our ethics.” I also asked if they were only going to point out disinformation whenever Republicans do it, or when both sides do it.

And they said, “We're bipartisan. In fact, we have Republicans that we've worked with for a long time.”

THACKER: How was their business set up? Who was funding them?

DUPUIS: DARPA. Jonathon had gotten his seed money from DARPA, and he had actually been through several iterations of trying to get the company off the ground. Apparently, a whole other set of co-founders had left the company. I can’t remember why.

He had a podcast called Partially Derivative and some nonprofit organization called Data for Democracy.

There was a weird thing with people in the office, people that weren't in the office, people working as contractors. Some of the contractors had this aura around them. The same as what I've heard of Renee DiResta: “We're just really passionate about disinformation!”

One contractor was just involved in building scrapers.

THACKER: Explain what scraping means. I think it means an automated system to go out and collect or scrape data off the internet, instead of doing it manually.

DUPUIS: Instead of having a person go and copy/paste everything from a website, you use a computer that collects all the data.

I knew someone who had a scraping company that the State Department, FBI and other agencies use, and they could have saved a lot of money using him. Instead, they hired this contractor to learn how to scrape Twitter.

Twitter kept denying New Knowledge access to scrape, because it costs them money when you’re pulling too much data, and they didn't have an established partnership. New Knowledge was using a lot of their bandwidth.

THACKER: Tell me about working on the Hamilton 68 disinformation dashboard.

DUPUIS: We eventually had a meeting with J.M. Berger with the German Marshall Fund. There were other people on the Zoom, but the German Marshall Fund had done this dashboard and I was supposed to redesign it.

It was ugly and looked like a programmer designed it. I was supposed to repackage it into a better dashboard and allow them to sell that as a product. They were going to sell it to the Center for American Progress.

THACKER: Just to let readers know, the Center for American Progress (CAP) is a Democratic Party think tank and lobby shop. They're most famous for being the ones who basically ran Hillary Clinton's campaign in 2016. Simon Clark is a former member of CAP who now chairs the Center for Countering Digital Hate, a bogus “disinformation group” that works closely with the Biden Administration.

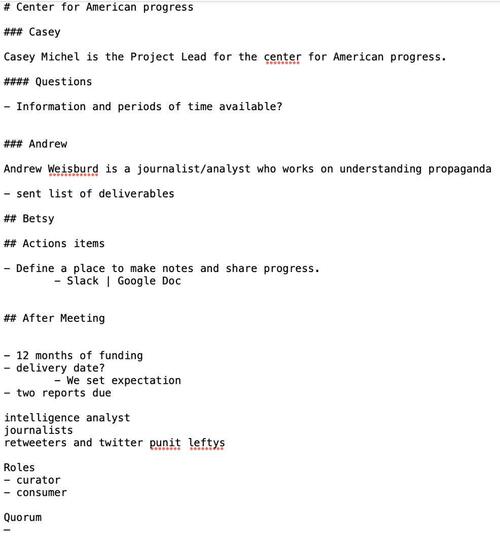

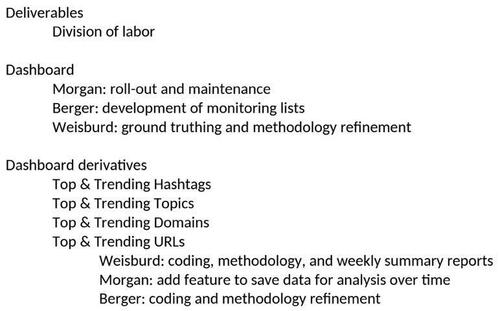

According to your notes from the time, the lead on this dashboard redesign at CAP was Casey Michel, who worked at their news site, Think Progress. Another was Andrew Weisburd, who was working at the German Marshall Fund and is now at Microsoft’s Threat Context.

And in the dashboard deliverables you were given, it says that J.M. Berger, who also had ties to the Brookings Institute, was developing the communities or lists of people to track.

What did the German Marshall Fund want you to make better?

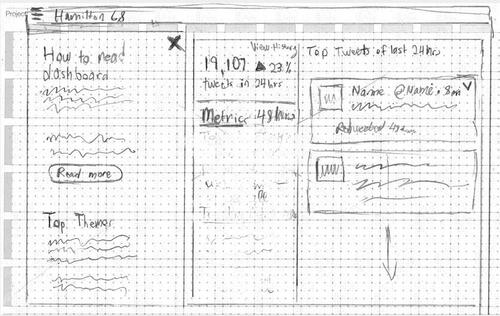

DUPUIS: The dashboard was called Hamilton 68 because it had something to do with Alexander Hamilton, some paper he wrote, or something esoteric. You know how people name something after some esoteric fact to make it sound important?

THACKER: Right.

DUPUIS: The German Marshall Fund owned Hamilton 68, which was something Jonathon Morgan had built for them. I think with his previous business partners.

J.M. Berger was there because he was somehow involved with the Center for American Progress getting their own version. They were going to launch it on Think Progress, which was CAP’s news organization, but is now defunct.

I wrote specifically in my notes that Center for American Progress was giving us 12 months of funding. I don't know what that meant in terms of actual money.

THACKER: I’m gonna guess that Center for American Progress won’t tell me how much funding they were putting out for this. (The Center for American Progress did not respond to questions asking how much money they provided to upgrade Hamiltion 68 and whether they still use the system.)

DUPUIS: My job was to take Hamilton 68 and repackage it with a better design. I think I did a good job of it.

THACKER: What did this upgraded Hamilton 68 allow them to do?

DUPUIS: They could observe emerging trends on Twitter, trending hashtags, trending topics and track what people were linking to.

Click here to continue reading...