|

[]

Kerry Picket: A Whistleblower Reveals that James Comey Ordered and Directed an "Off-the-Books" Operation, Before Any Official Criminal Investigation, Into Trump, Sending "Honey Pot" Spies Into His Campaign in 2015

Kerry Picket: The House Judiciary Committee is examining a new whistleblower report that the FBI targeted Donald Trump soon after he announced his presidential campaign in June 2015, an off-the-books operation ordered by FBI Director James Comey that predated the...

Published:10/29/2024 12:18:59 PM

|

|

[Artists]

At Opera Gallery, Gustavo Nazareno Bridges Spiritual and Contemporary

Nazareno's artistic journey began with books, but the works in "Orixa´s: Personal Tales on Portraiture" show a range of influences, academic and otherwise.

Published:10/29/2024 10:58:28 AM

|

[Markets]

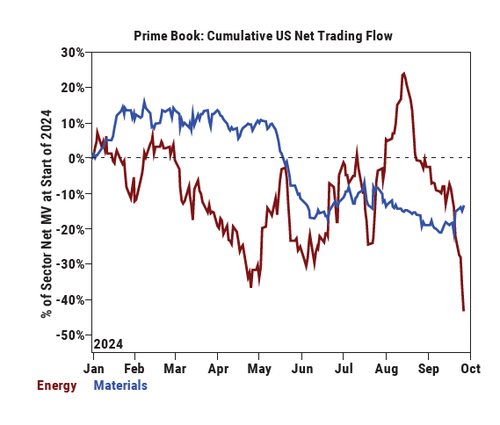

China Planning 10 Trillion Yuan In Extra Debt For Fiscal Stimulus; Oil, Commodities Rebound

China Planning 10 Trillion Yuan In Extra Debt For Fiscal Stimulus; Oil, Commodities Rebound

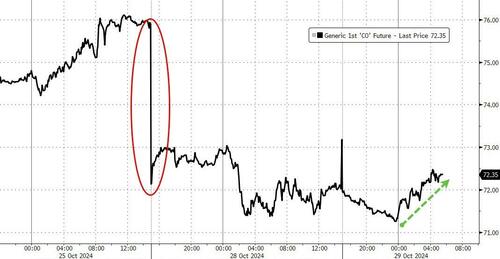

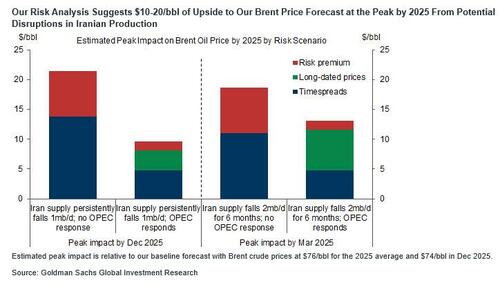

After suffering its biggest drop in two years after the latest iteration of the performative "war" between Israel and Iran ended with yet another dud, oil has rebounded and is 1.4% higher after a Reuters report that China is considering approving the issuance of over 10 trillion yuan ($1.4 trillion) in extra debt in the next few years to revive its fragile economy, a fiscal package which is expected to be further bolstered if Donald Trump wins the U.S. election.

Citing two sources with knowledge of the matter, Reuters said that China's top legislative body, the Standing Committee of the National People's Congress (NPC), is looking to approve the fresh fiscal package, including 6 trillion yuan which would partly be raised via special sovereign bonds, on the last day of a meeting to be held from Nov. 4-8. The 6-trillion-yuan worth of debt would be raised over three years including 2024, said the sources, adding the proceeds would primarily be used to help local governments address off-the-books debt risks.

The planned total amount, to be raised by issuing both special treasury and local government bonds, equates to over 8% of the output of the world's second-largest economy, which has been hit hard by a protracted property sector crisis and ballooning debt of local governments.

Oil prices climbed along with industrial metals on the Reuters report; WTI was up 1% near $68 a barrel while copper rises 0.9%.

The Reuters report was the first confirmation of speculation among financial analysts, who have said in recent weeks they expect Beijing to consider a 10 trillion yuan stimulus.

The spending plans suggest that Beijing has switched into a higher stimulus gear to prop up the economy although it's still not the 2008-like bazooka that some investors have been calling for. That said, after starting with a bang in late September, all subsequent Chinese stimulus reports have been whimper after whimper as Beijing failed to provide much needed details or clarity for what is actually coming, resulting in a sharp unwind of the 30% surge in Chinese stocks observed at the end of Q3.

Which may explain why the Reuters sources cautioned that the plans are not finalized yet and remain subject to changes; i.e., yet another dud may be on deck for a country which desperately needs trillion in stimulus yet has shown unprecedented restraint in actually putting money where its money is.

As part of its latest fiscal package, the NPC Standing Committee is also expected to greenlight all or part of up to 4 trillion yuan worth of special-purpose bonds for idle land and property purchases over the next five years, said the sources. Local governments would be allowed to raise that amount on top of their usual annual issuance quota, which mainly funds infrastructure spending. The quota stood at 3.9 trillion yuan this year and 3.8 trillion in 2023.

The latest move is aimed at enhancing local governments' ability to manage land supply, and alleviate liquidity and debt pressures on both local governments and property developers, they added. Special-purpose bonds are a tool for off-budget debt financing used by Chinese local governments, with the proceeds raised typically earmarked for specific policy objectives, such as infrastructure expenditures.

Should the NPC Standing Committee approve these issuances in full instead of in stages, it could increase the total stimulus size to over 10 trillion yuan, they added. An average of 2 trillion yuan in new central government debt annually underscores an urgency in Beijing to shore up the economy. Late in 2023, China issued 1 trillion yuan in sovereign bonds to bolster flood-prevention infrastructure and meet its roughly 5% economic growth target.

China's top legislative body generally holds its meeting every two months - in the second half of even-numbered months. As per the parliament's 2024 work agenda, released in May, a standing committee session was planned for October. The forthcoming meeting was initially planned for late October before being rescheduled to early November, said one of the sources.

The meeting's timing, which coincides with the week of the U.S. presidential vote on Nov. 5, offers Beijing greater flexibility to adjust the fiscal package including the total size, based on the election outcome, said the sources.

Reuters notes that Beijing may announce a stronger fiscal package if Trump wins a second presidency as his return to the White House is expected intensify the economic headwinds for China. Trump, who has gained in recent polls to erase much of the early advantage of Kamala Harris, has vowed to impose 60% duties on imports from China.

Beijing started this year with plans to issue 1 trillion yuan in special sovereign debt already in place, but that sum is widely expected to be increased as growth has been drifting off target and economists said a longer-term structural slowdown could be in play. All the same, the planned fiscal spending falls short of the firepower deployed in 2008, when Beijing's 4 trillion yuan in fiscal stimulus in response to the global financial crisis accounted for 13% of GDP at the time.

The extra money fueled a property market frenzy and led to unfettered lending to local government financing vehicles, which municipalities used to get around official borrowing restrictions.

As part of the overall fiscal spending, China is also considering approving other stimulus initiatives worth at least one trillion yuan, such as a consumption boost including trade-in and renewal of consumer goods, said the sources. Another trillion yuan could also be raised via special treasury bonds for capital injection into large state banks, said one of the sources and another source with knowledge of the matter.

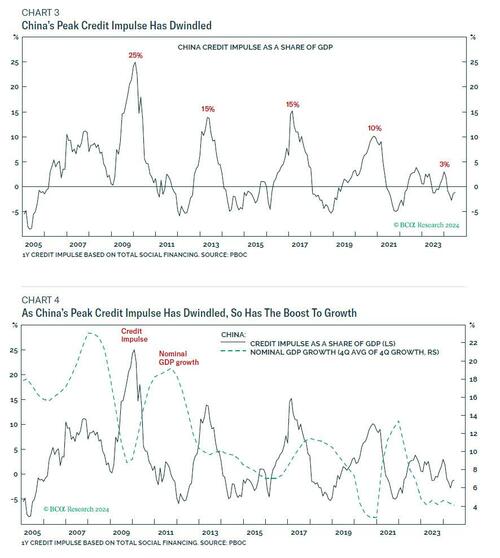

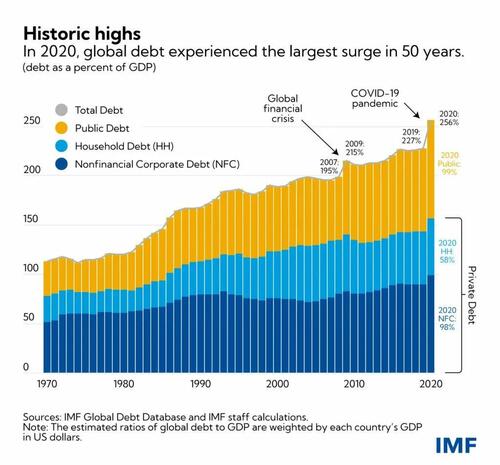

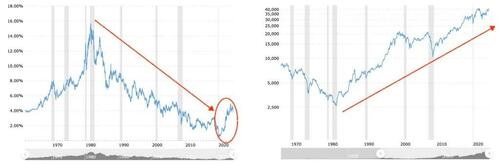

At the end of the day, however, even the 10 trillion yuan package may be insufficient to kickstart the economy. The reason, as explained in "Why China's Rally Won't Have Legs", is that China's peak credit impulse - the all important reflationary variable that propagates across the global economy - has dwindled, and so has the boost to growth.

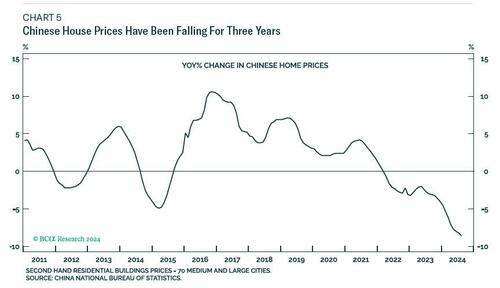

In other words, to achieve the same level of stimulus as a % of GDP, China would need to inject tens of trillions more. And since it can't do that, at least not without its middle class kicking and screaming (literally), China's house price will continue to slide, having recently tumbled by a record YoY amount...

... and so on, until one day Beijing will have no choice but to unleash a real bazooka, one which will spark a reflationary tidal wave across the globe.

|

|

[autumn]

10 Romantic Autumn Reads With Plenty of Spice

The books in this roundup will toast your buns, whether you prefer cinnamon or cayenne levels of heat.

Published:10/29/2024 8:18:16 AM

|

|

[]

Daily Tech News 20 October 2024

Top Story AI is 90% marketing and 10% reality says Linus Torvalds, creator of Linux. (Tom's Hardware) And Git, in much the same way Donald Knuth created TeX and Metafont to typeset hos own books. Ever the optimist, is Linus....

Published:10/29/2024 3:07:22 AM

|

[Markets]

Will Donald Trump Get His Revenge?

Will Donald Trump Get His Revenge?

Authored by Susan Quinn via AmericanThinker.com,

There’s almost nothing that Donald Trump likes better than throwing his adversaries off their game; he likes to be unpredictable, confusing and in charge. It gives him an edge in achieving his goals.

He's kept his adversaries guessing to the extent that he will pay them back for their lawfare and deep-state machinations, and not surprisingly, they expect the worst. Yet he has said repeatedly that victory in the election will be his revenge. They don't know what to make of it.

A Trump senior advisor made the following observation:

"President Trump has made clear that success will be the best revenge," Trump senior adviser Brian Hughes said.

"When others have weaponized government and legal institutions against him for political interference, he will return these institutions to their constitutional purpose of protecting Americans’ liberty and creating a safe and prosperous nation again."

But since the political Left almost always chooses to see deceit in Trump’s comments, they don’t believe he is sincere.

He made it even more unpredictable for them with this:

"Look when this election is over, based on what they’ve done, I would have every right to go after them," Trump said.

"And it’s easy because it’s Joe Biden, and you see all the criminality, all of the money that’s going into the family and him, all of this money from China, from Russia, from Ukraine."

And then Trump underscored it again, wanting to be sure there was no doubt in the minds of the Left that he could act against them:

When asked during a Fox News interview on Wednesday if he plans to use the justice system to punish his political opponents, Trump said: "When this election is over, based on what they've done, I would have every right to go after them."

Note that in both of the previous quotations, Trump commented on what he could do, not on what he would do.

Given the incidents of lawfare that Trump has had to endure, the hyperbole spouted by the mainstream media and the political Left, it’s no wonder that Trump would want to take revenge against those who have relentlessly criticized and attacked him.

Jonathan Turley, law professor at Georgetown University, has commented several times on the pathetic and weak lawfare attacks that have been launched against Trump from various attorneys and district attorneys.

He made this comment a few months ago about Alvin Bragg, Manhattan District Attorney, who twisted the facts of a Trump misdemeanor to transform them into a felony:

Like his predecessor, Bragg previously scoffed at the case. However, two prosecutors, Carey R. Dunne and Mark F. Pomerantz, then resigned and started a public pressure campaign to get New Yorkers to demand prosecution.

Pomerantz shocked many of us by publishing a book on the case against Trump — who was still under investigation and not charged, let alone convicted, of any crime. He did so despite objections from his former colleague that such a book was grossly improper.

Nevertheless, it worked. Bragg brought a Rube Goldberg case that is so convoluted and counterintuitive that even liberal legal analysts criticized it.

It’s no wonder that Trump is relishing the discomfort and fear that he is eliciting in his opponents. They have spent years trying to ruin his reputation, insulting him, discrediting him and trying to humiliate him.

Meanwhile, in reflecting on the 2016 election, Trump said the following about Hillary Clinton:

“I could have gone after Hillary. I could have gotten Hillary Clinton very easily. And when they say lock her up, whenever they said ‘lock her,’ you know, they’d start, 30,000 people, ‘lock her up, lock her up.’ What did I do? I always say take it easy, just relax. We’re winning. Take it easy. Take it easy.”

He added: “I could have had her put in jail. And I decided I didn’t want to do that. I thought it would look terrible. You had the wife of the president of the United States going to jail. I thought it would be very bad if we did that. And I made sure that didn’t happen, OK? I thought it would be bad.”

But now he has reached the point where striking fear in the hearts of his enemies seems righteous.

Yet the changes he will make will be in the way government operates, not mere petty payback to individual miscreants.

That will be devastating to the Leftist cause.

It will also serve as his retribution.

|

|

[Politics]

What a beloved children’s book series can teach Americans about Tim Walz

Maud Hart Lovelace’s “Betsy-Tacy” books captured Mankato, where Walz lived and taught high school for years, at the turn of the 20th century.

Published:10/27/2024 6:10:37 AM

|

[Markets]

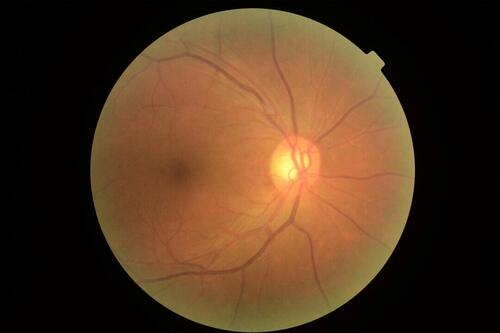

Biohacking To Better Health

Biohacking To Better Health

Authored by Isabella Cooper via The Brownstone Institute,

People have always been fascinated with immortality. While great gains in medical care have enabled lifespan extension, this has often come with the price of co-existing with chronic diseases associated with aging, such as cardiovascular diseases, cancer, type 2 diabetes mellitus (T2DM), hypertension, and dementias such as Alzheimer’s and Parkinson’s disease.

The true “aim of the game” is to have a long healthspan with negligible senescence. This means the absence of biological aging, such as reducing functional decline in organs and whole-body fitness, delaying loss of reproductive capabilities, and delaying death risk with age progression. What we really want is to extend youth, not aging. In achieving that, we may begin to push the envelope on increasing healthy lifespan.

Aging at the cellular level is determined by the cellular rate of damage versus rate of repair. Accumulation of aging-associated damage manifests as cells no longer “behaving correctly” as part of a collective that make up tissues of an organ, like cancer cells.

In healthy individuals, damage accumulation is managed through apoptosis, which is controlled cell death, and refined cellular housekeeping including autophagy and mitophagy; the “eating up, breaking down, and recycling” of damaged inner-cell (intracellular) components (organelles). The nutrient glucose and the hormone insulin govern cellular quality control. Intracellular housekeeping enables the culling of inefficient and toxic cells from the herd. Over time a cell’s ability to trigger apoptosis becomes impaired, enabling gradual dysfunction to sneak by under the radar. Over time, the accumulation of these dysfunctional cells within an organ promotes development of disease.

Humans are multicellular organisms within which our healthy cells operate collectively. In order to have a long healthy lifespan, our cells must not only live longer, but they must also function correctly. Cancer cells are long-lived and capable of unlimited replication; however, they evade apoptosis, and become selfishly primordial, regressing back to single-cell organism behaviour. Our goal is to maintain optimal organ function, ensuring ourselves a long healthspan with negligible senescence and perhaps a touch of immortality.

Mitochondria are intracellular organelles; these organelles are remnant symbiotic protobacteria, originating from proteobacterium that came to live within an archaeal-derived host cell which was most closely related to Asgard archaea (a recently identified group of ancient single-celled organisms). Put simply, a foreign single-celled ancient bacteria came to live inside the cells that eventually evolved into us. The Asgardian endocytosed proteobacteria evolved into mitochondria; through a process called endosymbiosis the two became interdependent. They now support us and we support them. Our cells, with mitochondria and other organelles within them, are called ‘eukaryotic’ cells.

Mitochondria have their own genome; polycistronic circular DNA, whilst their inner matrix membranes are rich in a phospholipid cardiolipin. Both of these features are common to bacteria and not to the eukaryotic nuclear DNA and other organelles of multicellular animals, other than those digesting mitochondria. Mitochondria produce the majority of our life-sustaining energy whilst also acting as a source of destruction for most of our cells. This occurs due to their use of oxygen to break down nutrients, in order to capture energy and store it in the energy carrier molecule ATP. Their (and so our) need and use of oxygen is both life-giving and corrosive; complete oxidation of glucose produces more oxidative damage than oxidising fatty acids, and in the process produces excess superoxide, a form of oxygen with an added electron which is termed a free radical.

Mitochondria also produce hydrogen peroxide, the same found in your household drain cleaner, albeit at a much lower concentration. Chronic low-grade elevated levels of reactive oxygen species (ROS) harm our cells. Achieving balance between “burning” glucose or fatty acids requiring oxygen to provide energy for our body (good) and producing corrosive substances (bad), is hormesis, like the “Goldilocks zone.” ROS toxicity is a key player in aging, as too much of it will decrease healthspan and lifespan.

The majority of ROS in cells is produced by mitochondria. Some amount is necessary for health, while excess causes damage; again, this requires balance or hormesis. ROS are also mitochondrial-signalling molecules, communicating to the nucleus and altering gene expression. This begs the question; what drives cellular behaviour, genes in the nucleus, or mitochondrial signals? The right amount of ROS causes production of new healthier mitochondria, excessive ROS increases damage over repair, accumulating toxic wayward mitochondria. Cancer cells consistently have damaged mitochondria; the same is also found in cardiovascular disease, Alzheimer’s, and Parkinson’s disease, and many of the diseases that we have just accepted as part of aging.

As mentioned above, we can produce energy from fat or from glucose (a sugar) through our cooperative mitochondria. The amount of glucose exposure (predominantly from dietary sources and also made and secreted into the bloodstream by the liver) is critical in achieving this balance between our mitochondria helping or harming us. Insulin is produced in response to carbohydrate intake (sugars such as glucose, starch, and sucrose), increasing absorption (and use) of glucose by our cells and mitochondria and reducing fat-burning (beta-oxidation and subsequent ketosis).

To simplify, we mostly use either glucose from carbohydrates to produce energy with our mitochondria, or fatty acids from food or our fat cells, or ketones from breakdown of fat, to produce energy through an alternative metabolic pathway, called ketosis.

Calorie restriction (carbohydrate restriction) in yeast, nematode worms, and mice to primates increases lifespan with healthspan by inducing ketosis. It causes insulin to become low enough to allow ketogenesis (a product from beta-oxidation, the burning of fat) to occur. Upregulated fat-burning results in the production of molecules called ketone bodies, mainly by the liver (endogenous synthesis).

One of these ketone bodies is beta-hydroxybutyrate (BHB), derived from fatty acids that come either from our fat cells or from a meal. The ketone BHB is a fuel and signalling molecule, causing mitochondria and nuclei to adapt to metabolic changes. Fasting-mimicking diets such as time-restricted feeding, and very low carbohydrate/healthy fat diets (also known as ketogenic diets) also induce ketosis without the conscious effort of calorie restriction.

These diets high in healthy fats (such as animal fats) and low in sugars/starchy carbohydrates lead to decreased insulin and glucose and increased ketones (BHB) in the bloodstream. Over time this induces intracellular machinery changes, shifting the body’s metabolism to fuelling itself mainly off fat and ketones instead of sugar (glucose). Ketosis increases intracellular housekeeping activity, enabling cells to remove and replace damaged organelles. It also allows more time for DNA to be checked by DNA housekeeping proteins that are able to prevent propagation of DNA duplication errors into daughter cells, thus reducing cancer and other age-related disease development. Ketosis has been shown to hold a hint of an elixir to a healthier if not longer life.

In contrast, high carbohydrate diets, providing glucose through starchy carbohydrates like bread, pasta, rice, corn, and sucrose found in cane sugar, high fructose corn syrup, coconut sugar, fruit, and honey, all stimulate insulin secretion. Prolonged hyperinsulinaemia increases the risk of development of Alzheimer’s disease, malignancies, cardiovascular disease, and T2DM. While insulin is essential to life, excess insulin (due to these high carbohydrate diets) leads to hyperinsulinaemia, which is implicated in chronic diseases and aging. Decreased insulin demand is shown to increase healthspan and lifespan. Insulin also causes cells to replicate faster, decreasing the pauses to check DNA copy quality, telling cells that food is abundant and therefore “there is no need to keep a tight ship.”

Insulin is the aging hormone, and a dietary pattern that regularly triggers too much insulin secretion prevents our ability to produce ketones, including BHB. Insulin suppresses ketogenesis (ketone production), depriving us of BHB’s anti-aging properties. The endogenous production of BHB, a powerful antioxidant that directly neutralises free radicals and ROS, has been shown to improve and prevent chronic diseases associated with aging conditions. So, we can control much of our aging by our dietary choices. Ketones such as BHB are produced when we are not overstimulating insulin secretion and requirement through our dietary choices.

We are often advised to eat to keep up our energy and health. However, perhaps a little less results in a little more with regards to healthspan and lifespan, and instead of calorie restriction, we can bio-hack through either eating as much as we want once a day, or eating non-insulin-stimulating foods. Doing both will further enhance their effects. The results are the same as fasting and calorie restriction, less insulin, and more ketones, in turn translating into healthier cells, a healthy you, and a chance to realise your maximal lifespan potential.

* * *

Link to donate to support Isabella D. Cooper’s research in Ageing Biology, Age-Related Diseases, and Longevity at the University of Westminster, UK. This is one of few academic research groups in the diet and metabolism area free from food industry sponsorship. One hundred percent of donation funds go towards active laboratory-based research, with zero funds lost to administrative costs.

|

|

[Entertainment]

Washington Post hardcover bestsellers

A snapshot of popular books.

Published:10/23/2024 7:14:40 AM

|

|

[]

The Secular Keep Me Religious

Published:10/22/2024 4:53:14 AM

|

[Markets]

Gold, Kamala, Trump, Control, Cash, Murder, & Water...

Gold, Kamala, Trump, Control, Cash, Murder, & Water...

Via Greg Hunter’s USAWatchdog.com,

Catherine Austin Fitts (CAF), Publisher of The Solari Report, financial expert and former Assistant Secretary of Housing (Bush 41 Admin.), gives her take on gold, Kamala, Trump, control, cash, murder and water.

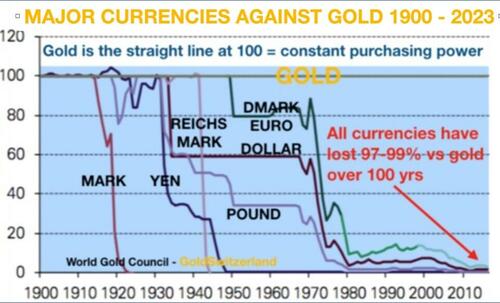

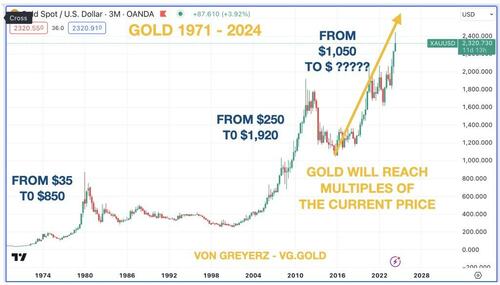

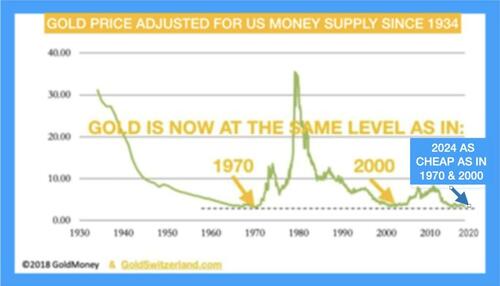

On gold’s rocket rise, CAF says, “Gold is very important..."

"We divide gold into two positions: Your ‘core’ position and your ‘investment’ position... Right now, gold looks phenomenally attractive as a core position. It is also attractive as an investment position.”

Why the big move up now?

CAF says, “Part of it is the incredible monetary policies and the monetary inflation coming from the central banks. "

"The other is too many people are watching government implode in a variety of different ways, and people are saying I want a core position in gold...

We are also seeing the BRICs . . . and seeing states in the US move to put gold and silver in a position to be used as a currency.

So, we are watching people put monetary reserves in gold and monetary liquidity in gold.

That is happening steadily, and more and more people are saying they need a percentage of their assets in gold. . . . We are in a long-term bull market in gold.”

On Kamala Harris, the operative word is “meltdown.” CAF says:

“Kamala is in, what we call in a campaign, a ‘meltdown.’ If you look at the current meltdown, I am baffled because why would somebody with her characteristics be made the nominee?

You are talking about major donors putting major money behind her. Why would they spend that much money if there were serious holes in her vetting and she is inclined to melt down this way? It’s kind of baffling.”

On Trump, what is the first thing he should do if re-elected? CAF says:

“He should stop the poisoning of the American people.

This is one of the reasons we did this issue on water. The American people are being poisoned...I travel a lot by car. I see deterioration in the air, in the water, in the food–they are being poisoned. And, of course, the big one is the CV19 vaccines. Vaccines are poisoning Americans.

There was just a big ruling against putting fluoride poison being added to municipal water supplies. One of the things you can do is to march down to your city or county and tell them to stop wasting money on putting poison in your water. If you reverse that, it is one important action you can take.”

The Deep State and central bankers want total control of your money and your life. Fitts says this is why she started pushing the use of cash instead of digital transactions.

She calls it “Make Cash Great Again.”

"If we don’t fix the finances from an actuarial standpoint, they are going to continue to delay benefits or lower life expectancy, and that is what they are doing. They are balancing the books by lowering life expectancy.”

One way to lower life expectancy is to inject people with a so-called vaccine that is really a bioweapon that murders and disables people.

That is exactly what happened with the CV19 vax, and the deaths or murders are still piling up. CAF says,

“You can cut back on the fraudulent rackets, or you can cut back on the people.”

They are cutting back on the people by any measure.

There is much more in the 54-minute interview.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with the Publisher of The Solari Report, Catherine Austin Fitts, for 10.19.24.

* * *

To Donate to USAWatchdog.com Click Here

There is a lot of free information on Solari.com.

|

[Markets]

Kamala's "Opportunity Agenda" Will Be Disastrous For African Americans

Kamala's "Opportunity Agenda" Will Be Disastrous For African Americans

Via SchiffGold.com,

With Kamala Harris rapidly fading in polls among African-Americans, her campaign just released a desperate “Opportunity Agenda” for black men outlining policies that will have disastrous economic consequences. Ironically, the consequences of “forgivable loans” are likely to be the most damaging to the very same groups that she’s claiming to help.

A “forgivable loan” is another way of saying “free money.” Printing $20,000 and handing it out to black entrepreneurs is only going to push prices up for the things those entrepreneurs need. Meanwhile, banks that get to issue the loans do so with no risk, because it’s all backed by the Full Faith and Credit of you, the American taxpayer.

The idea is to get “mission-driven lenders” to issue the loans. This slathers a gloppy layer of do-gooderism over the fact that, most likely, these loans will be issued by the usual State-favored megabanks. After all, they all have “Mission Statements,” so who’s to argue whether they’re “Mission-Driven” or not? They’re all part of a criminal banking cartel that enjoys an incredibly privileged position in terms of being inextricable from the US political structure, first in line at the low interest rate and QE money printer.

Meanwhile, megabanks like Wells Fargo (owned by BlackRock, Fidelity, and Vanguard) have stolen far more houses and cars than any street thief ever could, preyed on Native Americans, opened millions of fraudulent accounts, violated international sanctions, aided money laundering, along with other offenses.

Having some guaranteed loans on the books also incentivizes malinvestment, encouraging banks to dump more money into risky bets in other areas. When you get some free money, you want to play with it. It’s just human nature.

Forgivable loans offered to a specific ethnic group even incentivizes discrimination against them.

If loan officers know that African-Americans are getting forgivable loans courtesy of the federal government, they’re more likely to charge higher interest rates even to black entrepreneurs whose loans aren’t guaranteed.

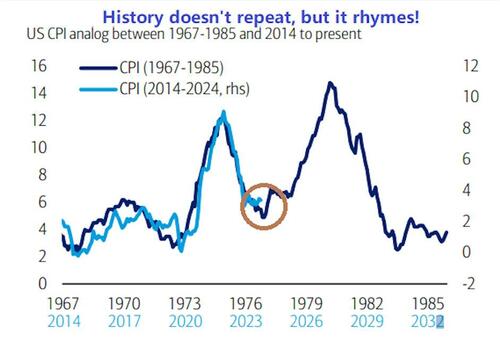

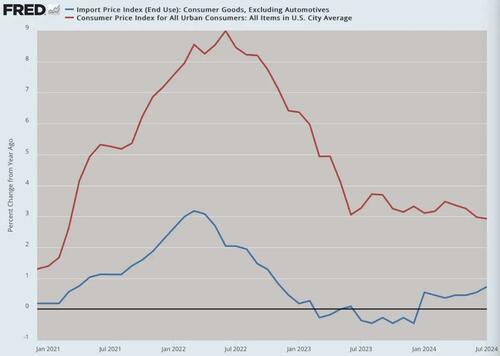

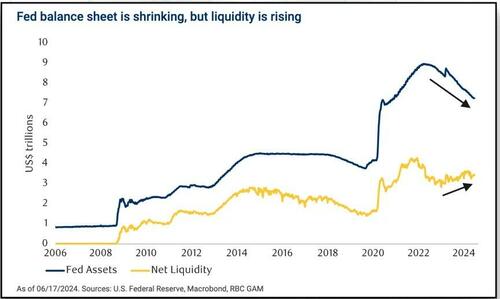

Meanwhile, the Fed’s inflationary policies cause the most pain to the lowest earners and the middle class.

While bursts of “economic stimulus” like those of the 2008 and 2020 crises juiced the economy in the short or medium-term, we’re feeling the effects today in the form of drastically higher prices and a middle class that continues to vanish.

Federal Reserve Total Assets (Less Eliminations from Consolidation)

It all comes down to less competition in the marketplace, which inevitably leads to higher prices. No matter the context, nature or finance, humans respond to incentives, and markets are no different. That’s why no central authority can overcome the natural will of the market, no matter how hard it tries. In the long run, nature always wins.

Of course, the Harris campaign’s “proposal” is a campaign season prop to buy votes, and wouldn’t be enforceable without an act of Congress. But it’s still a notable sign that the campaign is worried that being a black woman might not be enough for Harris to get back the black vote. While it favored Biden, African-American support faded continuously throughout the course of his administration. For his part, Trump is promising a utopia of his own, and is a fan of the money printer as long as he gets credit, even making a point to ensure his name would appear on the inflationary Covid stimulus checks. As Peter Schiff recently said on Kai Hoffman’s Soar Financially, “Trump is promising immediate results—positive, no pain, just gain.” But inflation is already baked into the cake.

“We have, you know, inflation that masquerades as growth…I think the economy is very weak, that’s why the Fed is cutting rates, and they’re going to cut them even more, and I think they’re going to go back to QE.”

Incumbent administrations love when the Fed juices the economy for them, since they can take the credit.

But Kamala’s campaign season pandering to “help” African American entrepreneurs is going to create more of the inflation and discrimination that holds back disadvantaged groups in the first place.

|

[Markets]

For Harris, Pro-Choice Does Not Include Cars And Appliances

For Harris, Pro-Choice Does Not Include Cars And Appliances

Authored by Kenin M. Spivak via RealClearWire,

Kamala Harris wants to deprive Americans of the right to choose cars and household appliances. When she claims, as she did at a rally last week in Michigan, that “I will never tell you what kind of car you have to drive” she is guilty of two of the Democrats’ most reviled offenses, malinformation (failure to contextualize a statement) and misinformation (lying).

Combating climate by changing infrastructure, consumer goods, and lifestyle is one of Harris’s core values. As recently as this year, the Biden-Harris administration continued to issue regulations and battle in court for the right to reduce consumer options for automobiles and home appliances. Harris favors consumers having choices, just so long as those choices are limited to those she pre-approves.

Then Senator Harris co-sponsored the Senate version of Alexandria Ocasio-Cortez’ Green New Deal. Harris believed that mandating priorities and choices to limit emissions was so important that she advocated ending the filibuster to do so. Harris also co-sponsored the Zero Admissions Vehicles Act to require that all cars be EVs, or otherwise zero-emissions, by 2040. When she ran for president in 2019, she issued a plan to phase out new gas-powered cars even sooner – by 2035.

In April 2023, the Biden-Harris administration proposed rules that would ensure that EVs accounted for about 67 percent of all new car sales by 2032 (just eight years from now). After objections from nearly every sector and region of the country, the EPA issued final rules on March 20 of this year that require from 31 percent to 44 percent of new cars, SUVs, and pickup trucks manufactured in 2027 be EVs, with the final percentage to be based on emissions from other vehicles. The EPA rules require that by 2032, EVs account for at least 56 percent of new car sales, and at least another 13 percent be hybrids, leaving not more than 31% as gas powered.

In 2023, EVs accounted for only 7.6 percent of new car sales. That is because, despite subsidies and massive pressure from government and the Left, consumers dislike EVs. EVs have limited range, particularly in the cold. They take a long time to charge, and it is difficult for those who live in apartments to do so. They are costly. EVs may not even be particularly good for the environment once the electrical grid and generating capacity are expanded to support mandates, and disposal of lithium ion batteries is considered. It also is unlikely the U.S. could have sufficient generating capacity without brownouts, blackouts, and other conservation measures.

EV mandates imperil national security by replacing fossil fuels, in which the U.S. is the world leader, with minerals found in China. China also is the low cost manufacturer of EVs, meaning that EV mandates will send American jobs and profits to China.

Energy expert Mark P. Mills warns that “All the world’s mines, both currently operating and planned, can supply only a small fraction of the… increase in various minerals that will be needed to meet the wildly ambitious EV goals,” while the UN Trade Development Agency advises there will be considerable shortages in lithium, cobalt, and copper if EV requirements are not slowed.

The strong disfavor in which consumers hold EVs is seen in two numbers. As Fortune observed, “no one wants to buy used EVs,” destroying resale value, and second, EVs are the least likely cars to be stolen. Numerous major automobile manufacturers are cutting EV production targets, and earlier this year Hertz announced that it was disposing of a third of its almost new EV fleet. The 2024 Deloitte Global Automotive Consumer Study found that EVs were never very popular among consumers, and familiarity is breeding contempt, with a 9% increase in the popularity of gas powered cars. A Gallup survey in April found that among Democrats who don’t yet own an EV, the percent saying they would never purchase an EV rose 10 points, compared to a year ago.

Harris not only wants to deprive Americans of the opportunity to choose gas-powered cars and most hybrids, but she also supports the Green New Deal’s goal of prohibiting sales of home appliances that do not meet draconian emissions standards. To date, the Biden-Harris administration has sought to take off the market most home dishwashers, heaters, air conditioners, and gas stoves. A federal appeals court struck down the Department of Energy’s action targeting dishwashers.

In May, the House passed the Hands Off Our Home Appliances Act on a bipartisan basis. That bill is intended to restrain the administration from banning home appliances that run on natural gas.

Next time Kamala Harris claims that she won’t tell you what to buy, just keep in mind that she intends to eliminate most options, leaving you with a Hobson’s choice of poorly performing alternatives.

Kenin M. Spivak is founder and chairman of SMI Group LLC, an international consulting firm and investment bank. He is the author of fiction and non-fiction books and a frequent speaker and contributor to media, including The American Mind, National Review, the National Association of Scholars, television, radio, and podcasts.

|

[Markets]

Confiscation Games: Public Expropriation Of Private Assets

Confiscation Games: Public Expropriation Of Private Assets

Submitted by Brent Johnson of Santiago Capital.

Executive Summary

Throughout history, governments around the world have occasionally resorted to confiscating the assets of their citizens in response to economic crises, political purges, or ideological pursuits. These actions, often justified as necessary for the greater good, have frequently resulted in widespread social disruption and significant hardship for the affected populations.

This report delves into four significant historical episodes of asset confiscation, examining the methods used by governments to seize property and the diverse strategies individuals and communities employed to resist or evade these confiscations. Each case provides insight into the complex relationship between state power and personal property rights, as well as the resilience of the human spirit in the face of adversity.

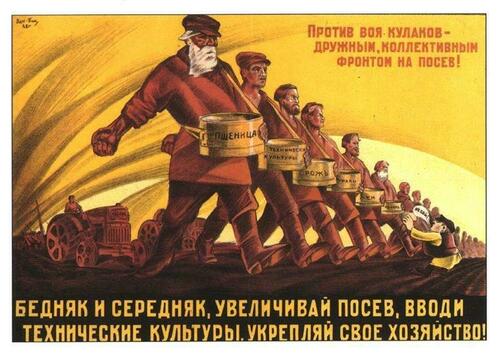

One of the most notorious examples of asset confiscation occurred in the Soviet Union under the leadership of Joseph Stalin.

As part of his larger effort to transform the Soviet economy and eliminate potential opposition, Stalin launched campaigns of collectivization and dekulakization. The government forcibly consolidated individual landholdings into collective farms (kolkhozes) and state farms (sovkhozes), seizing land, livestock, and other assets from the peasantry.

Wealthier farmers, known as kulaks, were particularly targeted as class enemies. The methods of confiscation were harsh and systematic, ranging from forced collectivization to the seizure of grain and livestock.

Despite the brutality of these measures, many peasants engaged in acts of defiance. Resistance took various forms, including hiding grain and livestock, sabotaging government efforts, and fleeing to urban areas in search of refuge.

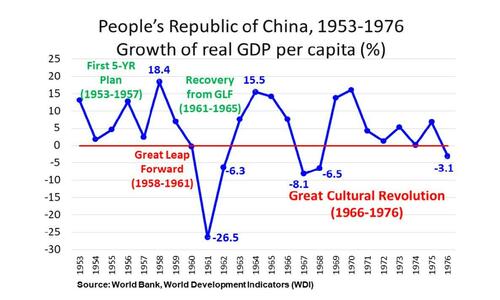

A parallel can be drawn to the Chinese Cultural Revolution, which took place from 1966 to 1976.

During this period, Chairman Mao Zedong's government sought to enforce radical socialist policies, resulting in widespread confiscation of assets, particularly from intellectuals, landlords, and those accused of harboring bourgeois values. The Cultural Revolution, led in large part by Mao's Red Guards, was a time of immense social upheaval, characterized by public denunciations, property seizures, and the internment of perceived enemies of the state in re-education camps.

Common strategies included hiding valuable possessions, falsifying records to obscure ownership, and relying on informal networks of support to protect assets. Despite the pervasive atmosphere of fear and persecution, these methods allowed some to shield their belongings from the relentless scrutiny of the state.

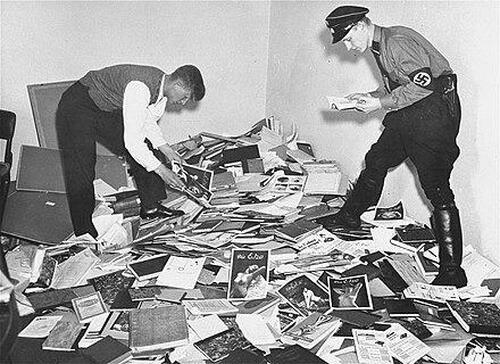

Another dark chapter in history is found in Nazi Germany's policy of Aryanization, implemented between 1933 and 1945 under Adolf Hitler’s regime. Aryanization was designed to systematically transfer Jewish-owned businesses and property into the hands of "Aryan" citizens, stripping Jews of their economic power and wealth.

The Nazi government employed a range of tactics to facilitate this transfer, including legal decrees that forced the sale of Jewish assets at drastically reduced prices, as well as violent pogroms that terrorized Jewish communities and forced them to flee. In this environment of coercion and violence, many Jewish families sought to protect their assets by transferring funds and property abroad, hiding valuables, or arranging false ownership transfers to trusted non-Jewish individuals.

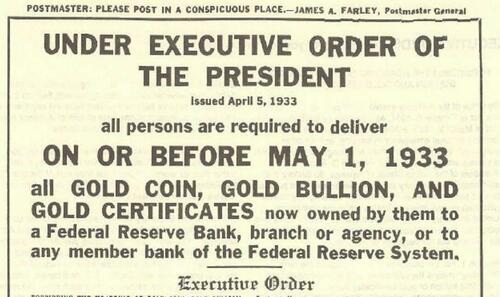

In the United States, the government’s confiscation of gold in 1933 offers a striking contrast to the more overtly ideological or ethnic-driven confiscations of the Soviet, Chinese, and Nazi regimes.

During the Great Depression, President Franklin D. Roosevelt implemented a series of policies aimed at stabilizing the economy, one of which was the forced conversion of privately held gold into paper currency. This measure was designed to combat deflation and restore public confidence in the banking system, but it also represented a significant intrusion into the personal property rights of American citizens.

Under Executive Order 6102, individuals were required to surrender their gold holdings to the government in exchange for paper money, with financial penalties or even imprisonment for those who failed to comply.

While many citizens adhered to the order, a number of individuals employed various tactics to avoid surrendering their gold. These included hoarding gold in hidden locations, exploiting legal loopholes that allowed for certain exemptions, storing gold in offshore accounts, and participating in black market trading or barter systems.

Each of these historical episodes of asset confiscation underscores the extremes to which governments will go in pursuit of political, economic, or ideological goals.

Whether driven by a need to consolidate political control, redistribute wealth to fulfill ideological aims, or stabilize an economy on the brink of collapse, the actions of these regimes resulted in profound social disruption, economic devastation, and widespread human suffering.

In each case, state intervention—through aggressive asset confiscation—deepened the divide between governments and their citizens, often intensifying resentment and leading to acts of defiance. The human toll was not limited to financial loss; entire communities were destabilized, livelihoods destroyed, and societal structures upended, all in the pursuit of these ambitious governmental agendas.

Yet, amid the harshness of these measures, these episodes also illuminate the extraordinary resilience and resourcefulness of individuals and communities determined to protect their assets and livelihoods. Faced with overwhelming odds and often brutal enforcement, people devised creative methods of resistance. From concealing valuable property and leveraging legal loopholes to forming clandestine networks and escaping oppressive regimes, these acts of defiance highlight a fundamental human instinct for survival.

The capacity to adapt and push back against overwhelming state control demonstrates a profound determination to retain autonomy, even under the most oppressive circumstances.

By reflecting on these historical events, we gain valuable insight into the delicate balance between state authority and individual property rights. These instances of asset confiscation expose the vulnerabilities of ownership during periods of political and economic instability, underscoring the precarious nature of personal wealth when confronted with unchecked governmental power.

More importantly, they serve as enduring reminders of humanity's ability to resist, adapt, and reclaim autonomy in the face of overwhelming adversity. Ultimately, these episodes reinforce the critical importance of safeguarding individual rights and freedoms, even when faced with the seemingly invincible force of state intervention.

The Soviet Collectivization and Dekulakization (1929-1933)

In the late 1920s and early 1930s, the Soviet Union, under the iron-fisted rule of Joseph Stalin, embarked on a colossal and brutal campaign of collectivization. This policy was the cornerstone of Stalin's First Five-Year Plan, designed to transform the Soviet Union from a predominantly agrarian society into an industrial powerhouse. The grand vision involved consolidating individual landholdings and labor into collective farms known as kolkhozes and state farms called sovkhozes. The ambitious goals were to boost agricultural productivity, generate surplus grain for export, and fund rapid industrialization.

Stalin’s ideology painted collectivization as essential to eliminating the Kulaks, the relatively wealthier peasants seen as class enemies obstructing socialist progress. To Stalin, the Kulaks represented a threat to his vision of a socialist utopia. They were perceived as hoarders and exploiters, resisting the equitable distribution of resources. Economically, the Soviet government aimed to extract grain surpluses from the countryside to support urban workers and finance industrial projects. Politically, the consolidation of land and labor into collective farms was a strategic move to exert greater control over the rural population and suppress any potential dissent. By breaking the economic independence of the peasants, Stalin aimed to solidify his control over the countryside.

The methods employed to enforce collectivization and dekulakization were multifaceted and often brutal. The government used a mix of coercion, propaganda, and outright violence. Forced collectivization involved peasants being coerced into surrendering their land, livestock, and equipment to join collective farms. State agents and party activists used threats and intimidation to persuade or force peasants into compliance. These activists, often young and ideologically driven, conducted aggressive campaigns in villages, sometimes going door-to-door to enforce policies.

Kulaks were specifically targeted as class enemies, facing expropriation, arrest, deportation, and even execution. The dekulakization campaign involved identifying, dispossessing, and removing kulaks from their communities in a process that was often arbitrary and brutal. Local officials had quotas to fulfill, leading to widespread abuses and targeting of anyone seen as a threat or simply unfortunate enough to own slightly more property than their neighbors.

The state also requisitioned grain and livestock from peasants, often leaving them with insufficient food and resources to survive. Grain procurement quotas were imposed, and failure to meet these quotas resulted in severe penalties, including the confiscation of all remaining food supplies. These quotas were often unrealistically high, putting immense pressure on peasants to meet demands at the cost of their survival.

Propaganda played a significant role in promoting collectivization, with the government depicting it as a path to prosperity and a socialist utopia. Posters, films, and speeches glorified collective farming and painted a rosy picture of a future where everyone shared in the bounties of the land. Agitation propaganda campaigns involved speeches, pamphlets, and posters aimed at convincing peasants of the benefits of collectivization. Schools and youth organizations were mobilized to spread the message, and dissenting voices were quickly silenced.

The impact on the peasantry was devastating.

Millions of peasants suffered from displacement, famine, and violence, fundamentally altering the social and economic fabric of rural communities. Many kulaks and their families were deported to remote areas such as Siberia and Kazakhstan, where they faced harsh conditions and high mortality rates.

These remote regions were often ill-prepared to receive large numbers of deportees, leading to widespread suffering and death. The requisitioning of grain and livestock led to widespread famine, most notably the Holodomor in Ukraine, where millions of people died of starvation. The Holodomor was a particularly harrowing tragedy, with entire villages wiped out and desperate survivors resorting to eating grass, bark, and, in some cases, even more desperate measures.

Resistance to collectivization was met with brutal repression, including mass arrests, executions, and punitive measures against entire villages. Villages that resisted were labeled as "enemy strongholds" and subjected to collective punishment. This often included increased grain quotas, confiscation of all food supplies, and the arrest of community leaders.

Despite severe repression, many peasants resisted collectivization and employed various strategies to avoid asset confiscation. Peasants hid their produce and livestock in secret caches or remote areas to prevent confiscation. Grain was buried in hidden pits, and livestock was sometimes driven into forests or remote areas to avoid requisition. Acts of sabotage, such as destroying machinery and livestock, were common.

This was a form of resistance intended to undermine the productivity of collective farms. Passive resistance tactics included working slowly, feigning ignorance, or intentionally mismanaging collective farm resources. Some peasants fled to urban areas, seeking jobs in factories and construction projects to escape collectivization. The migration to industrial centers increased as peasants sought to escape the oppressive conditions in the countryside.

Peasants also formed support networks to help each other hide assets and provide mutual aid. Secret meetings and communications were used to coordinate resistance efforts and share information about government actions. These networks provided a lifeline for many, offering support and solidarity in the face of overwhelming oppression.

The Holodomor, also known as the Terror-Famine, was one of the most tragic outcomes of Stalin's collectivization policies. It occurred in Soviet Ukraine from 1932 to 1933, resulting from forced grain requisitions, unrealistic procurement quotas, and harsh punitive measures against those who resisted.

Estimates of the death toll range from 3.5 to 7 million people, with widespread starvation, disease, and death. Despite efforts to conceal the famine, reports from foreign journalists and diplomats brought international attention to the crisis, though the Soviet government denied the existence of the famine and suppressed information.

The Holodomor remains a deeply painful chapter in Ukrainian history and is widely regarded as a genocide orchestrated by the Soviet regime.

The long-term consequences of collectivization and dekulakization were profound and far-reaching. The upheaval in rural areas led to a significant decline in agricultural productivity, with collective farms often inefficient and poorly managed. The mass displacement and deaths of millions of peasants altered the demographic landscape of the Soviet Union.

The trauma of collectivization and the Holodomor left a legacy of mistrust towards the Soviet government, contributing to the eventual collapse of the Soviet Union.

Collectivization succeeded in extending the state's control over the countryside but also entrenched fear and resentment among the rural population. The policies of collectivization and dekulakization did not achieve the intended economic benefits and instead left a legacy of suffering and inefficiency.

The Soviet collectivization and dekulakization campaigns represent one of the most significant and tragic episodes of state-imposed asset confiscation in history. The brutal methods employed by the government, combined with the resilience and ingenuity of the peasantry, highlight the complex dynamics of power, resistance, and survival. Understanding this period is crucial for comprehending the broader history of the Soviet Union and the enduring impact of Stalin's policies on its people.

The resilience of the peasantry in the face of such brutal oppression underscores the human spirit's capacity for resistance and survival against overwhelming odds.

The Chinese Cultural Revolution (1966-1976)

The Chinese Cultural Revolution, initiated by Mao Zedong in 1966, stands as one of the most tumultuous periods in modern Chinese history. This decade-long movement was characterized by widespread social, political, and economic upheaval. Mao's goal was to enforce communism by removing capitalist, traditional, and cultural elements from Chinese society. This ambitious and ruthless campaign led to the persecution of millions and the confiscation of personal and communal assets on an unprecedented scale.

Mao, in his relentless drive to reshape China, called upon the nation's youth. Imagine millions of young people, mostly students, mobilized to form the Red Guards. These enthusiastic, often fanatical, groups were tasked with attacking the "Four Olds": old customs, culture, habits, and ideas. The Red Guards, fuelled by revolutionary fervor, would ransack homes, destroy cultural artifacts, and seize property.

These young revolutionaries, armed with Mao's Little Red Book, stormed through cities and villages alike, determined to purge society of its capitalist and traditionalist elements. Streets that were once vibrant with the rhythm of daily life were now filled with the chaotic energy of the Red Guards. They scoured neighborhoods, hunting for any sign of the "Four Olds." No item was too insignificant; anything from ancient family heirlooms to revered cultural relics became their targets.

Public struggle sessions became a chilling spectacle across China. Individuals identified as counterrevolutionaries, landlords, intellectuals, and others deemed bourgeois were subjected to public humiliation, beatings, and confiscation of their property. Imagine a crowded square where accused individuals were paraded before jeering crowds, forced to confess their "crimes" while enduring physical and verbal abuse.

These sessions were not mere public shaming; they were brutal, often violent displays of power meant to break the spirit of the accused and serve as a warning to others. Their homes and belongings were often seized by the state, leaving families destitute. The trauma of these public humiliations lingered long after the crowds dispersed, marking the psyche of an entire generation.

Those not caught up in struggle sessions might find themselves sent to rural labor camps for re-education. These camps, far from the cities, were places of hard labor and harsh conditions. Imagine being uprooted from urban life and thrust into the backbreaking work of the countryside. People were forced to toil in the fields or work on infrastructure projects, all while being indoctrinated with revolutionary ideology. Life in these camps was gruelling; the combination of physical exhaustion and ideological brainwashing wore down even the most resilient spirits. Their properties were confiscated and redistributed by the state, further dismantling the old social order and creating a new class of disenfranchised citizens.

The impact on society was devastating.

Millions faced persecution, with estimates suggesting up to 1.5 million people were killed and countless others imprisoned, tortured, or displaced. Families were torn apart, and communities shattered as neighbors turned against each other, driven by fear and ideological fervor. The economy suffered as well, as intellectuals and skilled workers were removed from their positions, and resources were diverted to support revolutionary activities. Factories slowed, agricultural production dropped, and the nation struggled to maintain even basic economic stability. The economic infrastructure that had been painstakingly built over decades crumbled under the weight of ideological purges and mismanagement.

The Cultural Revolution also targeted China's rich cultural heritage. Libraries, temples, and monuments were destroyed. Books, paintings, and other cultural artifacts were burned or otherwise eradicated. Picture centuries-old temples reduced to rubble, rare manuscripts turned to ash, and priceless artworks lost forever.

The aim was to break with the past and create a new, ideologically pure culture, but the result was an irreplaceable loss of historical and cultural treasures. The destruction was not just physical; it was an attempt to erase the very memory of China's rich and diverse heritage. The emptiness left by this cultural annihilation was felt deeply by those who understood the value of what was lost.

Despite the atmosphere of fear and repression, many Chinese citizens found ways to resist and protect their assets. People hid valuable items such as jewelry, family heirlooms, and important documents in clever places—buried underground, concealed in walls, or tucked away in hollowed-out furniture. These acts of defiance were often small but significant, providing a lifeline to a past that many were desperate to preserve. Families altered or destroyed official documents to obscure their backgrounds or ownership of property, all in a bid to avoid persecution.

Communities formed clandestine networks to help each other hide assets, provide false testimonies, or even escape to safer areas. Imagine neighbors collaborating to protect a targeted family by hiding their possessions and spreading misinformation about their activities. These networks operated in the shadows, providing a fragile but crucial support system for those targeted by the revolution. Some people outwardly conformed to the demands of the Red Guards while secretly maintaining their old customs and traditions. These acts of defiance, though small, were acts of bravery in a time of widespread terror. In the face of overwhelming oppression, these quiet acts of resistance were a beacon of hope.

The long-term consequences of the Cultural Revolution were profound.

The destruction of cultural artifacts, historical sites, and intellectual works resulted in an irreparable loss to China's cultural heritage. The persecution and violence left deep psychological scars on survivors and their families, affecting subsequent generations. The memories of the brutality, the fear, and the loss were passed down, creating a legacy of trauma that would influence Chinese society for decades to come. And disruption of the education system created a generation with gaps in their formal education, further hindering the nation's progress.

Economically, the upheaval led to stagnation. The persecution of skilled workers and intellectuals hindered technological and industrial progress. Factories and farms, once bustling with activity, were now inefficient and unproductive, unable to meet the demands of the population. The forced redistribution of property and assets, while intended to eliminate class distinctions, often resulted in inefficiencies and further economic disruption. The grand vision of a classless, perfectly equal society clashed with the harsh reality of economic decline and social chaos. The economy was left in tatters, struggling to recover from the damage inflicted during the revolution.

In the end, the Chinese Cultural Revolution serves as a poignant reminder of the devastating impact of ideological extremism and political purges on a society.

Through the detailed examination of government actions and public resistance, we gain a deeper understanding of this historical period. The strategies employed by ordinary people to protect their assets and survive highlight the resilience and ingenuity of the human spirit. These stories of survival and resistance are a testament to the strength and courage of those who lived through this dark chapter in history. As China continues to navigate its complex historical legacy, the lessons of the Cultural Revolution remain relevant for understanding the interplay between state power and individual rights.

The Confiscation of Gold by the United States Government (1933)

The onset of the Great Depression in 1929 plunged the United States into a severe economic crisis unparalleled in its history. The stock market crash not only shattered the financial system but also led to catastrophic levels of unemployment, countless bankruptcies, and widespread despair. As banks collapsed and businesses shuttered, the American public grappled with unprecedented hardship.

By 1933, the economic situation had grown even more dire, with no sector of the economy untouched. Into this bleak landscape stepped Franklin D. Roosevelt, inaugurated as President in March of that year, bringing with him a new vision aimed at rescuing the nation from its economic plight.

Roosevelt’s New Deal was a series of programs and policies designed to revive the economy and restore confidence among the American people.

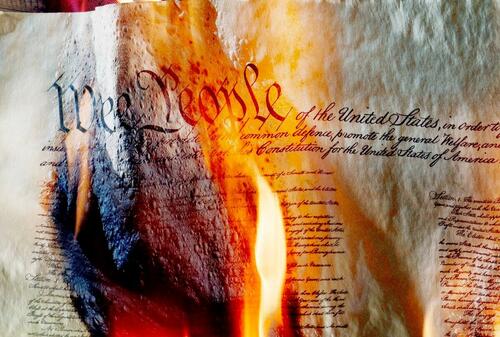

Among these initiatives, the decision to confiscate gold under Executive Order 6102 in April 1933 stands out as particularly bold and contentious.

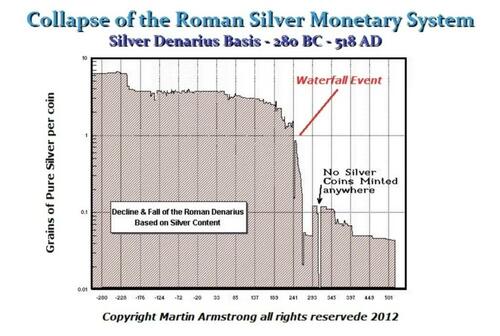

This executive order mandated that all persons, businesses, and institutions within the United States surrender their gold coins, bullion, and certificates to the Federal Reserve, receiving in return paper currency valued at $20.67 per troy ounce.

Roosevelt’s rationale for such a drastic measure was rooted in the belief that hoarding gold was exacerbating the economic downturn. By hoarding gold, he believed that individuals were limiting the money supply available, which in turn deepened the deflation that was strangling economic growth.

The move to confiscate gold was aimed directly at undermining the gold standard, a monetary system in which the value of national currencies was directly linked to specific amounts of gold. This standard restricted the Federal Reserve's ability to increase the money supply during economic downturns, thereby limiting its ability to stimulate economic activity. By removing gold from private hands and centralizing it within the Federal Reserve, Roosevelt hoped to expand the money supply and thus combat the crippling deflation.

The following year, Roosevelt pushed forward with the Gold Reserve Act of 1934, which not only reaffirmed the government’s control over all gold but also increased the official price of gold from $20.67 to $35 per ounce. This significant devaluation of the dollar sought to boost economic recovery by making American goods cheaper on the international market, thus increasing exports and reducing the balance of trade deficit. The government enforced these new policies with stringent penalties, threatening violators with hefty fines and imprisonment, signaling a stern commitment to these drastic measures

Public reactions to these gold policies were deeply divided. While many Americans complied with the order, either out of a sense of national duty or resignation to the economic emergency, a significant number resisted, driven by a combination of distrust in the government and a determination to safeguard personal wealth.

Resistance took many forms. Individuals went to great lengths to hide their gold, employing creative methods to evade confiscation. Gold was buried in backyards, secreted away in hidden compartments of homes, or transformed into innocuous items like jewelry or art.

Others exploited loopholes in the legislation, particularly the exemptions that allowed professionals like dentists, jewelers, and artists to retain necessary gold for their work. Some claimed these professional exemptions under dubious pretenses, while others rushed to invest in numismatic coins—rare and collectible coins that were initially exempt from confiscation.

The affluent and certain businesses looked beyond American borders, moving their gold assets to international banks or engaging in elaborate foreign transactions to protect their holdings. As government scrutiny intensified, a black market for gold flourished, allowing covert trading and providing an avenue for transactions that circumvented official channels. In certain areas, barter systems emerged where gold acted as a medium of exchange, further undermining the government’s attempts to control the currency.

The long-term consequences of Roosevelt’s gold policies were profound and multi-faceted.

Economically, these measures provided the necessary liquidity to tackle deflation, facilitating a gradual recovery from the Depression. The increased money supply resulting from the devaluation of the dollar and the abandonment of the gold standard allowed for greater flexibility in monetary policy. This adaptability was crucial not only during the remaining years of the Depression but also in shaping the economic strategies of subsequent decades.

The revaluation of gold and the shift away from a strict gold standard also laid the groundwork for the Bretton Woods system, which established the U.S. dollar as the backbone of the international financial system after World War II. This system played a pivotal role in global economic stabilization until its dissolution in the early 1970s.

Culturally, the legacy of the gold confiscation left an indelible mark on American society, engendering a deep-seated skepticism toward government intervention in personal financial matters. This skepticism fostered a strong libertarian streak in some segments of the population, influencing American attitudes toward economic policy and investment in precious metals for decades.

The episode remains a potent symbol in discussions about government overreach and economic liberty, shaping the ideological debates that continue to influence American political and economic thought.

In retrospect, the U.S. government's intervention in the gold market during the Great Depression was a watershed moment with lasting impacts. While it played a crucial role in addressing the immediate economic crisis and reshaping U.S. monetary policy, it also left a legacy of wariness about government power over personal assets.

These actions and their repercussions continue to echo through the financial markets and shape government policies, reminding us of the delicate balance between necessary economic intervention and the protection of individual freedoms.

Continue reading at the Macro Alchemist.

|

|

[World]

A roundup of crime, spy and military thrillers

I recall Otto Penzler, the owner of The Mysterious Bookshop in New York City, telling me that mystery, crime fiction, and thrillers were the best-selling genres of books today--and that business was good.

Published:10/17/2024 1:56:19 PM

|

|

[Politics]

Massive influx of shadowy get-out-the-vote spending floods swing states

Comic books, paydays, door-knocking, direct mail, giveaways, viral videos and “poll dancer” parties that happen independent of campaigns could be decisive.

Published:10/17/2024 11:02:11 AM

|

[Markets]

The US Plans To Let BRICS Fail In A Geopolitically Explosive Environment

The US Plans To Let BRICS Fail In A Geopolitically Explosive Environment

Authored by Peter Hanseler via VoiceFromRussia.ch,

Introduction

In less than two weeks, the 2024 BRICS Summit will take place in Kazan from 22-24 October. Our team will be there to follow and report on what is likely to be the most important geopolitical event of the year.

We are using the summit as an opportunity to publish several articles on this issue of the century. In this first article, we describe the adverse geopolitical environment in which this organisation is developing.

I would like to preface this with the following: Reliable geopolitical statements are based on facts. As the geopolitical facts change almost daily, this fact makes it difficult or impossible to produce analyses that will stand the test of time.

Several key geopolitical parameters are either completely in flux or will not have been decided at the time of the BRICS summit. I consider the following parameters to be crucial for medium-term geopolitical developments: (1) war in the Middle East; (2) war in Ukraine; (3) interest rate developments and the behaviour of the Fed until the end of this year as an indicator of the instability of Western financial markets with the inevitable consequences for the global economy; (4) US presidential elections.

For China and Russia, which play a leading role in BRICS – Russia currently holds the chair – the following questions arise: Should BRICS accept few, no or many new members? Candidates are lining up, but some are under enormous pressure from the US to avoid joining BRICS. Should a new payment mechanism independent of the US dollar be introduced now, further upsetting the balance in already unstable financial markets? Such decisions, or even the mere communication of them, have the potential to significantly alter the entire geopolitical situation within hours – positively or negatively, depending on the observer’s point of view.

This article can therefore be no more than a transcription of thoughts on significant geopolitical developments that are currently taking place simultaneously and unpredictably. A full assessment is impossible. Many factors cannot be reliably assessed – such as developments in Africa, Asia and South America.

The feigned disinterest of the West

For a long time, the Western media maintained an ironclad silence on the subject of BRICS. A glimmer of interest appeared when Turkey expressed interest in joining BRICS. Now there is radio silence again. Alternative media are outdoing each other with predictions that BRICS will change the world tomorrow. The Russian media are holding back in this fireworks of jubilation. But to interpret the silence of the Western media as a lack of interest in BRICS would be more than naive.

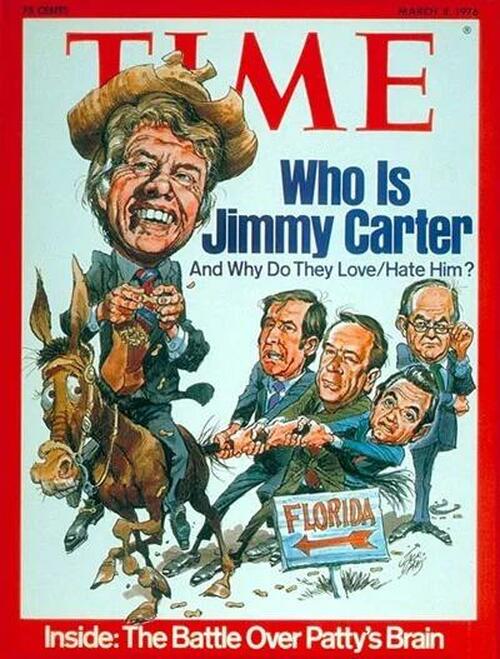

The Mainstream Media in the West as Hate Mongers and Warmongers

In retrospect, people are always amazed at how people allowed their leaders to behave so foolishly and against the interests of their own nations on the road to world wars.

The answer is banal: the mainstream media regularly play a devastating role, both on the road to war and during war. The mainstream media allow themselves to be used and wring their hands when those media that report honestly are destroyed. Without journalists who sell their souls and trample on the interests of their own country, there would be no such catastrophes.

A few gallows should be kept ready for the ladies and gentlemen responsible. That would be nothing new, by the way. Julius Streicher, publisher of the Nazi hate newspaper “Der Sturmer”, was hanged in Nuremberg.

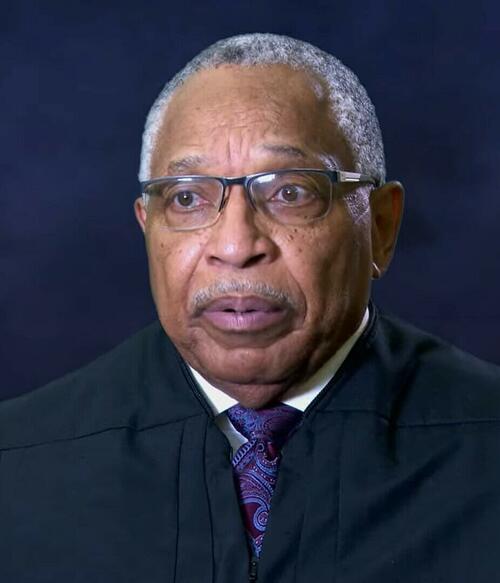

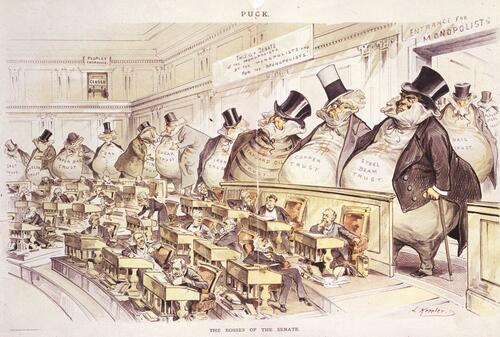

Hate propaganda can lead to a broken neck – Julius Streicher, former publisher of the newspaper “Der Stürmer”

This picture is intended to be a visual lesson in how it can end when you throw all journalistic principles overboard for evil.

The population in the West is already powerless

Since the brainwashing is not yet absolute, significant parts of the European population are still far from believing and supporting the madness spread by the media. The closed front of hatred – for example, against Russia – takes place primarily in the media, which are in complete lockstep throughout the West, with a few exceptions.

Significant parts of the population – in France, Germany and Austria, for example – have expressed their disgust with their leaders at the polls, and in a functioning democracy this should have led to political change. The political elites in France and Germany – and recently also in Austria – have used illegal means to prevent the political participation of those parties that advocate peace, for example in Ukraine, accompanied by the media labeling those who advocate peace as “Nazis” or at least “right-wing extremists. I have never heard of Adolf Hitler advocating peace.

There are certainly parallels with those dark times. The actions of the Nazi regime after it seized power in 1933 are virtually identical to those of today’s elites in Europe against dissenters in terms of restricting freedom of expression: inciting the masses against those sections of the population who question the policies of the powerful; bringing the media into line; and – especially in Germany – violating the law beyond recognition. For example, denying the winner of the regional elections in Thuringia the right to participate in the government or to have a blocking minority.

Freedom of expression in the midst of agony

Representative of the trend that freedom of expression in the West is hanging by a thread, here is a quote from John Kerry, on the occasion of a WEF meeting that took place between September 23 and 27.

“Our First Amendment stands as a major block to the ability to be able to hammer [disinformation] out of existence.

What we need is to win…the right to govern by hopefully winning enough votes that you’re free to be able to implement change.

In other words, Kerry qualifies freedom of expression as a problem and announces that this “problem” would be solved by the state if Kamala Harris wins. We leave this thought in the air and refer to our article: “US elections decide on war or peace”.

If it weren’t for the internet and blogs, the powerful would have already achieved their goal, because fortunately it seems practically impossible to silence all voices of reason.

BRICS: From an economic project to a geopolitical force

When representatives from Brazil, Russia, China and India first met formally on the sidelines of the UN General Assembly in New York in 2006, the world looked very different. Even in 2009, when the first formal BRIC summit was held in Yekaterinburg in June 2009, without South Africa – hence “BRIC” instead of “BRICS” – the world was different. The original goals of the BRIC countries were to achieve better economic cooperation between countries that had not yet been openly declared enemies or even sanctioned by the West. There seemed to be no rush (yet).

From 2014, pressure on Russia increased as a result of Maidan and Crimea. Russia was portrayed as the villain and sanctions were imposed. President Putin continued to seek diplomatic solutions for another eight years, welcomed Minsk I and II, but was again deceived. The artillery shelling of civilians in Donetsk by the “peaceful” Ukrainians did not stop, and NATO was building up the Ukrainian army for an attack on Russia.

Russia began to prepare for the foreseeable, especially economically, because militarily it had been doing so with great energy and creativity since the attack on Georgia in 2008. When the situation escalated in February 2022, Russia had apparently done its economic homework and could count on the loyalty of its partners in BRICS and SCO. The US miscalculation can be explained by the fact that Americans are unfamiliar with the concept of loyalty, while the EU miscalculation can be explained by the fact that most of its members are ruled by leaders whose stupidity borders on idiocy.

Russia has weathered the economic war unleashed by the West, despite a storm of sanctions unprecedented in world history. The losers are to be found in the West, with Germany being hit the hardest – also due to a senseless economic policy.

The U.S. did not limit its economic war to Russia, but also began to sanction China in 2014, as always with flimsy arguments. The EU – as a vassal of the US – has willingly gone along with this, and is currently doing so out of its own self-interest, since the industrial pearl that is Germany has already lost out due to misguided economic policies, bad decisions by its automotive industry and suicidal sanctions against Russia. Auto industry experts are speechless and wringing their hands: Since Covid, Mercedes has not managed to get its factories above 50% capacity – a complete collapse is becoming apparent across the board.

Next came the freezing of the reserves of the Russian Central Bank and the expropriation not only of Russians, but of anyone with a “Russian connection”, a term that is not legal in nature and has opened the door for governments and banks in the West to stage a raid.

China, which is only a few steps behind Russia in terms of sanctions, has become a target for the West because of its industrial superiority. It is the great new enemy of the US and Europe.

It would be naive to neglect the South China Sea and Taiwan, which are hot spots along with Ukraine and the Middle East, because what is at stake is nothing less than military domination of the Pacific, which the Americans have held since 1945, and control of one of the world’s most important transportation routes. Once the Americans are somewhere, you can’t get rid of them – even 80 years after a conflict. In Germany, for example, the US still operates 40 military bases. This alone makes it clear that Germany is not even nominally sovereign, but a mere vassal of the US. What “interests” the US “protects” for others around the globe remains in the dark.

Although most people consider military conflicts to be more important than economic wars because they are more bloody and evoke more emotion, history teaches us that the economically stronger ultimately prevails. As a consequence of this thought, it can be argued that the economic war as the decisive part of the 3rd World War is already in full swing.

In addition to many small military conflicts – such as in Africa – two increasingly escalating wars are currently raging: the conflict in Ukraine has been going on for two and a half years, and the latest conflict in the Middle East has been raging for a year.

Military escalation in Ukraine

Since last September, it has been clear who will prevail militarily in Ukraine. The advance of Russian troops across the entire front is accelerating steadily. We regularly recommend a YouTube channel that provides an unemotional daily report in English (“Military Summary”) and Russian (“??????e ??????”) of events at the front and has not made any mistakes: only facts.

Ukraine’s Kursk adventure will end as it was bound to end; the last elite Ukrainian troops that (President) Selenski assembled for this suicide mission and equipped with modern equipment will leave Kursk as prisoners or in body bags. My sources speak of more than 21,000 casualties on the Ukrainian side.