|

[Border Crossings]

[Ilya Somin] New Evidence that Making Legal Migration Easier Reduces Illegal Border Crossings

Economist Michael Clemens has the most extensive and sophisticated analysis of this issue to date.

Published:4/25/2024 5:06:13 PM

|

|

[Border Crisis]

Mexican NGO With Pro-Biden Flyers Also Allowed Anti-Trump Display, Images Show

A migrant services center in Mexico near the Texas border where pro-Joe Biden flyers recently were posted also was home to a display opposing Donald... Read More

The post Mexican NGO With Pro-Biden Flyers Also Allowed Anti-Trump Display, Images Show appeared first on The Daily Signal.

Published:4/25/2024 5:06:13 PM

|

|

[Markets]

Southwest Airlines is ending flights to four airports — and that’s not even the big news for travelers

Sit down for this one, Southwest Airlines travelers: The airline carrier with a distinct seating policy has suggested it’s rethinking its approach.

Published:4/25/2024 5:06:13 PM

|

|

[331dbc9e-755b-5ed5-911d-b2c8334b0627]

Bernie Williams is back in center - only this time Lincoln Center for New York Philharmonic debut

Bernie Williams, who signed with the NY Yankees in 1985 and later became a four-time World Series champion, has made his New York Philharmonic debut as a classical guitarist.

Published:4/25/2024 5:06:13 PM

|

|

[Politics]

A day all about Trump: Mostly out of sight, but still ubiquitous

From the Supreme Court to a Manhattan courtroom, Thursday showed how much of the 2024 campaign centers on Trump’s legal dramas.

Published:4/25/2024 5:06:13 PM

|

|

[Markets]

Trump’s tariffs could overshadow the benefits of his tax cuts, economists say

Published:4/25/2024 5:06:13 PM

|

|

[World]

Blinken set to meet Chinese leaders as superpowers manage rivalry

Relations have improved since Blinken’s 10 months ago, enabling the world’s two biggest economies to manage their tense and interdependent relationship.

Published:4/25/2024 5:06:13 PM

|

|

[World]

Speaker 'Moses' Johnson drowns House Republicans in the Red Sea

When Rep. Matt Gaetz and his band of political misfits cashiered former House Speaker Kevin McCarthy last year, they assured us they were leading Republicans out of the wilderness and finally into the promised land.

Published:4/25/2024 4:21:58 PM

|

|

[Politics]

Trump Faces 34 Felonies at Trial. But Was There a Crime?

I can’t tell you how many people I know who do not like former President Donald Trump yet nonetheless smell prosecutorial overreach in Manhattan. Manhattan... Read More

The post Trump Faces 34 Felonies at Trial. But Was There a Crime? appeared first on The Daily Signal.

Published:4/25/2024 4:21:58 PM

|

|

[Latest News]

Ilhan Omar and Daughter Show Face at Columbia Protest

Rep. Ilhan Omar (D., Minn.) and her daughter Isra Hirsi, a Barnard student who was arrested and suspended from Columbia University last week for her role in anti-Israel protests on campus, attended another anti-Israel demonstration at Columbia together on Thursday.

The post Ilhan Omar and Daughter Show Face at Columbia Protest appeared first on Washington Free Beacon.

Published:4/25/2024 4:21:58 PM

|

[Politics]

“Zionists don’t deserve to LIVE” – Alleged leader of Columbia pro-Hamas encampment which school leaders ignored

This is a great example of the wretched trash organizing Columbia students at this pro-Hamas encampment. This agitator, who is on video saying Jews don’t deserve to live and compares them to . . .

Published:4/25/2024 4:21:58 PM This is a great example of the wretched trash organizing Columbia students at this pro-Hamas encampment. This agitator, who is on video saying Jews don’t deserve to live and compares them to . . .

Published:4/25/2024 4:21:58 PM

|

|

[]

Karma Reigns: Harvard HamaNazis Wake Up to a Super-Soaking

Published:4/25/2024 4:21:58 PM

|

|

[1ab6a0f4-ba4f-5888-84ba-499218b16cb2]

Apes spotted on horseback at San Francisco beach for 'Kingdom of the Planet of the Apes' promotional shoot

The newest "Planet of the Apes" movie is on its way. Promotion for the film included three actors dressed as apes, riding horseback along a San Francisco beach.

Published:4/25/2024 4:21:58 PM

|

|

[b3fa08b3-f85d-5f06-a3d2-d35b1ecf0d95]

Trump prosecutor quit top DOJ post for lowly NY job in likely bid to ‘get’ former president, expert says

Matthew Colangelo, a key member of Manhattan DA Alvin Bragg's team prosecuting President Trump, was once a senior official in the Biden Justice Department.

Published:4/25/2024 4:21:58 PM

|

[Entertainment]

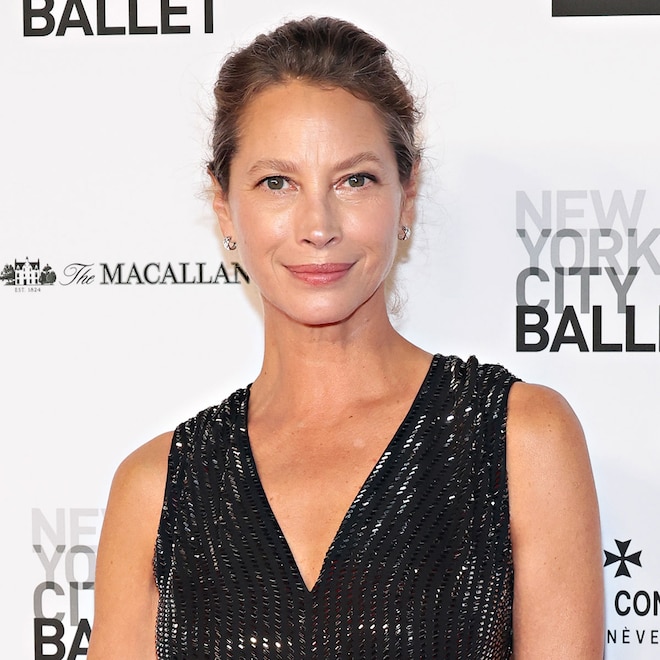

Christy Turlington Says Nude Pic Circulated at Son's Basketball Game

Christy Turlington Burns will not be nude-shamed.

The supermodel recently recalled an experience she had while attending one of her son Finn's high school basketball games during which she learned...

Christy Turlington Burns will not be nude-shamed.

The supermodel recently recalled an experience she had while attending one of her son Finn's high school basketball games during which she learned...

Published:4/25/2024 4:21:58 PM

|

|

[Radiative Imbalance]

Temporal & Spatial Thermal Response to Heat Input, Transfer & Retention in the Climate System

The thermal responses of different regions are analysed as a means to understand why spatial and temporal changes in ToA solar EMR drive temperature trends.

Published:4/25/2024 4:21:58 PM

|

|

[Uncategorized]

USC Cancels Main Commencement After Numerous Anti-Israel Protests

Crazy idea. How about you keep the students safe and punish those who break the law and school rules?

The post USC Cancels Main Commencement After Numerous Anti-Israel Protests first appeared on Le·gal In·sur·rec·tion.

Published:4/25/2024 4:21:58 PM

|

|

[Anti-Americanism]

The NFL we Knew is Gone, and it is Never Coming Back

I learned a few days ago that tonight is the start of the NFL Draft. For many years this date was marked on my calendar months out, and today I ...

The post The NFL we Knew is Gone, and it is Never Coming Back appeared first on Flopping Aces.

Published:4/25/2024 4:21:58 PM

|

[Markets]

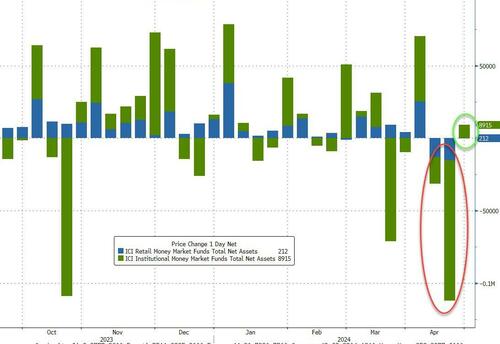

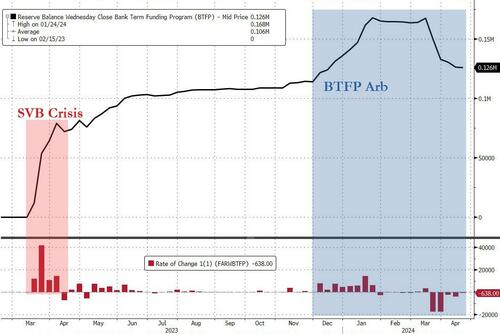

As Tax-Season Ebbs, Money-Market Funds See Return Of Inflows; Fed's Bank Bailout Fund Remains At $126BN

As Tax-Season Ebbs, Money-Market Funds See Return Of Inflows; Fed's Bank Bailout Fund Remains At $126BN

After the prior week's almost unprecedented outflows, total money market fund assets rose last week (admittedly by a modest $9.1BN), but remain below the $6TN level ($5.97TN) as tax-season draws roll off...

Source: Bloomberg

The flows into money-market fund assets through April 24 mainly on the back of inflows by institutional investors, which had led the tax-related decline the prior week. Institutions added $8.9 billion in money-market fund exposure.

Source: Bloomberg

In a breakdown for the week to April 24, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.84 trillion, a $3.97 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $1.02 trillion, a $3.15 billion increase.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold - and this week has seen rate-cut expectations tumble further...

Source: Bloomberg

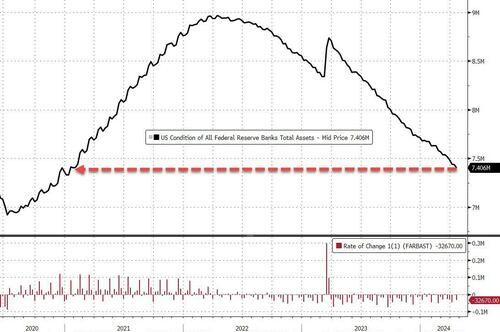

The Fed balance sheet continued to shrink, falling $32.8BN to its lowest since Jan 2021...

Source: Bloomberg

As The Fed starts discussing tapering QT, usage of The Fed's bank bailout facility (now expired but these are 12 month term loans) continued to decline (though only by a tiny $638MM), basically erasing all the late-period arb-driven inflows, leaving a huge $126BN hole in bank balance sheets still being filled by this...

Source: Bloomberg

This means the 'real' crisis money that banks used to save their souls is yet to really unwind from this bailout fund (and rates are considerably higher now than they were a year ago when the balance sheet holes were stuff with fake Fed paper - i.e. the losses are bigger).

Finally, we note that bank reserves at The Fed plunged last week and while US equity market cap has bounced a little in the last two days, we suspect the trend down (and a painful recoupling) remains a threat...

Source: Bloomberg

While there may be no rate-cuts anytime soon... will The Fed taper QT in a big enough manner to avoid that recoupling?

|

|

[Markets]

Stocks pared losses on Thursday with help of these bright spots

Published:4/25/2024 4:21:58 PM

|

|

[Politics]

Kavanaugh says ‘most people’ now revere the Nixon pardon. Not so fast.

It might have been true at one point. It’s not so clear it is anymore -- particularly as another former president stands accused of his own dirty tricks.

Published:4/25/2024 4:21:58 PM

|

|

[Markets]

Boston Beer reports a surprise profit as Twisted Tea shipments keep growing

Boston Beer’s stock surged in after-hours trading Thursday, after the beer brewer reported a surprise first-quarter profit and revenue that rose well above forecasts, fueled by volume increases, pricing and lower returns.

Published:4/25/2024 4:21:57 PM

|

|

[ae64ce5e-3c09-5a50-8fb7-122694bf4f86]

Kim Kardashian visits White House, will fight for criminal justice and learn with 'every administration'

Kim Kardashian spoke at the White House about criminal justice reform and emphasized she was committed to the fight, no matter the administration.

Published:4/25/2024 4:21:57 PM

|

|

[World]

Troubling S&P 500 chart suggests that stock investors have a rough road ahead

Oversold rally earlier this week doesn’t erase the U.S. market’s negative picture.

Published:4/25/2024 4:21:57 PM

|

|

[]

Terror-Sympathizers Attempt Takeover of UT Austin; Greg Abbott Sends in the Texas National Guard

The DOJ has explained to us that "parading" with the intent to disrupt any government function is a major felony. So parading to shut down a government-funded school is a major crime for which people should be jailed without trial...

Published:4/25/2024 4:21:57 PM

|

|

[Politics]

Litman: Will Trump be tried for Jan. 6? After Supreme Court arguments, it's more uncertain than ever

The conservative justices seemed likely to confer broad presidential immunity from prosecution — and in a way that would further delay any federal trial.

Published:4/25/2024 3:54:45 PM

|

|

[b3d15e93-2789-5cae-b70f-edff21c6960c]

Radical NPR chief Katherine Maher's top secret agenda

NPR CEO Katherine Maher’s résumé provides us with a map of modern power, connecting political revolutions overseas with the cultural revolution here at home.

Published:4/25/2024 3:54:44 PM

|

|

[Markets]

Skechers stock soars 7% after earnings crush estimates and company offers upbeat guidance

Skechers Inc.’s stock soared 7% in after-hours trade Thursday, after the athletic footwear company swept past earnings estimates for the first quarter.

Published:4/25/2024 3:54:44 PM

|

|

[Markets]

Dow Jones Futures Rise; Microsoft, Google Jump After Market Rally Shows Resilience

Microsoft and Google jumped on earnings late after the market rally attempt showed resilience Wednesday amid Meta's sell-off.

Published:4/25/2024 3:54:44 PM

|

|

[Markets]

Skechers stock soars on earnings that crushed estimates, upbeat guidance

Published:4/25/2024 3:54:44 PM

|

|

[Uncategorized]

NYU Anti-Israel Student Protester Asks Friend, ‘Why Are We Protesting Here?’

"I honestly don't know all of what NYU is doing ... I really don't know"

The post NYU Anti-Israel Student Protester Asks Friend, ‘Why Are We Protesting Here?’ first appeared on Le·gal In·sur·rec·tion.

Published:4/25/2024 3:30:08 PM

|

|

[925781ec-617f-5057-96a9-666c57103fbf]

Florida, Oklahoma instruct schools to ignore Biden's Title IX changes, pending legal challenges

Education officials in Oklahoma and Florida have instructed schools to avoid implementing the Biden administration's latest Title IX changes, warning that legal challenges are forthcoming.

Published:4/25/2024 3:30:08 PM

|

|

[World]

Pamela Paul on Grievance Culture and 'Progressive Stacking'

Published:4/25/2024 3:30:08 PM

|

|

[Gear]

There's a Rare $25 Discount on the Nintendo Switch OLED Right Now

Nintendo's top-of-the-line handheld gaming console hardly ever goes on sale, making this small discount super appealing.

Published:4/25/2024 3:30:08 PM

|

|

[747d584b-ac77-56ad-9196-10bb642707e9]

Kelly Osbourne says she 'almost died' after brother Jack Osbourne shot her with pellet gun

Kelly Osbourne opened up about the time her brother, Jack Osbourne, shot her with a pellet gun. She says it felt like someone put a "hot poker through" her.

Published:4/25/2024 3:30:08 PM

|

|

[Markets]

How major US stock indexes fared Thursday, 4/25/2024

Stocks closed lower on worries about a potentially toxic cocktail for financial markets, one where inflation remains stubbornly high but the economy’s growth flags. The Dow Jones Industrial Average lost 1%, and the Nasdaq composite gave back 0.6%. The Nasdaq composite fell 100.99 points, or 0.6%, to 15,611.76.

Published:4/25/2024 3:30:08 PM

|

|

[Markets]

Alphabet’s stock surges on Triple Crown of first-ever cash dividend, $70 billion stock buyback, strong results

Alphabet’s board also authorized the repurchase of up to $70 billion in shares.

Published:4/25/2024 3:30:08 PM

|

|

[Markets]

Intel's stock drops 8% after revenue miss

Published:4/25/2024 3:30:08 PM

|

|

[World]

Gilead’s quarterly loss is narrower than expected

Gilead Sciences Inc.’s stock rose 0.8% in after-hours trading Thursday, after the drug company’s adjusted first-quarter profit was narrower than expected.

Published:4/25/2024 3:30:08 PM

|

|

[Artists]

With a New Model, Forge Project Is Putting Indigenous Art at the Forefront

The arts organization is restructuring to further its sustainability and impact.

Published:4/25/2024 3:30:08 PM

|

|

[]

Tucker Carlson: Dropping Two Nukes to End WWII Was "Prima Facie Evil"

Tucker Carlson continues his headlong rush to the far left. He also seems to call for denuclearization. Even better. He showed off his newly woke philosophy for Joe Rogan, who is now certainly more rightwing than Tucker Carlson. I love,...

Published:4/25/2024 3:30:08 PM

|

[Markets]

Fauci To Testify In Public Hearing On COVID-19 Response, Origins

Fauci To Testify In Public Hearing On COVID-19 Response, Origins

Authored by Stephen Katte via The Epoch Times,

Dr. Anthony Fauci is locked in to testify before the Select Subcommittee on the Coronavirus Pandemic on June 3, his first public hearing since retiring as the president’s chief medical advisor in 2022.

Subcommittee Chair Brad Wenstrup (R-Ohio) announced in an April 24 press release that Dr. Fauci agreed to appear late last year.

“Retirement from public service does not excuse Dr. Fauci from accountability to the American people,” Mr. Wenstrup said.

“On June 3, Americans will have an opportunity to hear directly from Dr. Fauci about his role in overseeing our nation’s pandemic response, shaping pandemic-era policies, and promoting singular questionable narratives about the origins of COVID-19.”

Dr. Fauci testified in a closed door hearing in January.

According to Mr. Wenstrup, Dr. Fauci has already admitted “to serious systemic failures in our public health system,” which he says deserves “further investigation.”

Mr. Wenstrup says among other revelations, Dr. Fauci has said the six feet apart social distancing guidance, recommended by federal health officials and used to shut down small businesses across the country, “’sort of just appeared,” and was likely not based on scientific data.

During the two-day January hearing, Dr. Fauci revealed he signed off on every foreign and domestic NIAID grant without personally reviewing the proposals.

He also admitted that America’s vaccine mandates, which he promoted, could increase the public’s vaccine hesitancy in the future.

Lab Leak—Not So Far-Fetched

At the same time, Dr. Fauci said the lab leak hypothesis around COVID-19’s origins might not be a conspiracy theory, despite his previous very public assertions that it was.

The lab leak theory claims that SARS-CoV-2, the virus that causes COVID-19, was developed at the Wuhan Institute of Virology (WIV) and was accidentally leaked. In the years since COVID first appeared, this hypothesis has been gaining steam, with even the former head of the Chinese Center for Disease Control and Prevention (China CDC) saying it can’t be ruled out as an option.

Mr. Wenstrup claimed that during the previous hearing, Dr. Fauci said he “did not recall” specific COVID-19 information and conversations relevant to the Select Subcommittee’s investigations over 100 times.

A full transcript is expected to be released before the public hearing in June.

Mr. Wenstrup believes the testimony shared so far “raises significant concerns about public health officials and the validity of their policy recommendations during the COVID-19 pandemic.”

“We also learned that he believes the lab leak hypothesis he publicly downplayed should not be dismissed as a conspiracy theory,” he said.

“As the face of America’s public health response to the COVID-19 pandemic, these statements raise serious questions that warrant public scrutiny,” Mr. Wenstrup added.

Following Dr. Fauci’s hearing, the select subcommittee will also hold a public hearing with EcoHealth Alliance president Dr. Peter Daszak on May 1.

Mr. Wenstrup said it “will serve as a crucial component of our investigation into the origins of COVID-19 and provide essential background ahead of Dr. Fauci’s public hearing.”

“We look forward to both Dr. Fauci’s and Dr. Daszak’s forthcoming and honest testimonies, and appreciate their willingness to voluntarily appear before the Select Subcommittee for public hearings.”

|

[Entertainment]

Chris Pine Reveals the Story Behind His Unrecognizable Style Evolution

Wonder no more: Chris Pine is shedding light on his fashion evolution.

Indeed, when the 43-year-old stepped onto the carpet April 24 for his new movie Poolman, it was in homage to his character...

Wonder no more: Chris Pine is shedding light on his fashion evolution.

Indeed, when the 43-year-old stepped onto the carpet April 24 for his new movie Poolman, it was in homage to his character...

Published:4/25/2024 2:59:59 PM

|

|

[Markets]

Dow Jones Cuts Losses After Plunging 700 Points; Stock Market Still Down As Meta, Caterpillar Plunge

The Dow Jones Industrial Average trimmed what was a 700-point loss by nearly half in late-afternoon trading Thursday and is still trying to recover from an earnings-fueled drop courtesy of component Caterpillar. Other indexes also got hit as Facebook and Instagram operator Meta Platforms led techs lower, as it plunged as much as 16% on the stock market today. With an hour remaining in the regular session, Meta trimmed that big loss to a still-heavy 11.6%.

Published:4/25/2024 2:59:59 PM

|

|

[Business]

Net Neutrality Returns to a Very Different Internet

The FCC voted 3-2 to restore net neutrality rules that had disappeared during the Trump administration.

Published:4/25/2024 2:59:59 PM

|

|

[Markets]

Rubrik CEO says company focused on path to profitability as stock pops after IPO

Published:4/25/2024 2:59:59 PM

|

|

[Campus]

NYU Encampment Organizers Encourage Protesters To Join Pro-Hamas ‘Resistance Network’

Anti-Israel protest organizers at New York University protesters encouraged their followers to get "plugged into" a Telegram channel that routinely promotes Hamas and other terrorist organizations.

The post NYU Encampment Organizers Encourage Protesters To Join Pro-Hamas ‘Resistance Network’ appeared first on Washington Free Beacon.

Published:4/25/2024 2:59:59 PM

|

|

[World]

Trump’s Response to Bill Barr’s Endorsement Was Hilarious, but Was It Beneficial?

Published:4/25/2024 2:59:59 PM

|

|

[World]

GDP report revives stagflation fears in the market, with growing risk of a Fed rate hike seen

Thursday’s U.S. economic data is ringing alarm bells in the minds of traders, economists and others, who are beginning to voice concerns that the world’s largest economy could be shifting into a stagflation-type of environment.

Published:4/25/2024 2:59:59 PM

|

|

[Law]

Biden’s DOJ Wants to Give Crime Victim Compensation to Criminals, Illegal Aliens

The Biden administration essentially wants states to give federal grant money to illegal aliens, convicted criminals, and people who contributed to their own victimization under... Read More

The post Biden’s DOJ Wants to Give Crime Victim Compensation to Criminals, Illegal Aliens appeared first on The Daily Signal.

Published:4/25/2024 2:24:50 PM

|

|

[36f94956-6159-5595-b6a6-06c2a183035a]

Orlando Bloom confesses to extreme wellness trend that gave him ‘sensation of death’

Orlando Bloom explains why he's not afraid to try new things to better his health and overall well-being -- including ingesting frog poison.

Published:4/25/2024 2:24:49 PM

|

|

[Markets]

Oil prices give up losses to settle at a more than 1-week high

Oil futures shake off early losses Thursday to finish higher, with both U.S. and global benchmark prices settling at their highest in more than a week.

Published:4/25/2024 2:24:49 PM

|

|

[]

Of Course: One of LA Soros DA George Gascon's Top Employees -- the Attorney "For Ethics and Integrity Operations" -- Illegally Accessed Police Files on Political Opponents

How much degradation and brutalization by evil communists can this country withstand? Note she illegally read the records of opponents of his former boss, who was the LA Sheriff, not the opponents of George Gascon. (Although, of course, they share...

Published:4/25/2024 2:24:49 PM

|

|

[Politics]

Why Is Gold Up 12.5% for 2024, and Should I Invest?

Gold prices are experiencing an upward trend, and there are several factors contributing to this rise. Understanding these factors can help investors decide whether Gold is a suitable investment for their portfolio.

The post Why Is Gold Up 12.5% for 2024, and Should I Invest? appeared first on Breitbart.

Published:4/25/2024 2:07:31 PM

|

[Politics]

WATCH: Jonathan Turley weighs in on SCOTUS arguments on Trump immunity

Jonathan Turley weighed in on the Supreme Court’s oral arguments this morning on Trump’s claims of immunity regarding the 2020 election and January 6th. In short, Turley felt it was very positive . . .

Published:4/25/2024 2:07:31 PM Jonathan Turley weighed in on the Supreme Court’s oral arguments this morning on Trump’s claims of immunity regarding the 2020 election and January 6th. In short, Turley felt it was very positive . . .

Published:4/25/2024 2:07:31 PM

|

|

[Earnings]

Mark Zuckerberg Made Meta A.I. the Main Character in Q1 Earnings

Much of the conversation was centered around the new Meta A.I., an updated version of the company’s personal assistant model that is built into its social platforms.

Published:4/25/2024 2:07:31 PM

|

|

[Markets]

My stepfather is in a nursing home with dementia. His daughter whispers, ‘Where are your paychecks?’ in his ear. How can my mother protect him?

“My mother has a durable power of attorney for Sam’s healthcare and is his primary representative. No one has financial POA.”

Published:4/25/2024 2:07:31 PM

|

|

[Markets]

On Watch podcast: The Moneyist’s advice for financial fitness

Published:4/25/2024 2:07:31 PM

|

|

[Markets]

GLOBAL MARKETS-Equities fall amid earnings gloom, as persistent inflation lifts Treasury yields

Stocks snapped a three-day winning streak on Thursday as disappointing forecasts from Facebook and Instagram owner Meta hammered the tech sector, and Japan's yen sank through 155 per dollar for the first time since 1990. Tepid U.S. GDP data pushed Wall Street lower at its open, and Meta's slump also soured the mood. U.S. Treasury yields rose after the data showed signs of persistent inflation, lowering hopes that the Federal Reserve will cut interest rates anytime soon.

Published:4/25/2024 2:07:31 PM

|

[Entertainment]

The Simpsons Kills Off Original Character After 35 Seasons

A stool will remain empty at Moe's Tavern from now on.

After all, The Simpsons character Larry the Barfly, voiced by Harry Shearer, was killed off after 35 seasons on the longest-running animated...

A stool will remain empty at Moe's Tavern from now on.

After all, The Simpsons character Larry the Barfly, voiced by Harry Shearer, was killed off after 35 seasons on the longest-running animated...

Published:4/25/2024 1:42:16 PM

|

|

[]

Did Gov. Abbott's Crackdown on Pro-Hamas Protesters at UT Go Too Far?

Published:4/25/2024 1:42:16 PM

|

|

[World]

Housing supply surges by up to 50% in these metro areas — and many sellers are being forced to slash their asking prices

The property report includes 85 major metropolitan areas in the U.S. with populations of at least 750,000.

Published:4/25/2024 1:42:16 PM

|

|

[Uncategorized]

Report: Gaza Terrorists Attack U.S. Humanitarian Pier During Construction Work

i24NEWS: "Gazan terrorists fired mortar shells on Wednesday towards the construction work on the humanitarian pier being built off the coast of Gaza."

The post Report: Gaza Terrorists Attack U.S. Humanitarian Pier During Construction Work first appeared on Le·gal In·sur·rec·tion.

Published:4/25/2024 1:31:17 PM

|

[Entertainment]

Former Slack CEO's 16-Year-Old Child Mint Butterfield Reported Missing

Authorities are trying to locate Slack cofounder Stewart Butterfield's 16-year-old child.

Mint Butterfield was last seen late April 21 in Bolinas, Calif., a Marin County Sheriff's Office deputy...

Authorities are trying to locate Slack cofounder Stewart Butterfield's 16-year-old child.

Mint Butterfield was last seen late April 21 in Bolinas, Calif., a Marin County Sheriff's Office deputy...

Published:4/25/2024 1:31:17 PM

|

[Politics]

[FULL VIDEO] California mayor’s security detail ATTACKED while doing interview in San Jose

A California mayor’s security detail was attacked during an interview with Chron 4 on the streets of San Jose. The man first came up and interrupted the interview by talking on his . . .

Published:4/25/2024 1:31:17 PM A California mayor’s security detail was attacked during an interview with Chron 4 on the streets of San Jose. The man first came up and interrupted the interview by talking on his . . .

Published:4/25/2024 1:31:17 PM

|

|

[World]

Culture Warrior in Chief

The modern presidency is a divider, not a uniter. It has become far too powerful to be anything else.

Published:4/25/2024 1:31:17 PM

|

|

[79780807-d507-5fe1-aff2-6e3955300e56]

Bragg 'allowed political motivations' to 'infect' prosecution of Trump, House Judiciary GOP says

Manhattan DA Alvin Bragg "allowed political motivations and animus to infect its prosecutorial discretion," the House Judiciary Committee argued in a report Thursday

Published:4/25/2024 1:31:17 PM

|

|

[1788bf1e-7c60-5937-8b9b-018c796f5787]

'Friends' star Courteney Cox admits regret about how she raised teenage daughter

"Friends" star Courteney Cox has some parenting regrets when it comes to her now 19-year-old daughter, Coco, including wishing she had been a little more strict.

Published:4/25/2024 1:31:17 PM

|

[Markets]

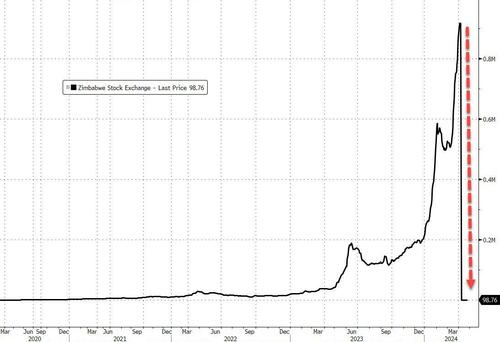

Sixth Time The Charm? Meet The ZiG: Zimbabwe's New 'Gold-Backed' Currency

Sixth Time The Charm? Meet The ZiG: Zimbabwe's New 'Gold-Backed' Currency

Authored by Peter C. Earle via The American Institute for Economic Research,

Zimbabwe’s historical relationship with money has been inundated with mistakes, recklessness, and hardship. During the peak of its 2008 hyperinflation, the nation experienced a catastrophic economic downturn, characterized by the issuance of billion- and trillion-dollar banknotes that were, despite their nominal enormity, virtually worthless. Recent economic challenges have revived painful memories of that era with the resurgence of inflation (currently at 55 percent), a return to the US dollar, euro, and South African Rand as de facto currencies, and the necessity of using large physical stacks of bills to purchase basic commodities like bread and eggs.

On April 5, a new currency was announced.

Later this month, the ZiG (Zimbabwe Gold) will replace the current monetary unit, the Zimbabwean Real Time Gross Settlement dollar (RTGS). The ZiG marks a sixth attempt by the Zimbabwean government and central bank to introduce a currency unit that sets its monetary house in order.

Upon declaring independence in 1980, the Reserve Bank of Zimbabwe (RBZ) issued the original Zimbabwe dollar (ZWD) to replace the Rhodesian dollar at par (1:1). Over the subsequent two decades, the money supply expanded amid fiscal mismanagement, policy errors, and authoritarian governance. Denominations of the ZWD grew from two, five, and 10 ZWD denominations into bills marking hundreds, thousands, and millions of units, each with precipitously dissipating purchasing power.

In August 2006, the first attempt to reform the original ZWD was undertaken.

The RBZ recalled outstanding currency notes, replacing them with redenominated notes of one one-thousandth the value of the previous notes by slashing three decimal places.

Roughly two years later, in August 2008, a second redenomination marked the third ZWD reissue, this time slashing ten decimal places.

By this point, prices were at least doubling on a daily basis. Thus did each ten billion ZWD note become one ZWD to address the increasingly unwieldy terms of face-to-face market transactions. The apex of the hyperinflation was reached with the issue of the 100 trillion ZWD banknote, after which in February 2009 — barely six months later the previous redenomination — twelve zeros had to be removed from currency units. This was the fourth ZWD issue. By this point, the 1980 ZWD had been whittled down to one-sextillionth (0.000000000000000000001) of its initial value. Errors in simple transactions became commonplace, with both calculators and computers unable to handle fundamental accounting operations. Agriculture, a difficult commercial undertaking even with a stable currency, is all the more challenging when consummated in units usually reserved for astronomers.

By the end of 2008, 28 years of inflation topped a total 231 million percent.

The ZWD was demonetized in 2009, with the Euro, the South African Rand, and the US dollar as well as smaller, regional currencies supplanting it.

In 2015, that process was completed, with every 35 quadrillion ZWD presented at a bank being retired for a single US dollar.

Alongside a wide array of currencies in use throughout the next few years were Zimbabwean government bond notes.

In 2019, the Real Time Gross Settlement (RTGS) dollar was issued, but quickly ran into trouble — even before the COVID pandemic broke out. Inflation followed yet again, and the use of international currencies — which had been outlawed upon the introduction of the RTGS — was again legalized. When issued, the RTGS was set at an official exchange rate of 2.5 per US dollar. Since the start of 2024, though, it has lost 80 percent of its value, recently trading at 30,671 per US dollar. At this rate of inflation, an item that cost $100 US dollars in 1980 would have cost over $700 billion dollars by 2023.

USD-ZIM/RTGS exchange rate (2022 – present)

(Source: Bloomberg Finance, LP)

On April 30, 2024, RTGS units will be exchangeable for ZiG as the new coins and bills begin circulating. RBZ Governor John Mushayavanhu has announced the initial exchange rate for the ZiG at 13.56 per US dollar, with subsequent rates to be determined through interbank markets. Hopes for the success of the ZiG are underpinned by a reputed $185 million worth of gold and other reserves backing it. There are practical hurdles, though.

The sustainability of a gold-backed currency like ZiG is uncertain considering the limited extent of Zimbabwe’s physical gold reserves relative to the desired exchange rate. Moreover, the absence of concurrent measures from its trading partners leaves the new currency susceptible to fluctuations in gold prices. Black markets, which speak truth to a fault, are registering doubt.

And investors in the Zimbabwe Stock Exchange in Harare have made no secret whatsoever about their cynicism, sending stock prices down 99 percent in several hours after the ZiG announcement.

Zimbabwe Stock Exchange (Jan 2024 – present)

(Source: Bloomberg Finance, LP)

Zimbabwe still relies upon printing money to finance its budget deficits. Although Mushayavanhu has adamantly pledged to avoid this practice, at the onset the ZiG faces an uphill battle to claim public trust, given nearly a half century of monetary disasters. Moreover, the government’s insistence on accepting payments for certain services exclusively in US dollars, such as road toll fees and passport processing, is undermining confidence in the new money even before it begins changing hands.

Reports indicating that the government will require tax payments in mixed currency are further dimming prospects for the ZiG’s acceptance and viability.

The Zimbabwean government has, in addition, associated the latest monetary project with the global dedollarization movement. While there remains a possibility for the ZiG to outperform its predecessors, the country’s tumultuous economic history, transitioning from hyperinflation to hyper-dollarization and currently grappling with double-digit inflation and interest rates, underscores deep-rooted issues beyond mere monetary policy, including governance deficiencies and corruption risks. Ruinous policies which have destroyed the productiveness of the nation’s economy, as well as the classic blame-mongering of businesses for the rising general price level (something Americans have borne witness to recently as well) have been commonplace. Without comprehensive fundamental reforms addressing these systemic challenges, Zimbabwe risks perpetuating its reliance on emigration as a coping mechanism alongside the enduring symbol of its economic turmoil, the multi trillion-dollar banknote. The efficacy of any monetary system, whether a commodity standard or any other, hinges singularly upon the integrity and competence of its custodians.

Dissipated Zimbabwean cash is thumbtacked to many a bulletin board, and fetches many more US dollars in exchange on eBay than it ever did in its circulatory prime. The trinketization of that money, however, has come at great human cost. According to the US Agency for International Development, a staggering 63 percent of Zimbabwean households endure poverty, with one in eight experiencing extreme deprivation. That juxtaposes with the nation’s abundant mineral resources, spanning over 40 distinct minerals: platinum group metals, gold, coal, lithium, and diamonds among others. Despite that potential wealth, the realization of economic advancement remains contingent upon substantive political reforms.

Even the most faithfully implemented commodity-backed money standard is fundamentally predicated on the integrity and competence of its overseers. Successive waves of spectacular currency destruction speak to a deeper illness in economic and political institutions, strongly alluding to systemic vulnerabilities. One hopes, for the sake of the long-suffering citizens of Zimbabwe, that this time around the result of yet another monetary reconstitution is successful, fostering a stable general price level, a reliable monetary unit for saving and spending, and enhanced possibilities for economic calculation. Without fundamental changes guaranteeing private property protection, pro-market reforms, and safeguards against corruption, though, the ZiG is likely to retrace the unfortunate steps of its predecessors.

|

|

[World]

Europe needs to be stronger, not a U.S. ‘vassal,’ says France’s Macron

Emmanuel Macron outlined his vision for Europe, including plans to bolster defense production and expand industrial policy to stand against Russia and compete with economic superpowers.

Published:4/25/2024 1:31:17 PM

|

|

[Markets]

Half of households can only afford a $400 car payment. Their options are scarce.

Published:4/25/2024 1:31:17 PM

|

|

[Markets]

Dow Jones Cuts Losses In Half After Plunging 700 Points; Stock Market Still Down As Meta, Caterpillar Plunge

The Dow Jones Industrial Average trimmed what was a 700-point loss by half in afternoon trading Thursday as the index tried to recover from an earnings-fueled drop courtesy of component Caterpillar. Other indexes also got hit as Facebook and Instagram operator Meta Platforms led techs lower, plunging as much as 16% on the stock market today. Inside the IBD 50, Deutsche Bank and First Citizens BancShares led with gains of roughly 8% each.

Published:4/25/2024 1:31:17 PM

|

|

[]

Callous Joe Biden Ignores Hostage Video of American Hersh Goldberg-Polin

Published:4/25/2024 1:31:17 PM

|

|

[Markets]

Royal Caribbean sees record bookings as demand for experiences and travel grow

There were a lot of records associated with Royal Caribbean’s first-quarter report, including ticket pricing, bookings and the stock, as demand for cruises remained “very robust.”

Published:4/25/2024 1:31:17 PM

|

|

[]

NY Court of Appeals Tosses Harvey Weinstein's 2020 Rape Conviction

There's a rule that you can't put on evidence of prior "bad acts" to prove that a defendant committed the specific bad acts he's being tried for in the present case. It's not that such evidence is completely irrelevant; it's...

Published:4/25/2024 1:31:17 PM

|

|

[Energy]

Biden’s Anti-Solar Solar Energy Plan

President Joe Biden has pledged to reduce carbon emissions to “net zero” in the U.S. electricity sector by 2035. This fantastical plan is, we are... Read More

The post Biden’s Anti-Solar Solar Energy Plan appeared first on The Daily Signal.

Published:4/25/2024 12:26:29 PM

|

|

[World]

GDP Growth Slows in First Quarter While Inflation Remains High. Can You Say 'Stagflation'?

Published:4/25/2024 12:26:29 PM

|

|

[Bad science journalism]

L A Times Editorial Claim that “The planet is experiencing a horrifying streak of record-breaking heat” is Unsupported by NOAA’s Climate Data

This L A Times hyped claim of global “horrifying streak of record-breaking heat” is falsified by NOAA’s 129+ yearlong measured climate data outcomes as measured over 9 of 16 NOAA’s global climate regions, the Contiguous U.S. and California as presented in detail in the analysis provided above.

Published:4/25/2024 12:26:29 PM

|

|

[european central bank]

How Did Europe Get Left Behind?

If the United Kingdom or France joined the United States, they would become the poorest states in the country, with a GDP per capita lower than even Mississippi.

Published:4/25/2024 12:26:29 PM

|

|

[Markets]

Why a $100,000 salary no longer buys you a middle-class lifestyle

Published:4/25/2024 12:26:29 PM

|

|

[World]

José Andrés eulogizes World Central Kitchen workers killed in Gaza

José Andrés praises the World Central Kitchen workers killed in Gaza as “the best of humanity” in an emotional speech at a Washington National Cathedral memorial service.

Published:4/25/2024 12:26:29 PM

|

|

[Politics]

Anti-democratic warning signs are blinking in current polling

The Pew Research Center found indifference among Republicans about Donald Trump’s actions in 2020 and about the need to concede in the future.

Published:4/25/2024 12:26:29 PM

|

|

[]

A Secret Service Agent Assigned To Kumala Harris Physically Attacks the Special Agent In Charge of the Detail, While Armed;There Were Reportedly "DEI Concerns" About How This Agent Was Hired

Tom Rogan @TomRtweets Scooplet- An armed U.S. Secret Service agent assigned to Vice President Kamala Harris's protective detail fought unarmed with other detail agents on Monday morning. The incident occurred at Andrews AFB, shortly before Harris arrived. Susan Crabtree @susancrabtree...

Published:4/25/2024 12:26:29 PM

|

|

[Politics]

Trump Trials: NY Jury Hears Tabloid Publisher's Testimony, Supreme Court Hears Immunity Arguments

Former President Donald Trump will be back in a New York City courtroom Thursday as his business records trial resumes after a day's break.

The post Trump Trials: NY Jury Hears Tabloid Publisher’s Testimony, Supreme Court Hears Immunity Arguments appeared first on Breitbart.

Published:4/25/2024 11:56:07 AM

|

|

[World]

How treatment of miscarriages is upending the abortion debate

New abortion restrictions after Roe vs. Wade was overturned, such as an Arizona legal ruling that effectively bans abortions there, are affecting women who miscarry.

Published:4/25/2024 11:56:07 AM

|

[Politics]

White House CENSORS Biden gaffe over his teleprompter fail

The White House censored Joe Biden’s teleprompter fail where he read the word ‘pause’ instead of actually pausing after saying “four more years”. In the transcript on the White House website, they . . .

Published:4/25/2024 11:56:07 AM The White House censored Joe Biden’s teleprompter fail where he read the word ‘pause’ instead of actually pausing after saying “four more years”. In the transcript on the White House website, they . . .

Published:4/25/2024 11:56:07 AM

|

|

[Politics]

[Josh Blackman] The Kentucky Legislature Removed The Governor's Power To Temporarily Appoint A Senator

Would the Governor's veto of the bill have even been effective?

Published:4/25/2024 11:56:07 AM

|

|

[Quick Takes]

Emerson Students Erect Tents in Public Alley, Allegedly Harass Jewish Passersby

“Up, up, with liberation, down, down, with occupation.”

The post Emerson Students Erect Tents in Public Alley, Allegedly Harass Jewish Passersby first appeared on Le·gal In·sur·rec·tion.

Published:4/25/2024 11:56:07 AM

|

|

[Latest News]

Terrorists Attack US Humanitarian Pier Construction Site Off Gaza: Report

Gazan terrorists on Wednesday launched mortar shells at a site off the coast of Gaza where the United States is planning to construct a floating pier to deliver humanitarian aid, according to a report from Israeli outlet i24NEWS.

The post Terrorists Attack US Humanitarian Pier Construction Site Off Gaza: Report appeared first on Washington Free Beacon.

Published:4/25/2024 11:56:07 AM

|

|

[Gear]

The 14 Best Barefoot Shoes (2024): For Running or Walking

Our favorite zero-drop, minimalist footwear will let you feel the ground beneath your feet.

Published:4/25/2024 11:56:07 AM

|

|

[a1421f29-adff-5f49-91b4-2230c8e85192]

'Golden Bachelor' Gerry Turner's daughter says family is experiencing 'rage and cruelty' since surprise split

Gerry Turner's daughter is sharing that she and her family have been subjected to "rage and cruelty" since he and wife Theresa Nist announced their shocking divorce three months after their wedding.

Published:4/25/2024 11:56:07 AM

|

|

[Markets]

Long-term Treasury bond ETFs under pressure as investors weigh GDP report

Exchange-traded funds that buy long-term Treasury bonds were under pressure Thursday, as investors parsed fresh data on U.S. economic growth and inflation in the first quarter.

Published:4/25/2024 11:56:07 AM

|

|

[World]

A Ukraine-born congresswoman voted no on aid. Her hometown feels betrayed.

Indiana Republican Victoria Spartz, the first Ukrainian-born member of Congress, voted against aid for Ukraine, drawing fury in her home city, which is still under Russian attack.

Published:4/25/2024 11:56:07 AM

|

|

[Demonstrations, Protests and Riots]

Emory in Atlanta Is Latest University to Crack Down on Protests

More than 400 demonstrators across the country have been taken into police custody since last Thursday, when arrests at Columbia University in New York set off a wave of student activism nationwide.

Published:4/25/2024 11:56:07 AM

|

[Markets]

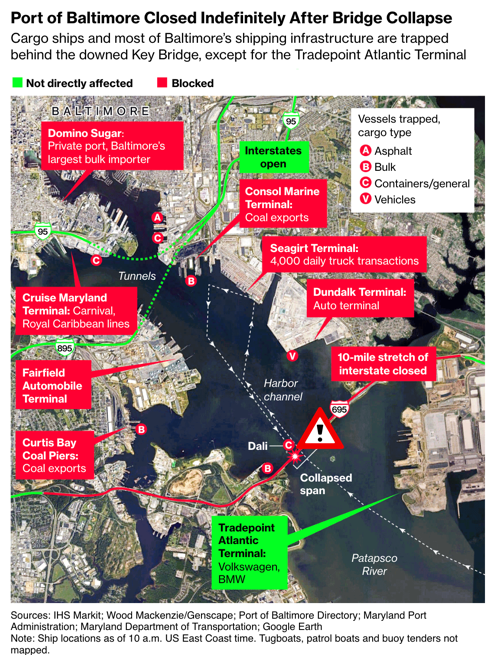

"None Of This Should've Happened": Baltimore Takes Container Ship Owner & Manager To Court Over Bridge Collapse

"None Of This Should've Happened": Baltimore Takes Container Ship Owner & Manager To Court Over Bridge Collapse

Baltimore City filed a lawsuit against the owner and operator of the container ship that crashed into the Francis Scott Key Bridge last month, causing it to collapse.

Attorneys for Baltimore's mayor and City Council claim the bridge collapse was caused by "negligence of the vessel's crew and shoreside management," according to the Washington Post.

In the early morning hours of March 26, the Dali, a 213-million-pound container ship owned by Grace Ocean Private Limited and managed by Synergy Marine PTE LTD., lost power and slammed into one of the main pillars of the 1.6-mile long Key Bridge, instantly crumpling the bridge and blocking the only shipping channel in and out of the Port of Baltimore.

Source: Bloomberg Source: Bloomberg

"The Dali slammed into the bridge, causing the bridge's immediate collapse, killing at least six individuals, destroying Baltimore property, and bringing the region's primary economic engine to a grinding halt," the city said in court filings.

"None of this should have happened," the attorneys said, adding, "Reporting has indicated that, even before leaving port, alarms showing an inconsistent power supply on the Dali had sounded. The Dali left port anyway, despite its clearly unseaworthy condition."

Earlier this month, Grace Ocean and Synergy Marine submitted a request in federal court to cap their potential liability at $43.6 million. Baltimore on Monday requested that the court dismiss the companies' petition to limit liability.

The court filing also called the crew of the Dali "incompetent" and lacked proper skill or training, adding they were "inattentive to their duties" and "failed to comply with local navigation customs."

The source of the "inconsistent power supply" has yet to be identified, and the Federal Bureau of Investigation and the US Coast Guard have launched a criminal investigation into the crash.

Meanwhile, the city of Baltimore failed to install fender systems to prevent ships from crashing into the bridge. These fenders could have prevented the collapse.

Why did the city, county, or whoever manages the bridge fail to install fender systems? Were progressive lawmakers in the city and state too distracted with their socialist agenda to focus on upgrading critical infrastructure?

|

|

[Markets]

Why is Oracle moving to Nashville? Because this one industry is thriving there.

Published:4/25/2024 11:56:07 AM

|

|

[Markets]

GDP print will have minimal impact on markets: Strategist

Markets (^DJI, ^IXIC, ^GSPC) are moving lower on Thursday, reacting to a weaker-than-expected GDP print for the first quarter. Deutsche Bank Chief US Equity and Global Strategist Binky Chadha joins The Morning Brief to discuss his market and inflation outlooks as stocks come under pressure this session. Chadha argues that "there's very little to take away" from the GDP print, suggesting that it should be analyzed "in components." He highlights that the largest component, the Personal Consumption Expenditures (PCE) Index, grew in line with its ten-year trend, indicating that GDP has "few implications for markets going forward." Chadha notes that the disappointing print stemmed from "the two largest, noisiest components of GDP": inventories and trade bonds, which, upon closer inspection, "look absolutely fine." Addressing inflation concerns, Chadha states: "Yes, of course, it matters for inflation, but the growth we've had has not mattered for inflation." He adds, "If you measure inflation relative to growth... we've been steady for about two years." For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance. This post was written by Angel Smith

Published:4/25/2024 11:56:07 AM

|

|

[World]

Rubrik’s stock pops 20% in IPO debut

Rubrik seemed to check off the right boxes for investors Thursday as its stock surged in its public debut.

Published:4/25/2024 11:56:07 AM

|

|

[Colleges and Universities]

Campus Protests Over Gaza Intensify Amid Pushback by Universities and Police

There were more than 120 new arrests as universities moved to prevent pro-Palestinian encampments from taking hold as they have at Columbia University.

Published:4/25/2024 11:26:55 AM

|

|

[d9b0f2e8-0b3c-5581-b662-b28acc1d8a2e]

Most voters doubt Biden’s physical, mental fitness to be president, Trump’s ability to act ethically: poll

Most Americans remain broadly critical of both President Biden and former President Trump just six months ahead of the election, a Pew Research Poll finds.

Published:4/25/2024 11:26:54 AM

|

[Entertainment]

Carl Radke Reveals Influencer Income—& Why Lindsay Hubbard Earns More

Carl Radke and Lindsay Hubbard's relationship is experiencing layoffs rather than lift off.

In E! News' exclusive look at the April 25 episode of Summer House, Carl is having trouble putting...

Carl Radke and Lindsay Hubbard's relationship is experiencing layoffs rather than lift off.

In E! News' exclusive look at the April 25 episode of Summer House, Carl is having trouble putting...

Published:4/25/2024 11:26:54 AM

|

|

[Business]

Meta’s Open Source Llama 3 Is Already Nipping at OpenAI’s Heels

Meta’s decision to give away powerful AI software for free could threaten the business models of OpenAI and Google.

Published:4/25/2024 11:26:54 AM

|

|

[Markets]

US STOCKS-Wall St loses over 1% amid fading rate-cut hopes

U.S. stocks slumped on Thursday as most megacaps fell after Meta Platforms' quarterly results, while sentiment was shaken amid signs of persistent inflation that dampened hopes of the Federal Reserve easing monetary policy anytime soon. Meanwhile, U.S. economic growth slowed more than expected in the first quarter, but an acceleration in inflation suggested that the Fed would not cut interest rates before September.

Published:4/25/2024 11:26:54 AM

|

|

[Entertainment]

Countertenor Anthony Roth Costanzo takes charge at Opera Philadelphia

Opera Philadelphia names countertenor Anthony Roth Costanzo as its seventh general director.

Published:4/25/2024 11:26:54 AM

|

|

[Markets]

Why the NFL draft is one of the only sports events where bettors have the upper hand over sportsbooks

‘Handicapping the NFL draft is one of the most difficult things that we do,” one DraftKings executive said

Published:4/25/2024 11:26:54 AM

|

|

[World]

Heavy rains and flooding kill dozens as extreme weather racks Kenya

The Red Cross reported at least 38 dead and almost 12,000 displaced after weeks of heavy rains swamped the country and caused rivers to burst their banks.

Published:4/25/2024 11:26:54 AM

|

|

[Markets]

Crude-oil futures are on track for their lowest closing price in a month

Published:4/25/2024 11:26:54 AM

|

|

[World]

Why is Oracle moving to Nashville? Because this one industry is thriving there.

The town known as Music City is striking a chord as a tech hub, and Oracle Corp. is about to join the chorus.

Published:4/25/2024 11:26:54 AM

|

|

[]

Unexpectedly, Dow Drops Over 600 Unexpected Points After GDP Unexpectedly Flatlines to Unexpectedly Low 1.6%

Bidenomics, baby! Stocks tumbled Thursday after the latest U.S. economic data showed a sharp slowdown in growth and pointed to persistent inflation. The Dow Jones Industrial Average slid 611 points, or 1.6%, weighed down by steep declines in Caterpillar and...

Published:4/25/2024 11:26:54 AM

|

|

[Education]

Police Arrest More Than 100 Protesters at College in Boston as Pro-Palestinian Protests Flare Across Country

The Boston Police Department arrested more than 100 pro-Palestinian protesters Wednesday evening at Emerson College, the Daily Caller News Foundation confirmed. Students have been protesting... Read More

The post Police Arrest More Than 100 Protesters at College in Boston as Pro-Palestinian Protests Flare Across Country appeared first on The Daily Signal.

Published:4/25/2024 11:01:50 AM

|

|

[Business]

Elizabeth Warren Calls for Crackdown on Crypto’s Role in Child Sexual Abuse

US senators have called for fresh scrutiny of crypto’s role in paying for child sexual abuse imagery online, a problem that they say has worsened.

Published:4/25/2024 11:01:50 AM

|

|

[comics]

Gianluca Constantini Is Using Art to Change the World

“I will continue to fight for freedom of expression and for the right of every artist to express themselves freely, wherever they may be.”

Published:4/25/2024 11:01:50 AM

|

|

[Latest News]

US Economy Sees Low Growth, High Inflation in Q1

U.S. economic growth in the first quarter fell below the Federal Reserve's estimates of the economy's long-run potential for the first time in nearly two years, but the signs of slowing were accompanied with fast inflation that, if sustained, would pose a particular dilemma for the central bank.

The post US Economy Sees Low Growth, High Inflation in Q1 appeared first on Washington Free Beacon.

Published:4/25/2024 10:51:59 AM

|

[Politics]

BIDENOMICS: GDP far lower than expected, prices rise at faster pace – stock market PLUMMETS on bad news

The numbers for Joe Biden’s economy are in for the first quarter of 2024 and they are not good. The GDP came in far lower than was expected and overall prices rose . . .

Published:4/25/2024 10:51:59 AM The numbers for Joe Biden’s economy are in for the first quarter of 2024 and they are not good. The GDP came in far lower than was expected and overall prices rose . . .

Published:4/25/2024 10:51:59 AM

|

|

[Markets]

GLOBAL MARKETS-Tepid economic data weighs on equities; yen sinks to fresh lows

Stocks snapped a three-day winning streak on Thursday as disappointing forecasts from Facebook and Instagram owner Meta hammered the tech sector, and Japan's yen sank through 155 per dollar for the first time since 1990. Tepid U.S. GDP data pushed Wall Street lower at its open, and Meta's slump also soured the mood. "If Meta is a guide, it seems the market is simply not tolerant of in-line – if you've had a good run through Q1 & Q2 you either blow the lights out, or the market takes its pound of flesh," said Chris Weston, head of research at Pepperstone.

Published:4/25/2024 10:51:58 AM

|

|

[]

AOC Lets the Mask SLIP in UNHINGED, Angry Rant at Republicans for DEFENDING Israel and Jewish Students

Published:4/25/2024 10:51:58 AM

|

[Markets]

Is Dune A Copy Of Our Real World

Is Dune A Copy Of Our Real World

By Michael Every of Rabobank

The Golden Path

USD/JPY is at 155, a fresh 34-year high, with the Yen slumping 10.2% year-to-date and suggestion that intervention may not come until we get to 160, a level last seen in 1986. USD/CAD is off recent lows at 1.37 but under pressure (as noted by Christian Lawrence): some suggest the Loonie could fall as far as 2 (so CAD/USD at 0.5) a decade from now. So, a higher US dollar. Which FX dominoes haven’t fallen yet, and when might they?

Australian CPI data suggest it will be hard to cut rates in 2024, as the median Sydney house price moves up to A$1.6m with them at 4.35%. Mexican CPI surprised to the upside, also suggesting further rate cuts may not roll out as had been priced in. Bank Indonesia shocked markets with a 25bp rate hike to 6.25% to try to relieve downwards pressure on IDR. So, what looks like higher rates for longer than had been expected. What breaks where, and when?

Geopolitical tensions will also be higher for longer. Europe made a dawn raid on a Chinese firm as Politico says: ‘EU to China: Open your public markets or we’ll close ours’. US Secretary of State Blinken is in Beijing against headlines warning of US sanctions on Chinese banks for helping Russia. President Biden signed the TikTok divest-or-ban bill, which Bloomberg warns will see China target US firms in kind. US military aid is already flowing to Taiwan, Ukraine, and Israel: the US is planning to convert old Pacific oil platforms to military bases; Ukraine was striking Russian energy targets even before it got access to new, longer-range US missiles; and Israel is closer to moving against Hamas in Rafah and Hezbollah in Lebanon, if not Iran (for now). The New Statesman echoes warnings made here since the mid-2010s: ‘The age of danger: order is breaking down as the great powers take sides in multiple wars’.

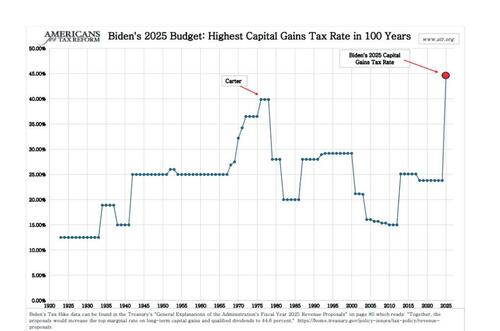

Economic policy also continues to get more populist: although it has no chance of happening, President Biden has proposed a 44.6% capital gains tax, the highest in US history, and a 25% tax on unrealized gains by high net-worth individuals. More realistic, perhaps, France’s opposition has proposed financing the country’s green transition with entirely with QE.

Let’s be frank, it’s hard to see a ‘Golden Path’ for markets ahead. It’s even harder to see ‘The Golden Path’ - a global economic system that allows maximum market/personal freedoms, yet with minimal inequality both domestically and internationally, and so socioeconomic and geopolitical stability. Yet absent that Path, we end up Hamiltonianism or mercantilism, economic war, real war, and a Great-Power-struggle ‘age of danger’.

Bloomberg just made reference to this (‘Geostrategy Industrial Complex Is a Win-Win’) vis-à-vis the real economy, noting corporate and foreign policy elites are talking more to each other, “which is good for both sides”. Yet financial markets continue to ignore foreign policy elites! Where are the macro forecasts adjusted for a world of Great Power struggles? Most still look remarkably similar to ones without that backdrop. (By contrast, note our ‘geopolitical’ work on Europe’s growth and inflation.) Where are the FX, rates, equity, credit, commodity, and property scenarios for a world of Great Power struggles? Again, most still look remarkably similar to ones without that backdrop – correct me if I am wrong, but it seems only our Fed watcher Philip Marey is predicting Trump tariffs would be a roadblock to ongoing Fed cuts in 2025.

Let’s be Frank Herbert.

Bloomberg also praises Hollywood’s ‘Dune 2’ for predicting the future better than Fukuyama for its old-and-new high-tech, feuding Great Houses struggling for control of the Spice without which the economy can’t function, as religion sweeps people to violent jihad. That comparison is true, but there is a deeper parallel to our present situation. Those who have read the Dune series repeatedly know all that backdrop supports two central overarching themes:

-

First: “Don’t follow charismatic leaders.” Paul Atreides is no hero: he is directly responsible for the deaths of 61 billion people.

-

Second: “The Golden Path.” Paul doesn’t have the stomach to follow through on what he needs to do for mankind, but his son, Leto II, does. **SPOILER ALERT** He fuses himself with a sandworm to become a dictator for 3,500 years, destroying Spice, space travel, and the economy, to teach people “a lesson they will remember in their bones”: that once they can break free of his reign, which he eventually allows, they should become as diverse and far-flung as possible to never allow anyone or anything to threaten them in their entirety again.

The conflict between humanity's stated desire for peace and their actual need for volatility is the central message of the Dune series.

We built a centralised neoliberal global system that repressed volatility as QE Spice flowed. But while Great Houses thrived, and some got very rich selling shadow-bank Spice derivatives, that system only increased, not decreased, our fundamental vulnerabilities to key threats. Returning to a world of Great Power struggles may ironically create healthier economic systems and societies over time, in some respects.

True, that likely won’t allow such free markets. But while we need some volatility to get stronger --think of Taleb’s anti-fragility-- we don’t need other kinds, like a sandworm swallowing us whole (or the financial market equivalent as past vol-repression has to be unwound), or people launching jihads at home or abroad. Which there is rather too much of right now.

So, Trump fusing with a sandworm may teach us all a geopolitical lesson “in our bones”: does his orange skin reflect excess McMelange consumption even if his eyes aren’t blue-in-blue?

Back to markets: the God Emperor of Dune, Leto II, maintains a complete monopoly on melange, the real currency in the universe; but apart from that, the books don’t say much about rates or FX. I’m just not sure what the Golden Level of rates is on our Golden Path. Then again, neither do central banks. And financial markets mostly have their heads deep in the sand.

|

|

[Markets]

The timing may be just right to buy Nvidia or other semiconductor stocks

So far this year, the PHLX Semiconductor Index has increased 8.7% (with dividends reinvested), but it has declined 7.7% in April. Meanwhile, shares of industry star Nvidia Inc. have declined 12% this month.

Published:4/25/2024 10:51:58 AM

|

|

[Markets]

Treasury Secretary Janet Yellen says the U.S. economy is firing on all cylinders

Published:4/25/2024 10:51:58 AM

|

|

[World]

Nvidia stands to benefit as Meta spurs an even greater AI spending spree

Nvidia is among a number of companies expected to benefit from Meta’s loftier capital-expense budget.

Published:4/25/2024 10:51:58 AM

|

|

[Markets]

Haiti’s prime minister has resigned

Published:4/25/2024 10:38:26 AM

|

|

[Markets]

Why this GDP report represented the ‘worst of both worlds’ for markets

Published:4/25/2024 10:28:24 AM

|

|

[257e18f6-f673-5f3e-bfe9-a28e03032468]

Gwyneth Paltrow and husband Brad Falchuk only 'fight about one thing' in couples therapy

Gwyneth Paltrow opened up about why couples therapy has been "super helpful" when it comes to maintaining a strong relationship with her husband of six years.

Published:4/25/2024 10:28:24 AM

|

|

[Politics]

Donald Trump sat through the first chunk of testimony Thursday morning without much visible reaction.

Published:4/25/2024 10:28:24 AM

|

|

[Markets]

Retirees feel good about money now and love their lifestyle, but worry about inflation and Social Security

Most workers haven’t given much thought to how they’ll spend their time in retirement

Published:4/25/2024 10:28:24 AM

|

|

[]

Trump Can't Go to Supreme Court, So Instead He Surprised Construction Workers in NYC

Published:4/25/2024 10:16:35 AM

|

|

[Markets]

Ketamine therapy is proliferating. As are patient-safety concerns.

Published:4/25/2024 10:16:35 AM

|

|

[World]

Pending home sales see unexpected jump in March, despite rising mortgage rates

U.S. pending home sales rose 3.4% in March from the previous month, the National Association of Realtors said on Thursday.

Published:4/25/2024 10:16:35 AM

|

|

[sports movies]

‘Challengers’ and The Best Movies About Tennis

'Challengers' — which puts Zendaya at the apex of a love triangle — is one of the most engaging movies to ever center around the world of tennis. From documentaries to satires to bio pics and thrillers, here are the others.

Published:4/25/2024 10:16:35 AM

|

|

[World]

The Baltimore Accident and Other ‘Supply Chain Crises’ That Keep Not Happening

The global economy is far more dynamic—and resilient—than you think.

Published:4/25/2024 10:07:23 AM

|

|

[]

Hamas Makes Pointless Peace Offer

Published:4/25/2024 10:07:23 AM

|

|

[eff6aaed-a789-56d0-bc89-414773b60933]

Harvey Weinstein rape conviction overturned by NY appeals court

A New York appeals court overturned Harvey Weinstein’s 2020 rape conviction, ordering a new trial in stunning landmark #MeToo case. The entertainment mogul was convicted on two charges.

Published:4/25/2024 10:07:23 AM

|

|

[Entertainment]

The 31 best things to do in D.C. this weekend and next week

This weekend brings outdoor markets, museum open houses, a cocktail festival and a neighborhood multi-block party with performances by almost 300 musicians.

Published:4/25/2024 10:07:23 AM

|

[Politics]

WATCH LIVE: Supreme Court hears Trump immunity case at 10AM – [HAPPENING NOW]

The Supreme Court will hear former President Trump’s immunity case this morning at 10:00 am. Trump’s legal team will argue that he had presidential immunity during the events of January 6th for . . .

Published:4/25/2024 10:07:23 AM The Supreme Court will hear former President Trump’s immunity case this morning at 10:00 am. Trump’s legal team will argue that he had presidential immunity during the events of January 6th for . . .

Published:4/25/2024 10:07:23 AM

|

[Entertainment]

Harvey Weinstein's 2020 Rape Conviction Overturned by Appeals Court

One of Harvey Weinstein's legal cases has taken an unexpected turn.

The New York Court of Appeals announced April 25 that the disgraced film producer's 2020 rape conviction has been...

One of Harvey Weinstein's legal cases has taken an unexpected turn.

The New York Court of Appeals announced April 25 that the disgraced film producer's 2020 rape conviction has been...

Published:4/25/2024 10:07:23 AM

|

|

[e6587bb4-7d0a-5d1f-87a2-76cdd5e94729]

Dems attack Johnson over impassioned Columbia speech condemning anti-Israel student activists

National Democrats are up in arms over House Speaker Mike Johnson's appearance at Columbia University on Thursday.

Published:4/25/2024 10:07:23 AM

|

|

[Sexual Harassment]

Harvey Weinstein’s Conviction Was Fragile From the Start

New York’s highest court overturned a conviction on Thursday that tested how #MeToo cases could be tried.

Published:4/25/2024 10:07:23 AM

|

[Markets]

Russia To Seize $440 Million From JPMorgan

Russia To Seize $440 Million From JPMorgan

Seizing assets? Two can play at that game...

Just days after Washington voted to authorize the REPO Act - paving the way for the Biden administration confiscate billions in Russian sovereign assets which sit in US banks - it appears Moscow has a plan of its own (let's call it the REVERSE REPO Act) as a Russian court has ordered the seizure of $440 million from JPMorgan.

The seizure order follows from Kremlin-run lender VTB launching legal action against the largest US bank to recoup money stuck under Washington’s sanctions regime.

As The FT reports, the order, published in the Russian court register on Wednesday, targets funds in JPMorgan’s accounts and shares in its Russian subsidiaries, according to the ruling issued by the arbitration court in St Petersburg.

The assets had been frozen by authorities in the wake of the western sanctions, and highlights some of the fallout western companies are feeling from the punitive measures against Moscow.

Specifically, The FT notes that the dispute centers on $439mn in funds that VTB held in a JPMorgan account in the US.

When Washington imposed sanctions on the Kremlin-run bank, JPMorgan had to move the funds to a separate escrow account. Under the US sanctions regime, neither VTB nor JPMorgan can access the funds.

In response, VTB last week filed a lawsuit against the New York-based group to get Russian authorities to freeze the equivalent amount in Russia, warning that JPMorgan was seeking to leave Russia and would refuse to pay any compensation.

The following day, JPMorgan filed its own lawsuit against the Russian lender in a US court to prevent a seizure of its assets, arguing that it had no way to reclaim VTB’s stranded US funds to compensate its own potential losses from the Russian lawsuit.

Yesterday's decision sided with VTB, ordering the seizure of funds in JPMorgan’s Russian accounts and “movable and immovable property,” including its stake of a Russian subsidiary.

JPMorgan said it faced "certain and irreparable harm" from VTB’s efforts, exposed to a nearly half-billion-dollar loss, for merely abiding by U.S. sanctions.

The order was the latest example of American banks getting caught between the demands of Western sanctions regimes and overseas interests. Last summer, a Russian court froze about $36mn worth of assets owned by Goldman following a lawsuit by state-owned bank Otkritie. A few months later the court ruled that the Wall Street investment bank had to pay the funds to Otkritie.

The tit-for-tat continues.

|

|

[Markets]

Market pressure is 'normal' despite slowing GDP: Strategist

The first-quarter US GDP (gross domestic product) print grew by 1.6%, a slower pace than was expected for the quarter. Carson Group Chief Market Strategist Ryan Detrick joined the Morning Brief to discuss his market outlook following pressures sparked by the latest data print. Detrick points out that, historically, markets "tend to be a little weak" at the start of an election year, calling the current market environment "normal." He is not "overly concerned that the economy's slowing down" when taking the GDP print into account. Detrick expresses optimism that the economy is moving in the right direction, stating that "inflation's not perfect"; however, he still believes that two to three interest rate cuts could materialize in 2024. On the earnings front, with markets spooked after Meta Platforms' (META) earnings report and second-quarter guidance, Detrick cautions against drawing broad conclusions from a single company's performance: "It's hard to just say one company matters for everybody." However, he advises adopting a neutral stance on Big Tech due to group's pricy stocks. For more expert insight and the latest market action, click here to watch this full episode of Morning Brief. This post was written by Angel Smith

Published:4/25/2024 10:07:22 AM

|

|

[Markets]

Caterpillar’s stock is having its worst day since 2020

Published:4/25/2024 10:07:22 AM

|

|

[World]

Haitian Prime Minister Ariel Henry resigns, allowing U.N. force, elections

Interim replacement Michel Patrick Boisvert is to work with a transitional council to accept a Kenyan-led U.N. security force and lead the country to a new vote.

Published:4/25/2024 10:07:22 AM

|

|

[California Restaurants]

How Chef Joe Garcia Is Ushering in a Culinary Renaissance at the Hotel Bel-Air

For decades, Hotel Bel-Air has been a haven for A-list celebrities, film aficionados and L.A. neighborhood locals, and the restaurant has acted as the heart of the iconic property.

Published:4/25/2024 10:07:22 AM

|

|

[Gear]

Yale Approach Smart Lock Review: Magical Door-Unlocking Powers

Yale’s first deadbolt adapter magically unlocks your door when it senses you’re returning home.

Published:4/25/2024 10:07:22 AM

|

|

[Uncategorized]

New York Appeals Court Overturns Harvey Weinstein’s 2020 Rape Conviction

Law lesson: Only call witnesses relevant to the charges in the case.

The post New York Appeals Court Overturns Harvey Weinstein’s 2020 Rape Conviction first appeared on Le·gal In·sur·rec·tion.

Published:4/25/2024 10:07:22 AM

|

|

[Markets]

3M to recall about 40,000 noise-reducing earmuffs due to risk of overexposing user to loud noise

Earmuffs can develop cracks in the colored portion of the plastic cups, says consumer watchdog

Published:4/25/2024 10:07:22 AM

|

|

[World]

Hertz to sell 10,000 more EVs than planned, and stock suffers record plunge

Hertz’s stock resumed its selloff on Thursday, after the rental car company reported a much wider-than-expected first-quarter loss, and significantly expanded its plan to sell off its electric vehicles.

Published:4/25/2024 10:07:22 AM

|

|

[]

The Morning Rant: Minimalist Edition

Who could possibly have predicted this shockingly unexpected result of increasing labor costs via government mandate? The idea that if wages go up, demand for workers will decrease and the price of goods and services will increase is insane!...

Published:4/25/2024 10:07:22 AM

|

|

[Immunity from Prosecution]

Supreme Court to Hear Trump Immunity Case, and Campus Protests Spread

Plus, new airline refund rules.

Published:4/25/2024 8:32:24 AM

|

|

[AMLP]

What I Wish I Knew About Dividend Stocks Before Buying ETFs And CEFs

Published:4/25/2024 8:32:24 AM

|

|

[Gear]

Eufy X10 Pro Omni Review: Great Mopping and Decent AI Smarts

I regret to inform you that $800 is a decent price for Eufy’s midrange AI-enabled robot vacuum-mop.

Published:4/25/2024 8:32:23 AM

|

|

[Markets]

Dow Jones Futures Dive 500 Points On Weak GDP Data; Meta Plunges On Earnings

Stock Market Today: Dow Jones futures dived 450 points on GDP data. Meta stock plunged on earnings, while Google and Microsoft report next.

Published:4/25/2024 8:32:23 AM

|

|

[World]

As ketamine therapy booms, industry insiders worry about patient safety

Ketamine has become a popular alternative treatment for depression and other mental-health ailments — but doctors and regulators are increasingly concerned about its risks.

Published:4/25/2024 8:32:23 AM

|

|

[]

Mid-Morning Art Thread

Elijah fed by Ravens Giovanni Francesco Barbieri (Guercino)...

Published:4/25/2024 8:32:23 AM

|

|

[Books]

The Worst-Case Scenario of International Adoption

If children are the future, then Guatemala greatly undervalued its own.

The post The Worst-Case Scenario of International Adoption appeared first on The American Conservative.

Published:4/25/2024 8:15:57 AM

|

[Entertainment]

Donna Kelce Has Gorgeous Reaction to Taylor Swift’s TTPD Album

Donna Kelce put The Tortured Poets Department on and said it was her favorite.

Indeed, if you've been wondering whether Travis Kelce's family has listened to Taylor Swift's newest—double—album,...

Donna Kelce put The Tortured Poets Department on and said it was her favorite.

Indeed, if you've been wondering whether Travis Kelce's family has listened to Taylor Swift's newest—double—album,...

Published:4/25/2024 8:15:57 AM

|

|

[Gear]

How to Clean a Coffee Grinder (2024)

Cleaning your coffee grinder is a bit of a chore, but doing so will greatly improve the taste of your daily cup. It’s also way easier than you’d think.

Published:4/25/2024 8:15:57 AM

|

[Markets]

Initial & Continuing Jobless Claims Continue To Ignore Reality

Initial & Continuing Jobless Claims Continue To Ignore Reality

In the real world labor market, 2024 has been a shitshow of layoffs...

1. Everybuddy: 100% of workforce

2. Wisense: 100% of workforce

3. CodeSee: 100% of workforce

4. Twig: 100% of workforce

5. Twitch: 35% of workforce

6. Roomba: 31% of workforce

7. Bumble: 30% of workforce

8. Farfetch: 25% of workforce

9. Away: 25% of workforce

10. Hasbro: 20% of workforce

11. LA Times: 20% of workforce

12. Wint Wealth: 20% of workforce

13. Finder: 17% of workforce

14. Spotify: 17% of workforce

15. Buzzfeed: 16% of workforce

16. Levi's: 15% of workforce

17. Xerox: 15% of workforce

18. Qualtrics: 14% of workforce

19. Wayfair: 13% of workforce